Opening an offshore bank account in UAE in 2025 is no longer a drawn-out or uncertain process. In fact, with the right structure, documentation, and advisor, you can legally open your account in less than three weeks. The appeal is clear: global access, strong financial privacy, zero personal income tax, and a banking sector that works efficiently with international entrepreneurs, consultants, and investors. But here's the catch: banks in the UAE have tightened their compliance checks, and if you skip a step or choose the wrong path, your application may be delayed or rejected.

This blog is your fast-track guide to getting it right. We’ll explain why UAE is a magnet for international clients, how an offshore bank account in UAE works, who qualifies, which banks to consider, how to prepare, what recent trends are shaping the onboarding experience in 2025, and what mistakes to avoid. Whether you’re a founder, investor, or global professional, this will help you open your offshore bank account in UAE the smart and legal way.

Table of Contents

Why Entrepreneurs Are Flocking to the UAE for Offshore Banking in 2025

Over the last five years, the UAE has firmly positioned itself as a top jurisdiction for setting up an offshore bank account. The appeal lies in its ability to offer speed, legal certainty, and access to a banking system that supports international operations without unnecessary friction. In 2025, the demand to open an offshore bank account in UAE has reached record levels, with entrepreneurs, investors, and consultants turning to the Emirates for a stable and legally sound financial base.

Opening an offshore bank account in UAE means banking in a jurisdiction that respects client privacy, supports multi-currency operations, and offers institutions that understand global business.

Zero Personal Income Tax

One of the biggest advantages of opening an offshore bank account in UAE is that the country doesn’t charge personal income tax. This policy hasn’t changed in 2025, making the UAE especially attractive to individuals earning globally who want to retain more of their income while staying fully legal.

Robust Regulatory System

The banking sector is supervised by the Central Bank of the UAE, which ensures high compliance standards while still being practical for non-resident clients. If your documents are in order, you can open an offshore bank account in UAE without unnecessary friction or red tape.

Global Connectivity

A UAE offshore bank account allows you to manage funds internationally with access to USD, EUR, AED, GBP and other major currencies. With SWIFT transfers and 24/7 online banking, entrepreneurs can run global operations efficiently from one trusted financial base.

Strategic Location

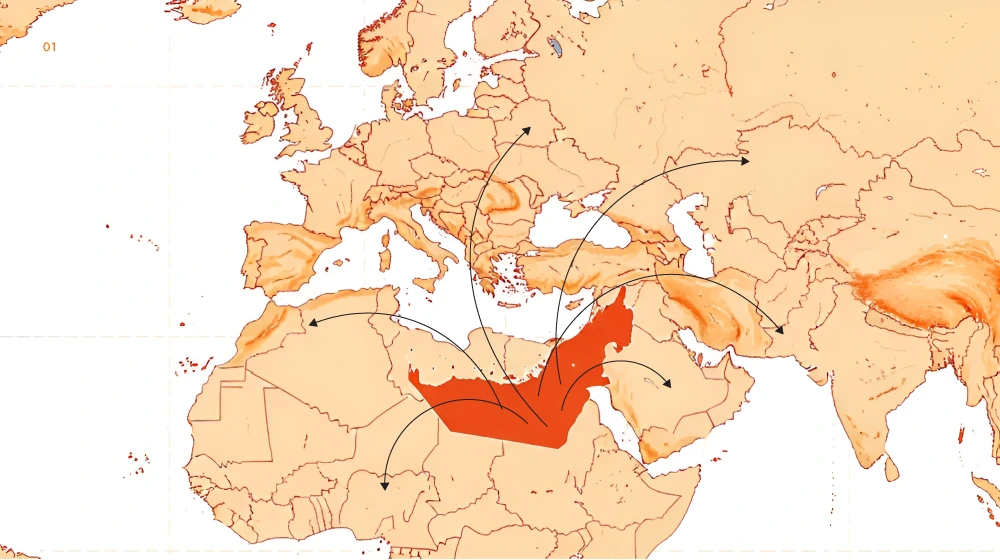

Located between three continents, the UAE supports smooth international business activity across time zones. Many founders open an offshore bank account in UAE to streamline operations with suppliers, clients, and partners across Europe, Asia, and Africa.

Strong Financial Sector

The UAE is home to over 50 reputable banks, many of which work directly with offshore structures like RAK ICC and JAFZA. Whether you’re looking for private banking or standard corporate services, you’ll find options tailored to setting up a UAE offshore bank account with full compliance.

According to the IMF’s 2024 Financial Access Survey, the UAE leads the region in financial inclusion and digital banking growth, making it a top jurisdiction for cross-border banking—learn more about how to open business bank account in UAE.

What Is an Offshore Bank Account in UAE and How Does It Work?

An offshore bank account in UAE is a business account opened by a non-resident individual or company, most often through a UAE-registered offshore structure like RAK ICC or JAFZA Offshore. These accounts are not tied to local business activity and are primarily used for international transactions, savings, and asset protection.

Opening an offshore bank account in UAE lets you operate globally without needing a residence visa or local trade license. This makes it ideal for international consultants, holding companies, and investment firms that want a compliant banking base outside their home country. The structure offers full access to regulated financial services while keeping your operations legally separate from the UAE mainland.

Here’s how a typical offshore bank account in UAE works in 2025:

Opened Under an Offshore Company

You can’t open an offshore bank account in UAE as an individual unless you have residency. Instead, you form a UAE offshore company typically through RAK ICC or JAFZA Offshore and the account is opened in the company’s name.

Multi-Currency Flexibility

Most offshore bank accounts in UAE support multiple currencies like USD, EUR, GBP, CHF, and AED. This gives you the ability to receive and send funds globally without conversion issues or currency restrictions.

Online Access and International Payments

UAE offshore bank accounts are built for global business. You’ll get secure online banking, full SWIFT access for international transfers, and dedicated account managers for support, even if you’re operating remotely.

Strict Compliance Protocols

To maintain global credibility, banks in the UAE enforce tight KYC and AML processes. When applying to open offshore bank account in UAE, you’ll need to prove your source of funds, clarify business activity, and verify shareholder identity clearly. Beyond banking, your VAT filing must align with corporate tax rules. Here’s a guide on filing VAT in the UAE while staying compliant.

Not for Local Trade

These accounts are not meant for invoicing or receiving payments within the UAE. A UAE offshore bank account is designed exclusively for foreign transactions and asset holding, not local business operations.

Overall, the offshore bank account in UAE has become a trusted option for those who need financial stability, remote access, and banking transparency without compromising on legal protection. It’s one of the few structures that offers global banking access without excessive exposure to international tax or compliance risks—ideal for those looking to open business bank account in Dubai

Who’s Eligible and What Do You Need to Open One?

Opening an offshore bank account in UAE isn’t automatic. Banks have strict rules and expect clear documentation in 2025. Here’s who qualifies and what you need to prepare to open an offshore bank account in UAE smoothly:

Eligible Entities

Offshore companies registered in RAK ICC or JAFZA Offshore. These are the most common structures for opening an offshore bank account in UAE. Banks require a legal entity, not just an individual account unless you have UAE residency.

Holding companies

Many entrepreneurs use holding companies to open their UAE offshore bank account for asset protection and international investment.

International trading firms

Businesses involved in import/export or cross-border services often open UAE offshore bank accounts to simplify global payments.

High-net-worth individuals with international assets

Wealthy individuals use UAE offshore bank accounts to manage multi-currency portfolios and maintain privacy.

Required Documents to Open Offshore Bank Account

Passport copies and utility bills of all shareholders and directors

These confirm identity and residence and are essential for KYC compliance when opening an offshore bank account in UAE.

Corporate documents: Certificate of Incorporation, Memorandum of Association, share registry

Banks need these to verify your company’s legal existence and ownership structure.

Business plan or activity summary

Explaining your business model clearly increases your chances to open an offshore bank account in UAE without delays. If you’re unsure what license fits your activity, check this overview of different Dubai business license types for clarity.

Proof of source of funds

Showing where your capital comes from is mandatory under UAE AML rules and global compliance standards.

CVs or professional profiles (optional but recommended)

Including these gives banks confidence in your background, making it easier to open your UAE offshore bank account.

Minimum Deposit Requirements

- Most banks require a minimum deposit between AED 25,000 and AED 100,000 depending on the bank and account type.

- Having this deposit ready speeds up the account activation process when opening an offshore bank account in UAE.

Bank Interview or Video Call

- Banks generally require a short interview or video call to verify your identity and understand your business intentions.

- This step is crucial for due diligence and helps banks approve your offshore bank account in UAE faster.

Fastest Offshore Company Setup Routes That Work in 2025

Before you can open your offshore bank account in UAE, you need to register an offshore company. In 2025, the two fastest and most bank-approved options are still RAK ICC and JAFZA Offshore. Both are legally recognized and widely accepted by banks offering offshore banking services.

RAK ICC

- Fast turnaround: RAK offshore company formation usually takes 2 to 5 working days, making it the fastest route to opening an offshore bank account in UAE.

- Cost-effective: Lower setup and renewal costs make RAK ICC ideal for first-time founders or lean international structures.

- Bank-friendly: Most banks that support offshore clients are already familiar with RAK ICC documentation, making account approval smoother.

- No audit or office: You’re not required to maintain a physical office or submit audits, making it ideal for consultants and holding companies.

JAFZA Offshore

- Property-friendly: JAFZA is the only offshore jurisdiction in the UAE that allows ownership of property in Dubai.

- Wider structure options: Often used for asset holding, licensing deals, or family wealth vehicles tied to international portfolios.

- Moderate speed: Setup takes up to 10 working days, slightly slower than RAK ICC but often preferred for more complex needs.

- Stronger presence: Seen as more premium, which may help when applying to open offshore bank account in UAE with higher-tier banks.

Whether you go with RAK ICC or JAFZA Offshore, both structures are fully compliant with UAE offshore regulations and widely accepted by banks. To open your offshore bank account in UAE without delay, make sure the company is formed properly, with clean ownership and supporting documents ready.

Choosing the Right Bank: Not All Banks Accept Offshore Clients

Opening an offshore bank account in UAE isn’t just about paperwork. The bank you choose matters just as much. Not all banks in the UAE accept offshore structures, and some have tightened their onboarding in 2025 due to global compliance standards. To avoid rejection, you need to match your company profile with the right bank from the start.

Here’s how to approach it strategically:

Banks Actively Accepting Offshore Clients in 2025

RAKBank

A top choice for RAK ICC entities. Known for quick onboarding and experience with offshore setups. Ideal if you’re setting up a service-based business or holding company.

Emirates NBD

A major bank that does accept offshore applications, but only if the structure is clear and documentation is tight. Better for well-established founders.

Mashreq Bank

Flexible with international consultants, traders, and tech companies. Works well with both RAK ICC and JAFZA offshore entities.

Wio and other digital banks

Some digital-first banks allow UAE offshore bank account setups remotely, but are still selective. Suitable for lean businesses with low-risk models.

What Banks Look For

Clean, transparent business activity

Banks want to see what your company actually does. Vague descriptions like “consulting” aren’t enough. To open an offshore bank account in UAE, describe your services clearly and show how your company earns money. Also, choosing the wrong legal structure is a common mistake. Here’s how to pick the right legal structure for your business.

Professional background or economic substance

If you’re a first-time founder, banks may look at your CV or past business experience. Offshore bank accounts in UAE are more easily approved for those with a proven track record.

Verified source of funds

Where your money is coming from is critical. Clean bank statements, contracts, or income history help you pass compliance.

International presence or business scope

Having clients, suppliers, or operations outside your home country boosts your profile when applying to open offshore bank account in UAE.

Where Most Applicants Fail

Weak or incomplete documents

Missing corporate docs or unclear ownership structure are the most common reasons for rejection.

Vague business activity

A general “advisory” or “investment” label with no backup plan often leads to delays or denials.

Complex shareholding with no explanation

Multi-layered structures without clarity on the real owner (UBO) raise red flags.

Step-by-Step: Fastest Way to Open an Offshore Bank Account in UAE

If you want to open an offshore bank account in UAE quickly and legally in 2025, the process needs to be precise. Banks are efficient, but only if your structure, documents, and communication are well-prepared from day one. Here’s the fastest, most compliant way to get it done:

1. Choose Your Offshore Jurisdiction (RAK ICC or JAFZA Offshore)

Before anything else, you need a legal company entity. Most applicants go with RAK ICC for its speed or JAFZA Offshore if they want to own property in Dubai. Both are fully compliant and widely accepted by banks offering offshore bank accounts in UAE. If you haven’t registered your company yet, follow this step-by-step guide to starting a business in Dubai before applying for a bank account.

2. Prepare All Required Documents

Your offshore company must have the basic documents in place: shareholder IDs, Certificate of Incorporation, MOA, share register, and proof of address. Without this, no bank will let you open an offshore bank account in UAE, no matter how clean your profile is.

3. Pre-Qualify with Suitable Banks

Not all banks work with offshore clients. GCG helps clients shortlist banks that actively support your type of company and industry. This step is key to successfully opening an offshore bank account in UAE without wasting time.

4. Draft a Strong Application Package

A weak business plan or vague explanation of funds can delay approvals. To open an offshore bank account in UAE quickly, you’ll need a solid business summary, fund flow breakdown, and clear ownership details. Some banks also ask for a professional CV or project history.

5. Attend a Bank Interview or Video Call

Most banks now require a quick verification call. This may be remote or in-person, depending on the bank. It’s typically a short session to confirm your identity, understand your business model, and finalize onboarding.

6. Account Approval & Activation (7–14 Working Days)

Once everything is submitted correctly, banks take anywhere from 7 to 14 working days to activate the account. Some may do it faster if your documents are fully in order and pre-vetted.

In total, it’s possible to register your offshore company and open your offshore bank account in UAE in as little as 9 to 19 working days. Timing depends on the quality of your documents and whether you’re working with professionals who understand the system.

New 2025 Trends: Digital Onboarding, KYC Automation & Remote Opening

As of 2025, UAE banks have adopted several digital improvements that speed up the process of opening an offshore bank account in UAE.

E-KYC Tools

Banks now use AI-driven ID verification, biometric checks, and facial recognition to verify shareholders remotely.

Remote Onboarding

Some banks (particularly digital-first institutions) now allow full onboarding remotely for offshore clients.

Automated Risk Assessment

AI tools help banks detect risk factors faster, reducing approval times if your documents are clean.

Online Communication

Banks increasingly use secured messaging portals for document submission and updates.

These tools make it faster than ever to open an offshore bank account in UAE, provided you’re working with professionals who understand the compliance protocols.

Compliance in 2025: What You MUST Get Right (or Risk Rejection)

UAE remains business-friendly, but compliance standards are high. To avoid rejection or worse, here’s what to focus on:

Economic Substance

Ensure your structure aligns with UAE’s ESR guidelines if you’re conducting relevant activities. For better compliance and smoother onboarding, make sure you set up a tax-efficient structure from the start.

KYC & Source of Funds

Be ready to explain where your money is coming from, with documentation to back it up.

Ownership Transparency

Hidden UBOs or nominee directors with unclear roles will raise red flags.

Tax Reporting Standards

UAE complies with CRS (Common Reporting Standard). Be prepared to disclose to your home country if it falls under CRS obligations.

Offshore Doesn’t Have to Mean Complicated

Opening an offshore bank account in UAE in 2025 is faster and more transparent than ever, but only if you know how to navigate the setup properly. Between choosing the right jurisdiction, matching with a bank that fits your business, and preparing documentation that meets compliance standards, there are a lot of moving parts. But it doesn’t have to be overwhelming.

At GCG Structuring, we simplify the process for you from day one. We help you choose the right offshore company setup in UAE, prepare documentation the right way, and introduce you directly to banking partners with a track record of approving accounts like yours. So you can focus on your business while we handle the structure, compliance, and bank approvals.

FAQ

1. 0 Can I open an offshore bank account in UAE without visiting?

Yes, many banks let you open an offshore bank account in UAE remotely via video call and digital onboarding.

2. 0 How fast can I open an offshore bank account in UAE?

With the right documents, you can open an offshore bank account in UAE in 7 to 14 working days.

3. 0 Do I need UAE residency to open an offshore bank account in UAE?

No. You only need a registered offshore company to open an offshore bank account in UAE legally.

4. 0 Is it legal to have an offshore bank account in UAE?

Yes. As long as you follow compliance rules, your offshore bank account in UAE is fully legal.