Mainland and free zone companies in the UAE operate under different rules. That matters especially in 2025 because more businesses are working across these boundaries.

If you’re running a Dubai mainland company or considering Dubai mainland company formation, you’ve probably asked: Can mainland company do business in freezone?

It’s not a yes or no answer. There are legal limits, updated regulations, and clear compliance steps you need to follow.

In this blog, we’ll break down what’s allowed, what changed in 2025, and how mainland businesses can legally work with free zone companies through service contracts, approvals, or specific licensing routes. You’ll also get clarity on tax, risk, and how to plan cross-zone trade without getting it wrong.

Table of Contents

Can Mainland Company Do Business in Freezone?

This is the question many business owners ask and the answer depends on what exactly you mean by “doing business.”

If you’re a Dubai mainland company, you cannot simply walk into a free zone and start operating like you’re licensed there. A mainland license doesn’t give you the legal right to trade, deliver services, or physically operate inside a free zone unless specific steps are taken.

That said, mainland companies can work with free zone companies, as long as the relationship stays within legal boundaries. This typically includes:

1. Business-to-Business Contracts

Mainland companies can sell services or products to a free zone company. For example, a mainland logistics firm delivering to a free zone warehouse, or a mainland marketing agency offering remote services to a free zone startup. This kind of collaboration is allowed, as long as operations remain in the mainland and proper invoicing and tax rules are followed.

2. No Physical Presence Inside the Freezone

Even if a contract exists, a mainland company can’t set up shop inside a free zone without a free zone license. This includes opening offices, hiring staff, or storing inventory within that jurisdiction. Doing so without proper licensing is considered a violation.

3. Can a Mainland Company Open a Free Zone Branch?

Generally no. The flow of access is currently structured the other way. As of 2025, Dubai allows free zone companies to operate on the mainland under specific approvals but the reverse is not legally supported. A Dubai mainland company looking to establish a free zone branch must go through standard company formation inside that free zone, which would result in a separate entity.

4. Shared Ownership Across Jurisdictions

Some businesses form separate entities: one in the mainland and one in a free zone under common ownership. This setup is legal, but each entity must follow the rules of its licensing authority, maintain separate books, and meet its own tax obligations.

Choosing the right legal structure is fundamental to compliance and growth. Learn more in our guide on legal structure of a business to pick the right one for structuring your business properly.

5. Common Misconception: Free Zone Access Through Mainland License

A common mistake is assuming that having a Dubai mainland license is enough to work anywhere in the UAE. It isn’t. Free zones are separate jurisdictions with their own laws and regulators. Without the right approvals, operating inside one even partially, can lead to penalties.

So, can mainland company do business in freezone?

Yes, but only through allowed channels, without crossing the legal boundary of physical or unlicensed operations inside the zone. The key is understanding where the legal lines are drawn and keeping operations compliant on both sides.

Mainland vs. Freezone: Legal and Structural Differences

Before you ask can mainland company do business in freezone, you need to understand how both are set up. The rules for mainland and free zone companies aren’t interchangeable and that’s where most of the confusion begins.

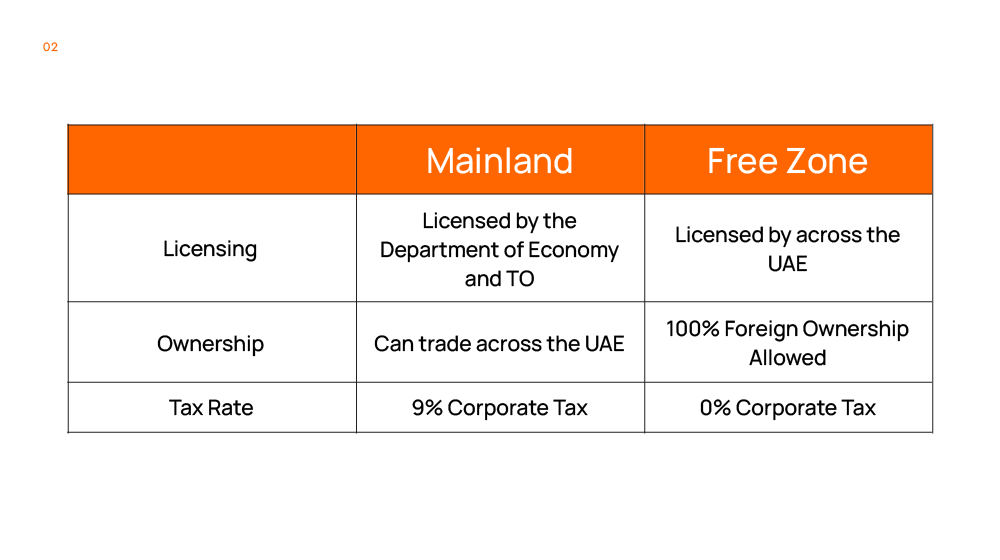

1. Licensing

A Dubai mainland company is licensed by the Department of Economy and Tourism (DET). It can operate across the UAE without restrictions.

A free zone company is licensed by a specific free zone authority. It’s limited to operations inside the free zone or overseas unless special permits are obtained.

2. Trading Rules

Mainland companies can trade freely across the UAE. Free zone companies cannot sell directly to the mainland without a local distributor or additional licensing.

That’s why can mainland company do business in freezone isn’t a simple yes or no. It depends on the type of activity and the licensing structure.

3. Ownership

Since 2021, Dubai mainland company formation allows 100% foreign ownership in most sectors, following Federal Decree Law No. 26. Free zones have always offered this. But ownership doesn’t equal access, so jurisdiction still matters.

4. Office Requirements

Mainland businesses must lease physical office space. Many free zones offer shared desks or virtual setups. This is ideal for lean operations or startups.

5. Tax Structure

Mainland companies pay 9% corporate tax on profits above AED 375,000.

Free zone entities can still access the 0% corporate tax rate but only on qualifying income, and only if all conditions are met.

If you’re unsure which setup suits your goals, our detailed guide on Dubai Free zone vs Mainland will help you decide.

What Changed in 2025? Executive Council Resolution No. 11 Explained

In 2025, Dubai introduced Executive Council Resolution No. 11, which allows free zone companies to legally operate in the mainland through a permit or branch license issued by the Dubai Department of Economy and Tourism (DET).

This led many to ask again: can mainland company do business in freezone now?

The answer is still no.

1. What the Resolution Allows

As of March 2025, free zone companies can operate in mainland Dubai if they:

- Open a mainland branch

- Apply for a DET-issued activity permit

- Operate under a hybrid setup, with HQ in a free zone and a DET license

Permit fees range from AED 5,000 to AED 10,000 depending on the setup. These businesses must also follow UAE tax rules, maintain proper accounting, and if applicable, secure regulator approvals.

2. What It Doesn’t Allow

This resolution doesn’t give mainland companies the right to operate inside a free zone.

So if you’re asking can mainland company do business in freezone under this new rule, the answer remains no. Not unless the mainland company sets up a separate free zone entity.

There’s no shortcut. A Dubai mainland company still needs to go through full registration to be active inside any free zone.

Ways Mainland Companies Can Work with Freezone Businesses

Even though the answer to can mainland company do business in freezone is generally no when it comes to operating inside the zone, there are still legitimate ways for mainland businesses to work with free zone entities.

The key is staying within legal and licensing boundaries.

1. Service Contracts

Mainland companies can offer services to free zone businesses, as long as those services are delivered from the mainland. For example, a mainland software firm or legal consultancy can serve a free zone client remotely or at the client’s mainland branch.

This is the most common and legal way for a Dubai mainland company to interact with free zone businesses.

2. Acting as a Supplier or Distributor

A mainland company can legally supply goods to a free zone company. The exchange must be recorded properly, and customs procedures must be followed if the goods are being physically moved across jurisdictions.

However, the mainland company cannot open a physical sales point inside the free zone without separate licensing.

3. Creating a Separate Free Zone Entity

If you want full access to free zone clients and operations, the cleanest solution is to form a separate company inside the free zone. Many business owners use this dual setup: one Dubai mainland company, one free zone company. Both under shared ownership.

This allows each company to operate where it’s licensed and issue tax-compliant invoices.

4. Joint Ventures and MOUs

Mainland and free zone companies can enter into memorandums of understanding (MOUs) or partnership agreements. These do not allow one party to operate in the other’s jurisdiction but can create a framework for collaboration, marketing, or joint delivery of services.

Just be careful. These don’t replace proper licensing. If your mainland company is using an MOU to bypass free zone rules, that’s still a violation.

5. Remote and Digital Services

Free zone companies often outsource remote services like accounting, digital marketing, IT and HR support to mainland providers. Since these services don’t require physical presence, they’re generally compliant, as long as contracts and invoicing are done properly.

This is one of the clearest cases where the answer to can mainland company do business in freezone is yes, within limits.

And if you’re starting fresh, our step-by-step guide on how to start a company in Dubai in 2025 walks you through the entire process from licensing to operations.

Licensing and Compliance: What the Law Allows (and What It Doesn’t)

Understanding licensing boundaries is critical when a mainland company works with a free zone entity. The UAE’s regulatory system is clear: you need to operate within the scope of your trade license, and jurisdiction matters. Learning how to get a trade license in Dubai can help ensure you stay compliant from the start.

What Mainland Companies Are Allowed to Do

Mainland companies can legally provide services or supply goods to free zone businesses as long as the operations are carried out from the mainland. This includes:

- Delivering physical goods from the mainland to the free zone

- Providing consultancy, maintenance, or remote services

- Issuing invoices and collecting payments directly from free zone clients

No additional approvals are needed if the service delivery remains outside the physical free zone premises.

What Mainland Companies Cannot Do Without a Free Zone License

Mainland companies are not allowed to operate inside a free zone physically unless they have a legal presence within that zone. Activities that require a free zone license include:

- Opening an office or warehouse inside the free zone

- Hiring staff to work within the zone

- Displaying products or holding client meetings at a free zone location

Doing any of the above without the proper setup is considered a regulatory violation.

What Happens If You Violate the Rules?

Operating beyond your licensed scope can lead to serious consequences. Common penalties include:

- Fines ranging from AED 5,000 to AED 50,000

- Suspension of trade license

- Legal notices from free zone authorities

- Potential blacklisting or restrictions on future activity

These are not just formalities, they’re actively enforced. Especially after the 2025 updates, compliance checks have increased across major emirates.

To make sure you have all the necessary paperwork ready, here’s a full checklist of business documents required for business setup in UAE.

Tax Implications of Cross-Zone Business in the UAE (2025)

When a mainland company works with a free zone company, tax rules can get complicated. Here’s what you need to know in simple terms.

1. Corporate Tax Basics

- Mainland companies pay 9% tax on profits above AED 375,000. This applies no matter who they work with.

- Free zone companies can get 0% tax but only if most of their income comes from outside the mainland (like foreign clients or other free zone companies).

- If a free zone company earns a lot from mainland clients, that income becomes taxable at 9%.

Example: If a free zone company makes AED 1 million and AED 300,000 comes from mainland customers, that AED 300,000 is taxed at 9%.

2. VAT (Value Added Tax) Basics

- VAT is 5% in the UAE and applies to most sales between mainland and free zone companies.

- Even if a free zone is “designated” for VAT purposes, VAT still applies on services sold to the mainland.

- Both mainland and free zone companies must charge VAT, keep records, and file returns on time.

3. What You Need to Do

- Keep clear records showing where your income comes from (mainland, free zone, or outside UAE).

- Make sure your contracts and invoices state who is responsible for VAT.

- Ensure your free zone partner qualifies for the 0% tax status if they want it.

- File your VAT and corporate tax returns correctly and on time.

4. Risks of Getting It Wrong

- Missing or wrong tax filings can lead to fines from AED 1,000 up to AED 50,000 or more.

- If a free zone company hides income from mainland clients, it risks losing its 0% tax status and paying back taxes.

- Mainland companies also face penalties if they don’t follow corporate tax or VAT rules.

Common Mistakes to Avoid When Mainland Companies Work with Free Zone Entities

Cross-zone business offers opportunities but also risks if not handled correctly. Here are common mistakes to watch out for:

- Assuming mainland companies can operate inside free zones without licensing. This is not allowed and can lead to fines and license suspension.

- Overlooking VAT and corporate tax requirements. Some think free zones are fully tax-exempt, but VAT applies on most transactions, and free zone companies may owe corporate tax if they earn income from the mainland.

- Physically operating inside a free zone without proper registration. Even temporary presence, like meetings or staff working onsite, requires a free zone license.

- Using another company’s license to operate across zones. This “license sharing” is illegal and heavily penalized.

- Poor documentation of cross-zone transactions. Contracts and invoices must clearly state tax responsibilities and jurisdictions to avoid compliance issues.

- Not consulting with legal or tax experts before structuring deals. Early professional advice helps avoid costly mistakes and ensures compliance.

Being aware of these pitfalls helps maintain your business’s legal standing and protects you from unexpected penalties. And we’ve listed must-know challenges in setting up a business in Dubai. You can read this to avoid costly mistakes.

Plan Smart, Stay Compliant

Successfully doing business across mainland and free zones in the UAE requires careful planning and strict compliance. Understanding licensing restrictions and tax obligations ensures your operations run smoothly and avoid costly penalties.

The main challenges lie in navigating complex licensing rules. Mainland companies cannot simply operate inside free zones without proper registration, and managing corporate tax and VAT correctly. Missteps in these areas can lead to fines, legal issues, and disruptions.

At GCG Structuring, we specialize in guiding businesses through the maze of cross-jurisdiction regulations, helping you set up the right structures, maintain compliance, and optimize your tax position. With us, you can focus on growing your business confidently and legally.

FAQ

1. 0 Can a Dubai mainland company open a branch inside a free zone?

Yes, a Dubai mainland company can open a branch in a free zone, but it must register with the free zone authority and comply with their specific rules. This setup allows limited operations within the free zone while keeping the mainland license active.

2. 0 Does Dubai mainland company formation simplify trading with free zones?

Dubai mainland company formation lets you legally trade with free zones, but customs duties and compliance requirements still apply. Goods moving from free zones to mainland or vice versa may face VAT or customs fees depending on the product and usage.

3. 0 Can a mainland company do business in freezone without opening a branch there?

Typically, no. Most mainland companies need to establish a branch or legal presence in the free zone to conduct ongoing business activities inside it. Otherwise, transactions must be structured as service contracts without physical operations.

4. 0 Is dual licensing available between a Dubai mainland company and a free zone entity?

Yes. Dual licensing allows companies to operate legally in both mainland and free zones, but it requires approval from relevant authorities and is limited to certain business activities.

5. 0 Which free zones are more flexible for partnerships with Dubai mainland companies?

Free zones like DMCC (Dubai Multi Commodities Centre) and DAFZA (Dubai Airport Free Zone) have frameworks that support partnerships and easier collaboration with Dubai mainland companies.

6. 0 How do banking options differ after Dubai mainland company formation compared to free zones?

Dubai mainland companies often find it easier to open bank accounts with local banks, as free zone companies sometimes face stricter Know Your Customer (KYC) requirements and longer processing times.

7. 0 Can a Dubai mainland company legally provide services inside a free zone?

Only if the mainland company has approval from the free zone authority or has established a registered branch within the free zone. Otherwise, services must be delivered from the mainland without physical presence inside the free zone.