The UAE is a top destination for businesses, attracting startups, SMEs, and foreign investors with its strategic location and business-friendly policies. A key incentive is the UAE free zone tax exemption, which allows eligible companies to benefit from reduced or zero corporate taxes.

With the UAE corporate tax starting in 2025, understanding how to qualify as a qualifying free zone person UAE is essential. Companies that meet the requirements can benefit from free zone 0% corporate tax UAE and remain compliant under the UAE corporate tax guide 2025.

This guide explains the eligibility, steps, and compliance needed to secure a UAE free zone tax exemption, along with strategic considerations, common challenges, and benefits beyond tax, helping businesses operate efficiently and plan for growth.

Table of Contents

Understanding UAE Free Zone Tax Exemption

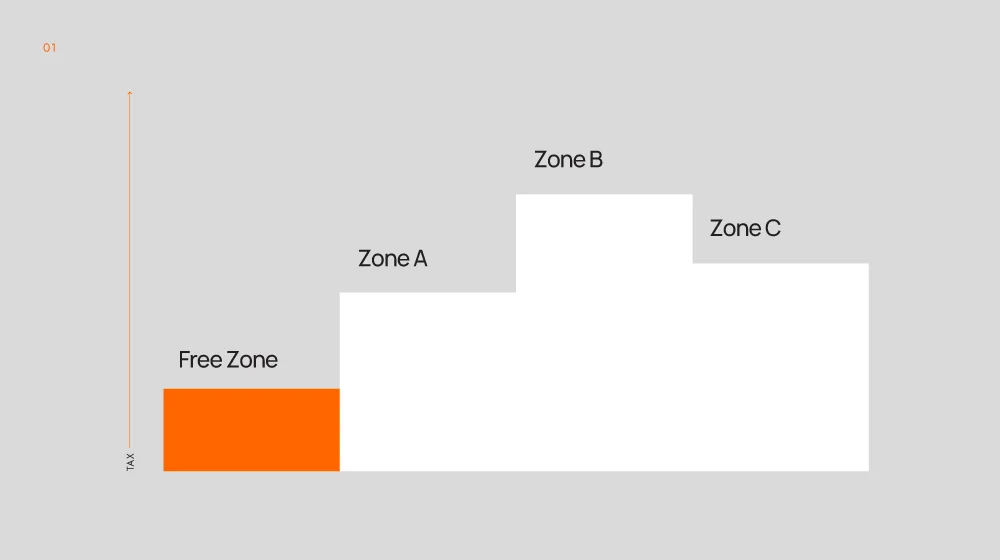

The UAE free zone tax exemption is one of the main reasons businesses choose to set up in UAE Free Zones. It allows companies that meet certain conditions to benefit from reduced or zero corporate taxes while operating legally in the country. With the UAE corporate tax coming into effect in 2025, understanding this exemption is essential for startups, SMEs, and foreign investors.

What is a UAE Free Zone Tax Exemption?

A UAE free zone tax exemption is a benefit available to companies incorporated in designated Free Zones. This exemption typically provides full or partial corporate tax relief and simpler reporting requirements compared to onshore companies. The exemption applies only to businesses that maintain real operations in the Free Zone, including an office, staff, and active business activities.

Who Qualifies as a Free Zone Person?

To claim a UAE free zone tax exemption, a company must meet the criteria of a qualifying free zone person UAE. This generally includes having a valid Free Zone license, conducting business primarily from or within the Free Zone, and maintaining adequate substance in the UAE through office space and employees. Some Free Zones also require that most of the revenue comes from clients outside the UAE.

Benefits of the Exemption

The UAE free zone tax exemption provides more than just tax savings. Eligible companies can enjoy full foreign ownership, the ability to repatriate profits without restriction, and legal protections under UAE regulations. It also aligns with the UAE corporate tax guide 2025, helping businesses plan their operations efficiently while remaining fully compliant.

Understanding how the UAE free zone tax exemption works and who qualifies is the first step for any business looking to operate efficiently and legally in the UAE. Companies that plan carefully can maximize their benefits, including access to free zone 0% corporate tax UAE, while meeting all regulatory requirements.

Eligibility Criteria for Free Zone Tax Exemption

Qualifying for a UAE free zone tax exemption requires meeting specific eligibility criteria set by the UAE authorities. Not every business operating in a Free Zone automatically qualifies, so understanding these requirements is essential to ensure compliance and benefit from tax incentives.

Legal and Licensing Requirements

To qualify as a qualifying free zone person UAE, a company must first be legally registered and licensed within a recognized Free Zone. This means having a valid trade license that reflects the business activity. The type of activity a company engages in can also affect eligibility, as some Free Zones are sector-specific, such as technology, media, or logistics.

Physical Presence and Operational Substance

Maintaining a physical presence in the Free Zone is critical for obtaining a UAE free zone tax exemption. Businesses must have office space, employees, and operational activities within the zone. Authorities require that the company’s activities are conducted from the Free Zone and that it demonstrates substantial economic presence rather than existing solely as a paper entity.

Revenue and Client Criteria

Certain Free Zones may require that a significant portion of a company’s revenue comes from clients outside the UAE to maintain eligibility. Meeting these revenue thresholds ensures that a business remains a qualifying free zone person UAE and continues to benefit from free zone 0% corporate tax UAE.

Compliance with UAE Corporate Tax Rules

Even when operating within a Free Zone, businesses must comply with the broader UAE corporate tax guide 2025. This includes maintaining proper accounting records, submitting necessary documentation, and meeting reporting deadlines. Compliance is a key condition for retaining the UAE free zone tax exemption status and avoiding penalties.

Meeting these eligibility criteria allows businesses to benefit fully from the tax advantages offered in UAE Free Zones. Companies that carefully align their operations with licensing, substance, revenue, and compliance requirements can secure the UAE free zone tax exemption and plan their growth efficiently under the new corporate tax rules.

Key Steps to Qualify as a Free Zone Person in the UAE

Securing a UAE free zone tax exemption requires following a clear process to ensure your business meets all eligibility criteria. Understanding each step helps companies avoid delays and maintain compliance under the UAE corporate tax guide 2025.

Step 1: Choose the Right Free Zone

Not all Free Zones have the same requirements or benefits. Businesses should select a Free Zone that aligns with their business activity, size, and growth plans. Choosing the right zone from the start makes it easier to qualify as a qualifying free zone person UAE and benefit from free zone 0% corporate tax UAE.

Step 2: Register Your Business

Once a Free Zone is selected, the company must complete the registration and licensing process. This includes submitting the required documentation, obtaining a trade license, and ensuring that the company’s activities are permitted within that Free Zone. Proper registration is the foundation for claiming a UAE free zone tax exemption.

Step 3: Establish Physical Presence

To maintain eligibility, the company needs a physical office, employees, and operational infrastructure in the Free Zone. Authorities require evidence that business activities are conducted from the Free Zone. This step is crucial to confirm that the company is a qualifying free zone person UAE.

Step 4: Maintain Compliance and Documentation

After registration, companies must ensure ongoing compliance with local regulations. This includes keeping accurate accounting records, filing reports, and meeting any audit requirements. Staying compliant is essential to continue enjoying the UAE free zone tax exemption and to align with the UAE corporate tax guide 2025.

Step 5: Monitor Revenue and Activity Sources

Some Free Zones require most revenue to come from clients outside the UAE. Businesses should track revenue and document transactions to remain a qualifying free zone person UAE and continue benefiting from free zone 0% corporate tax UAE.

Following these steps allows businesses to secure a UAE free zone tax exemption, stay compliant, and plan for growth while aligning with the UAE corporate tax guide 2025.

Free Zone 0% Corporate Tax UAE: Rules and Compliance

One of the most attractive aspects of UAE Free Zones is the free zone 0% corporate tax UAE. Companies that meet the eligibility requirements of a qualifying free zone person UAE can benefit from a full corporate tax exemption, making it a critical advantage for businesses planning their UAE operations.

How the 0% Corporate Tax Works

The free zone 0% corporate tax UAE applies to profits earned by qualifying companies operating within a Free Zone. This means eligible businesses pay no corporate tax on profits from their Free Zone activities, while still complying with the UAE corporate tax guide 2025. It is important to note that the exemption generally applies only to income generated from permitted Free Zone activities and may not cover income earned outside the Free Zone unless specific conditions are met.

Compliance Requirements

To retain the UAE free zone tax exemption, businesses must maintain proper records and demonstrate that they are a qualifying free zone person UAE. Key compliance measures include:

- Keeping accurate accounting records of all business transactions.

- Filing any required reports or declarations to the Free Zone authority.

- Ensuring that operational activities and staff remain within the Free Zone.

- Meeting any revenue thresholds from external clients, if applicable.

Failure to maintain these standards can lead to a loss of free zone 0% corporate tax UAE benefits and may result in penalties under the UAE corporate tax guide 2025.

Practical Tips for Compliance

Businesses should regularly review their operations to confirm they continue to meet all eligibility requirements. This includes monitoring employee presence, office usage, and income sources. Companies that maintain clear records and follow Free Zone rules can confidently benefit from the UAE free zone tax exemption while avoiding compliance issues.

The free zone 0% corporate tax UAE provides a clear advantage for eligible companies, but it requires consistent attention to compliance and operational standards. Businesses that plan ahead and manage their Free Zone operations effectively can enjoy tax-free growth while staying fully aligned with UAE corporate tax regulations.

Strategic Considerations for Businesses

Beyond meeting eligibility requirements, businesses should consider key strategies to maximize the benefits of a UAE free zone tax exemption and stay compliant under the UAE corporate tax guide 2025.

Choosing the Right Free Zone

Select a Free Zone that fits your business activity. Specialized zones, such as technology, media, or logistics, make it easier to qualify as a qualifying free zone person UAE and access free zone 0% corporate tax UAE benefits.

Structuring for Tax Efficiency

Plan your corporate structure to optimize tax benefits. Holding companies or separate entities for regional operations can centralize profits while maintaining eligibility for the UAE free zone tax exemption.

Maintaining Operational Substance

Ensure your company has employees, office space, and real business activities in the Free Zone. Regularly reviewing operations helps preserve your status as a qualifying free zone person UAE and continue benefiting from free zone 0% corporate tax UAE.

Planning for Cross-Border Activities

Consider the tax implications of regional or international business. While the UAE free zone tax exemption applies to Free Zone income, cross-border income may need additional planning under the UAE corporate tax guide 2025.

Focusing on these strategies allows businesses to make informed decisions, maximize the UAE free zone tax exemption, and support sustainable growth in the UAE market.

Common Challenges and How to Overcome Them

While the UAE free zone tax exemption offers clear advantages, businesses may encounter challenges in qualifying and maintaining the exemption. Understanding these issues helps companies remain compliant and avoid losing benefits.

Meeting Eligibility Criteria

Some companies struggle to meet the requirements to be a qualifying free zone person UAE. This often includes maintaining a physical office, employees, and real business operations in the Free Zone. To overcome this, businesses should plan their setup carefully and ensure all regulatory requirements are documented from the start.

Maintaining Compliance

Ongoing compliance with the UAE corporate tax guide 2025 can be challenging, especially for companies handling multiple revenue streams or cross-border activities. Regularly updating accounting records, filing reports, and reviewing business activities ensures continued eligibility for the UAE free zone tax exemption and avoids penalties.

Managing Revenue Sources

Some Free Zones require that a significant portion of revenue comes from clients outside the UAE. Companies that fail to monitor revenue may risk losing the free zone 0% corporate tax UAE benefits. Implementing proper tracking systems and reviewing transactions periodically can prevent this issue.

Adapting to Regulatory Changes

UAE tax regulations continue to evolve, and businesses must stay informed to maintain their UAE free zone tax exemption. Regular consultations with advisors and reviewing updates to the UAE corporate tax guide 2025 help businesses adjust operations and remain compliant.

By anticipating these challenges and implementing proactive measures, companies can continue benefiting from the UAE free zone tax exemption, retain their status as a qualifying free zone person UAE, and operate confidently in the UAE Free Zones.

Benefits Beyond Tax: Why Free Zones Are Still Worth It

While the UAE free zone tax exemption is a major advantage, Free Zones offer additional benefits that make them attractive for businesses and investors.

Full Foreign Ownership

Companies in Free Zones can enjoy 100% foreign ownership, allowing investors to control their operations without requiring a local partner. This is a key factor for businesses aiming to operate as a qualifying free zone person UAE.

Profit Repatriation

Free Zone companies can repatriate profits fully without restrictions. This flexibility supports international investors and complements the benefits of free zone 0% corporate tax UAE.

Simplified Business Setup

Free Zones offer streamlined registration and licensing processes, helping companies establish themselves quickly while meeting eligibility requirements for the UAE free zone tax exemption.

Sector-Specific Advantages

Certain Free Zones focus on specific industries, such as technology, media, or logistics. Businesses operating in the right zone gain access to specialized infrastructure, networking opportunities, and regulatory support, enhancing growth potential beyond tax savings.

These additional benefits make Free Zones appealing even beyond the UAE free zone tax exemption. Companies that leverage these advantages can operate efficiently, maintain compliance under the UAE corporate tax guide 2025, and plan for sustainable growth in the UAE market.

Conclusion

The UAE free zone tax exemption provides businesses with reduced or zero corporate tax, full foreign ownership, and the ability to repatriate profits. Qualifying as a qualifying free zone person UAE requires meeting eligibility criteria, maintaining operational substance, and complying with the UAE corporate tax guide 2025.

Securing the exemption involves careful Free Zone selection, proper operations, and ongoing compliance. Companies that follow these steps can benefit fully from free zone 0% corporate tax UAE while positioning themselves for sustainable growth in the UAE.

GCG Structuring helps businesses navigate this process efficiently. From Free Zone selection to compliance and setup, we ensure companies can qualify for the UAE free zone tax exemption and focus on growth with confidence.

FAQ

1. 0 What is a UAE free zone tax exemption?

It allows eligible Free Zone businesses to pay reduced or zero corporate tax.

2. 0 Who qualifies as a free zone person in the UAE?

A qualifying free zone person UAE is licensed in a Free Zone, has a physical office, and conducts most activities from there.

3. 0 How does free zone 0% corporate tax UAE work?

Eligible companies pay no corporate tax on profits earned in the Free Zone while staying compliant.

4. 0 Do Free Zone companies need to comply with UAE corporate tax rules?

Yes, they must follow the UAE corporate tax guide 2025 and maintain proper records.

5. 0 Can foreign businesses benefit from Free Zone exemptions?

Yes, if they meet the operational and licensing requirements to qualify as a qualifying free zone person UAE.