The United Arab Emirates is one of the most attractive places in the world for entrepreneurs, freelancers, and remote workers looking for a tax-friendly base. Among the different residency options, the freezone visa UAE is often the fastest and most straightforward. It is open to those setting up a business, working for a free zone company, or offering freelance services under an approved license.

In 2025, the freezone visa UAE continues to offer 100% foreign ownership, flexible visa quotas, and a wide choice of business activities without the need for a mainland sponsor. Whether you are starting fresh, expanding your company, or working remotely for global clients, it can be a highly efficient path to legal residency.

In this blog, we will explain who qualifies for the freezone visa UAE, the Dubai freezone visa benefits, the rules and regulations to follow, how to pick the right free zone, and the exact process from application to Emirates ID. We will also look at the Dubai freezone visa processing time, common mistakes that slow applications, and tips to get approved quickly under 2025 regulations.

Table of Contents

Freezone Visa UAE: Who Qualifies in 2025

The freezone visa UAE is designed for individuals and business owners who have a direct link to a UAE free zone, either through employment, company ownership, or an approved freelance license. It is not a tourist visa or a short-term work permit. It grants residency status, allowing you to legally live in the UAE, open a local business bank account, and access essential services.

In general, anyone who meets the eligibility requirements of a registered UAE free zone can apply for a freezone visa UAE. These include:

1. Free Zone Employees

If you are hired by a company registered in a UAE free zone, your employer can sponsor your freezone visa UAE. This is common for roles in sectors like IT, logistics, media, trading, and consulting.

2. Business Owners and Investors

If you set up a company in a UAE free zone, you can apply for your own freezone visa UAE as the owner or shareholder. This is a major draw for entrepreneurs seeking 100% ownership without a mainland sponsor.

3. Freelancers with an Approved License

Many free zones now issue freelance permits for professionals in areas like design, consulting, content creation, and software development. Having such a license qualifies you for a freezone visa UAE, even if your clients are entirely outside the UAE.

4. Company Directors and Managers

Senior managers and directors of free zone companies also qualify for a freezone visa UAE, even if they are not shareholders.

Basic Requirements in 2025

- Age: Must be at least 18 years old.

- Passport: Minimum 6 months’ validity at the time of application.

- Medical Fitness: Blood test and chest X-ray are required.

- Clear Record: No active UAE immigration bans or unresolved visa violations.

Free zones may have additional conditions depending on the license type. For example, a trading license might allow multiple visas, while a freelance license usually permits just one. It’s important to confirm these details before applying, as they can affect your eligibility and growth plans.

The freezone visa UAE remains one of the most flexible residency options in the region, but only if your activities fit within the approved categories of your chosen free zone. Selecting the right zone from the outset can save significant time, costs, and potential legal complications.

Dubai Freezone Visa Benefits You Should Know

The Dubai freezone visa benefits go far beyond just legal residency. Holding a freezone visa UAE gives you a package of rights and opportunities that make living and working in the UAE far more convenient. Whether you are an entrepreneur, freelancer, or investor, the advantages can directly improve how you run your business and manage your personal affairs.

Key Benefits in 2025:

1. 100% Foreign Ownership

With a freezone visa UAE, you can own your business outright without a local partner. This is one of the most sought-after Dubai freezone visa benefits, as it allows you full control over operations, profits, and strategic decisions.

2. Tax Advantages

Most UAE free zones offer zero personal income tax and zero corporate tax for qualifying activities. This tax regime is among the most competitive globally. These savings can be reinvested into business growth or personal investments.

3. Flexible Visa Quotas

Depending on your license type, your freezone visa UAE can allow you to sponsor additional visas for employees. This makes scaling your team easier and keeps operations within the same free zone framework.

4. Family Sponsorship

A freezone visa UAE enables you to sponsor your spouse, children, and in some cases, parents. This is a major lifestyle benefit for those relocating with family.

5. Access to UAE Banking and Credit Services

Opening a corporate and personal bank account is far simpler with a freezone visa UAE, giving you access to local financing, credit cards, and payment gateways.

6. Strategic Location for Global Business

Many free zones are located close to major airports and seaports, which supports import, export, and logistics operations. This makes the Dubai freezone visa benefits especially valuable for companies trading internationally.

7. No Restrictions on Currency Repatriation

With a freezone visa UAE, you can transfer your capital and profits abroad without currency restrictions, allowing smooth international financial management.

8. Access to Business Support Services

Free zones often provide co-working spaces, networking events, and administrative support. These extras can help new businesses grow faster without heavy upfront costs.

Types of Business Activities and Ownership Structures That Qualify

Your eligibility for a freezone visa UAE is closely tied to the type of business activity you register and the ownership structure you choose. Each UAE free zone has its own list of permitted activities, and some are more flexible than others. Selecting the right activity at the start is important, as it can determine not only whether your application is approved, but also how many visas your company can issue.

Approved Business Activity Categories in 2025

While each free zone has its own specific list, most approved activities for a freezone visa UAE fall into the following categories:

1. Trading Activities

Importing, exporting, and re-exporting goods is a common route for securing a freezone visa UAE. Many free zones near ports and airports specialize in this category.

2. Service Activities

Consulting, marketing, design, legal services, and IT support all qualify for a freezone visa UAE under a service license.

3. Industrial and Manufacturing

Free zones like Jebel Ali Free Zone and Khalifa Industrial Zone offer licenses for light manufacturing and assembly, which can also come with a freezone visa UAE.

4. Media and Creative Work

Media free zones support film production, broadcasting, publishing, and content creation. Freelancers in these fields can apply for a freezone visa UAE with the right license. If you’re a digital marketing agency owner, learn how you can set up in the UAE as a foreigner.

5. Technology and Innovation

Tech-focused zones issue licenses for software development, cybersecurity, and AI research, all of which qualify for a freezone visa UAE.

6. Education and Training

Licenses for education services, training institutes, and e-learning platforms also allow for a freezone visa UAE.

Common Ownership Structures That Qualify

1. Free Zone Establishment (FZE)

Single-owner structure where the individual holds 100% shares. Ideal for solo entrepreneurs applying for freezone visa in UAE.

2. Free Zone Company (FZC)

Multi-shareholder structure for two or more owners. Shareholders can all qualify for a freezone visa UAE.

3. Branch of a Foreign Company

Allows an existing overseas company to open in a UAE free zone and sponsor freezone visa UAE applications for managers and staff.

4. Branch of a UAE Company

Extends a mainland UAE company into a free zone, enabling them to issue freezone visa UAE under the new entity.

Dubai Freezone Visa Rules and Regulations in 2025

The Dubai freezone visa rules and regulations are straightforward but must be followed carefully to keep your freezone visa UAE valid. Each free zone sets its own procedures, but the main requirements are similar across Dubai.

1. Active Business License

A valid free zone license matching your business activity is mandatory.

2. Visa Validity

Most freezone visa UAE permits in Dubai are valid for 2 years, renewable with an active license and medical clearance.

3. Medical and Biometrics

Blood test, chest X-ray, and Emirates ID biometrics are compulsory.

4. Employer or License Link

Your visa is tied to your company license or free zone employer. Any change needs a cancellation and new application.

5. Residency Requirement

Enter the UAE at least once every 6 months to avoid cancellation.

6. Family Sponsorship

Allowed if income and housing criteria are met, based on free zone policies.

7. Activity Compliance

Only operate within your licensed business scope to avoid fines or suspension.

Choosing the Right Free Zone for Speed and Cost

Selecting the right free zone is crucial when applying for your freezone visa UAE. The choice affects how quickly your visa is processed, the total cost, and the types of business activities you can undertake. In 2025, Dubai and the wider UAE have several free zones, each with its own setup fees, visa quotas, and processing timelines.

1. Visa Processing Speed

Some free zones offer express services or have streamlined procedures that can cut down the Dubai freezone visa processing time to as little as two weeks. Zones like RAK Free Trade Zone, Meydan Free Zone, and Sharjah Media City (Shams) are known for quicker approvals.

2. Cost of Setup and Visa Fees

Initial licensing fees, office rent (virtual or physical), and visa issuance charges vary widely. As highlighted in our Dubai license cost guide, some free zones have packages starting around AED 12,000 including visas, while others charge more depending on facilities and services. Always compare total costs, not just license fees.

3. Business Activity Compatibility

Make sure the free zone supports your intended business activity, whether it’s trading, consulting, freelancing, or industrial work. Choosing a zone that aligns with your activity avoids unnecessary license amendments later.

4. Visa Quota and Flexibility

Different free zones allow different numbers of visas per license. If you plan to hire employees or sponsor family members, check the quota limits before deciding.

5. Location and Infrastructure

Some zones are strategically located near ports or airports, which benefits trading or logistics companies. Others focus on media, technology, or creative industries and offer specialized support.

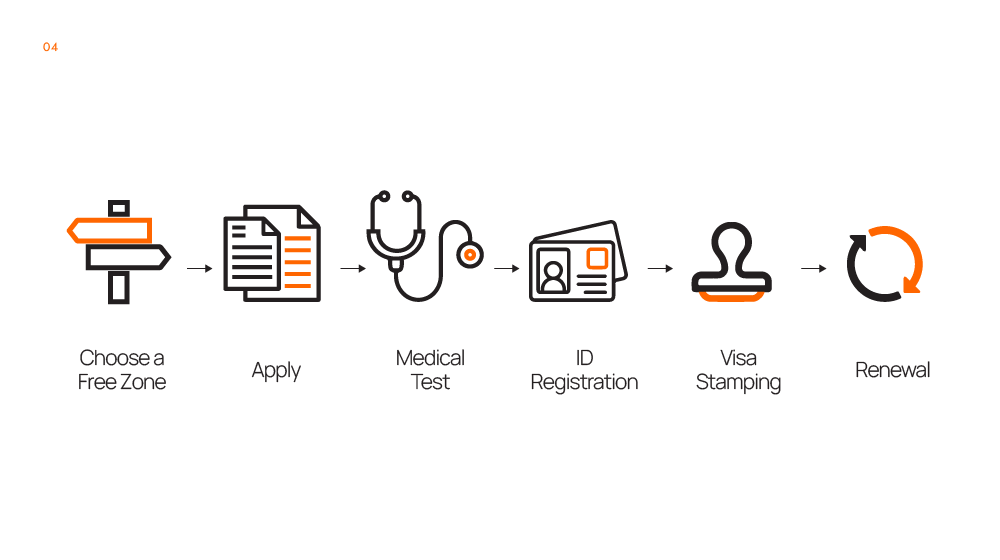

Step-by-Step Guide to Getting Your Free Zone Visa

Obtaining your freezone visa UAE involves several important steps, each necessary to ensure your application complies with local laws and moves through processing efficiently. Understanding the full procedure will help you avoid delays and complete your residency application smoothly.

Step 1: Choose and Register Your Free Zone Company or Freelance License

The first step is to decide which free zone suits your business activity and residency needs. Once you select the free zone, you must register your company or apply for a freelance permit. This registration includes submitting your passport copy, business plan, and relevant documents, along with payment of license fees. You can learn more about types of licenses here.

Step 2: Apply for the Entry Permit Through the E-Channel System

After your business license is issued, you can apply for an entry permit via the free zone’s E-Channel system. This permit allows you to legally enter the UAE for residency processing. It is usually valid for 60 days from issuance.

Step 3: Enter the UAE and Complete Medical Testing

With your entry permit, you must arrive in the UAE and undergo the mandatory medical fitness test, which includes a blood test and chest X-ray. This is a required step under the freezone visa UAE regulations.

Step 4: Register for Emirates ID and Biometrics

Next, you will register for your Emirates ID card and submit biometric data such as fingerprints and a photo at an authorized typing center. The Emirates ID is essential for residency validation and accessing government services.

Step 5: Finalize Visa Stamping in Your Passport

Once your medical results and Emirates ID registration are complete, your freezone visa UAE is stamped into your passport. This stamp confirms your legal residency status and typically lasts for two years.

Step 6: Renew Your Visa and License Regularly

Keep in mind that your visa and business license must be renewed before expiration to maintain your residency and legal business status. Renewal requires a valid license, updated medical test, and Emirates ID renewal.

Dubai Freezone Visa Processing Time: How to Get It Done Quickly

The typical Dubai freezone visa processing time is 2 to 6 weeks, depending on the free zone and how fast you submit documents. Most applicants get their freezone visa UAE within 3 to 4 weeks if everything is in order.

How to Speed Up Processing

- Submit complete, accurate documents.

- Book and complete medical tests quickly.

- Choose free zones known for fast processing, like RAKFTZ or Meydan.

- Avoid applying during holidays or busy periods.

- Use an experienced PRO or agent if possible.

Following these tips helps reduce your Dubai freezone visa processing time and get your freezone visa UAE faster.

If you want to learn how you can fast-track your entrepreneur visa processing, read this guide.

Common Pitfalls and How to Avoid Them

When applying for a freezone visa UAE, certain mistakes can cause delays, increased costs, or even visa rejection. Being aware of these common pitfalls can help you navigate the process smoothly.

1. Choosing the Wrong License or Free Zone

Selecting a free zone that doesn’t support your business activity or visa needs can lead to costly amendments and longer processing. Always verify the permitted activities and visa quotas before registering. If you’re new, you can check this list of free zones in Dubai and decide which one is best for you.

2. Incomplete or Incorrect Documentation

Submitting documents with errors, expired passports, or missing attestations is a common cause of application rejection or delay. Double-check all paperwork before submission.

3. Ignoring Medical and Emirates ID Requirements

Delaying medical tests or Emirates ID registration can halt your freezone visa UAE approval. Schedule these steps promptly once your entry permit is issued.

4. Overlooking Residency Entry Requirements

Failing to enter the UAE within the allowed timeframe or not renewing your visa on time may result in cancellation or fines. Stay on top of these deadlines.

5. Not Using Professional Help When Needed

Handling the process alone, especially if unfamiliar with UAE immigration, can increase errors and slow approvals. Consider hiring a PRO or consultant experienced with your chosen free zone.

There are many more challenges businesses face, but here are must know challenges when you’re setting up your business in Dubai and how you can avoid them.

Making Your UAE Move Smooth and Fast

Getting a freezone visa UAE is a smart choice for entrepreneurs, freelancers, and investors looking for legal residency and business growth in the UAE. However, many applicants face common challenges such as confusing paperwork, unclear regulations, unexpected delays, and costly mistakes that can stall or even derail their visa process.

Without the right guidance, these issues can lead to wasted time, extra expenses, and frustration. Missing medical appointments, submitting incomplete documents, or choosing the wrong free zone are just a few examples that cause avoidable setbacks.

At GCG Structuring, we help you avoid these pitfalls by guiding you through every stage of the freezone visa UAE process. As part of our freezone company formation in Dubai services, we assist with selecting the best free zone and license, and handle all paperwork and compliance details. Our expertise ensures your application moves smoothly and quickly.

FAQ

1. 0 Can I switch from a freezone visa to a mainland visa?

Yes, but you must cancel the freezone visa and apply for a mainland visa, which can take several weeks.

2. 0 Can I work for multiple companies on a freezone visa?

Usually no. Your freezone visa is tied to one company or freelance license unless your permit allows multiple clients.

3. 0 Do I need a physical office for a freezone visa?

Not always. Many free zones accept virtual offices, but some license types may require a physical space.