When entrepreneurs and investors choose the United Arab Emirates as their base, they are not only attracted to its reputation as a global business hub but also to the flexibility it offers in structuring companies. With a corporate tax regime that remains competitive, free zones that support cross-border trade, and a regulatory framework designed to welcome both startups and international enterprises, the UAE gives businesses the ability to think strategically about how they operate and grow.

One of the key decisions in that process is choosing between a Holding Company (HoldCo) and an Operating Company (OpCo), or in many cases, deciding how to combine both structures. This choice has direct consequences for risk protection, tax planning, scalability, and investor confidence.

In this blog, we are going to explore the debate of HoldCo vs OpCo in detail. You will learn what each structure means, how they differ, and why it matters in the UAE context. We will cover the benefits of each model, look at how debt works differently under holdco debt vs opco debt, and examine when it makes sense to use both together. You will also find practical examples of how entrepreneurs, family offices, and investors are using these structures in 2025 to safeguard assets and build long-term strategies.

Table of Contents

HoldCo vs OpCo: Understanding the Core Difference

When planning a business in the UAE, knowing the difference between HoldCo vs OpCo is key. Each serves a distinct purpose and affects risk, taxes, and growth strategy.

What is a HoldCo?

A Holding Company (HoldCo) owns shares, assets, or intellectual property but does not handle daily operations. In the UAE, HoldCos are commonly established in free zones such as ADGM, DIFC, or DMCC, where regulations favor asset protection, tax efficiency, and centralized control over multiple businesses. In fact, qualifying free zone entities may benefit from a 0% corporate tax rate on eligible income, provided they meet the required economic substance and activity criteria.

What is an OpCo?

An Operating Company (OpCo) manages day-to-day business activities. It hires staff, signs contracts, earns revenue, and handles operations. OpCos may operate under mainland or free zone licenses depending on market needs.

Many expats have misconceptions about business licenses in the UAE. If you’re an expat and want to understand them better, click here to learn everything you need to know.

Key Differences Here:

- Ownership vs Operations: HoldCo owns, OpCo executes.

- Risk Exposure: HoldCo shields assets, OpCo takes operational risk.

- Revenue Flow: OpCo generates income; HoldCo collects dividends or royalties.

Choosing the right structure in HoldCo vs OpCo terms affects tax planning, investor readiness, and long-term business growth in the UAE.

OpCo vs HoldCo: Breaking It Down Further

Understanding business strategy from the operational side can clarify the choices between HoldCo vs OpCo. While HoldCo vs OpCo generally focuses on ownership and control, looking at OpCo vs HoldCo emphasizes day-to-day operations and revenue generation first, showing how these activities fit into a broader corporate structure.

The OpCo Perspective

Many entrepreneurs in the UAE start with an OpCo because it handles the essential business functions: sales, client management, production, and service delivery. By focusing on the operational side, businesses can generate revenue and establish a market presence before considering more complex structures. Evaluating OpCo vs HoldCo helps identify how operational risks, profits, and growth potential can later interact with a holding company structure.

How HoldCo Supports the OpCo

Even when an OpCo is the starting point, understanding HoldCo vs OpCo provides strategic clarity:

- Asset Protection: Assets like intellectual property, real estate, or cash reserves can be moved under the HoldCo to protect them from operational risks.

- Profit Flow: Revenue generated by the OpCo can be distributed to the HoldCo in a tax-efficient manner, supporting reinvestment or expansion.

Multiple Ventures: A HoldCo can hold several OpCos, allowing businesses to diversify without exposing all assets to operational liabilities.

Benefits of a HoldCo Structure in the UAE

When considering HoldCo vs OpCo, a HoldCo provides clear advantages for asset protection, control, and long-term planning. Many UAE entrepreneurs choose a HoldCo to safeguard valuable assets and manage multiple ventures under one umbrella.

Asset Protection and Risk Management

A HoldCo separates ownership from daily operations, protecting assets like intellectual property, cash reserves, and real estate from operational risks. In the HoldCo vs OpCo debate, this separation is a key reason to use a HoldCo.

Tax Efficiency and Profit Flow

With the UAE applying 9% corporate tax on profits above AED 375,000, profits from OpCos can flow to the HoldCo as dividends with minimal tax impact. Understanding HoldCo vs OpCo helps structure these flows efficiently for reinvestment or investor distribution.

Centralized Ownership and Strategic Control

A HoldCo provides central oversight over multiple OpCos, allowing consistent policies and streamlined decision-making. Comparing HoldCo vs OpCo, central control is one of the HoldCo’s biggest benefits for scaling businesses.

Investor and Expansion Readiness

Investors often prefer a HoldCo because it limits exposure to operational risk while allowing participation in multiple ventures. A UAE HoldCo can also own foreign subsidiaries, supporting international growth. Evaluating HoldCo vs OpCo shows how this structure appeals to investors and protects assets.

Benefits of an OpCo Structure in the UAE

While a HoldCo focuses on ownership and long-term planning, an OpCo is the engine that drives revenue and daily operations. Understanding HoldCo vs OpCo helps entrepreneurs decide which structure fits their current business stage.

Direct Revenue Generation

An OpCo manages contracts, sales, and services, making it the primary source of income. Unlike a HoldCo, which collects dividends or royalties, the OpCo directly interacts with the market and clients, providing immediate cash flow.

Operational Simplicity

OpCos are generally easier to set up and maintain. For businesses in the UAE testing the market or starting a single venture, an OpCo provides a straightforward structure without the complexity of a separate HoldCo. Comparing HoldCo vs OpCo, simplicity is a key advantage for early-stage businesses.

Flexibility and Market Presence

An OpCo can operate under a mainland or free zone license depending on business needs. This flexibility allows companies to quickly adapt to market demands and regulatory requirements while maintaining operational focus. And if you’re opting for a free zone license, check out this list of free zones in the UAE to pick the right one for your business.

Lower Administrative Costs

Maintaining a single OpCo typically involves fewer licenses, filings, and compliance requirements compared with adding a HoldCo. In the HoldCo vs OpCo discussion, this cost efficiency is a significant consideration for small or growing businesses.

Foundation for Growth

Starting with an OpCo does not prevent future expansion. Once revenue and market presence are established, the business can later introduce a HoldCo to manage assets, multiple ventures, or investor relations. Understanding HoldCo vs OpCo ensures that the OpCo stage aligns with long-term strategy.

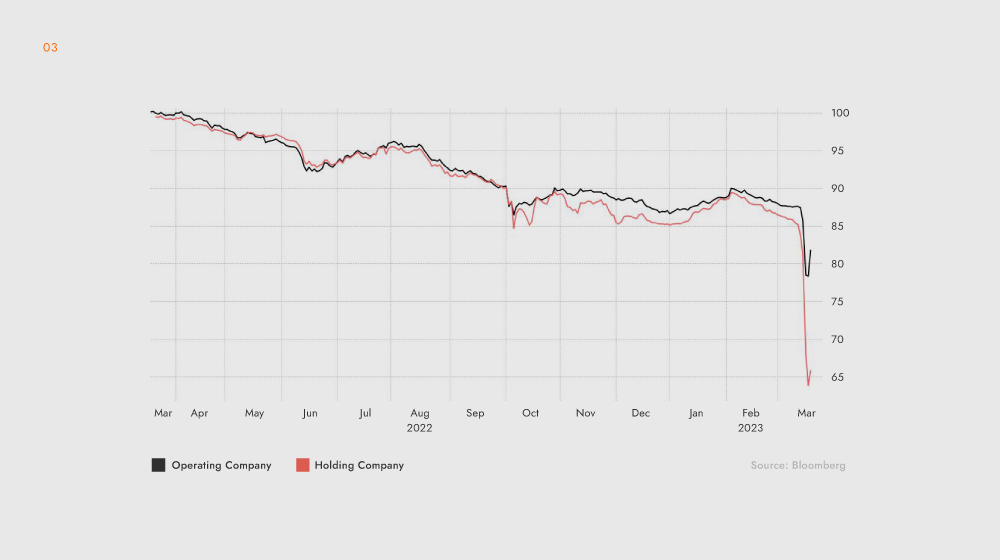

HoldCo Debt vs OpCo Debt: Understanding the Risk Allocation

When comparing HoldCo vs OpCo, understanding how debt is structured is critical for risk management and financial planning. The distinction between holdco debt vs opco debt influences liability, financing options, and investor confidence.

OpCo Debt: Operational Risk

Debt taken on by an OpCo is typically tied to its day-to-day operations. This includes loans for equipment, inventory, or working capital. In case of default, creditors usually target the OpCo’s assets, leaving the HoldCo’s holdings protected. Considering holdco debt vs opco debt, operational debt is contained within the OpCo to minimize exposure to broader corporate assets.

HoldCo Debt: Strategic Financing

HoldCo debt is usually raised to fund acquisitions, invest in subsidiaries, or manage strategic cash flow. Because a HoldCo generally does not operate directly in the market, its debt is linked to ownership stakes rather than operational assets. Evaluating holdco debt vs opco debt allows businesses to leverage the HoldCo for strategic growth while isolating operational risk in the OpCo.

Things to Consider:

- Risk Management: Using separate debt structures for HoldCo and OpCo shields key assets from operational or market fluctuations.

- Investor Perspective: Investors often prefer clear separation between holdco debt vs opco debt, as it clarifies where risk lies.

- Tax and Financial Planning: In the UAE, structured debt between HoldCo and OpCo can optimize interest deductions and support cross-company funding.

Understanding HoldCo vs OpCo in terms of debt ensures that businesses can raise capital efficiently without exposing assets unnecessarily, making this distinction crucial for both new and expanding companies.

When to Use a HoldCo + OpCo Combo

In many UAE businesses, the choice is not just HoldCo vs OpCo, it’s how the two can work together. Combining a HoldCo with one or more OpCos provides both operational efficiency and strategic control, offering advantages that neither structure alone can deliver.

Diversifying Risk and Protecting Assets

Using a HoldCo to own multiple OpCos allows businesses to isolate risks. Operational challenges, legal issues, or debt in one OpCo do not affect the assets held by the HoldCo or other subsidiaries. When considering HoldCo vs OpCo, this combination is particularly valuable for entrepreneurs with multiple business lines or significant intellectual property.

Optimizing Tax and Profit Flows

A HoldCo + OpCo structure enables efficient movement of profits. Dividends from OpCos can flow to the HoldCo, which can reinvest or distribute them strategically. Evaluating HoldCo vs OpCo in this context highlights how the combination supports long-term tax planning while maintaining operational flexibility.

Simplifying Governance for Multiple Ventures

Centralizing ownership under a HoldCo makes managing several OpCos easier. Policies, financial reporting, and investor communications can be standardized, giving business owners better control without micromanaging day-to-day operations. Using HoldCo vs OpCo strategically ensures governance remains clear and effective.

Supporting Growth and Investor Confidence

Investors often prefer a HoldCo + OpCo structure because it clearly separates operational risk from ownership. This approach is common in UAE free zones and mainland businesses aiming to attract investment or expand internationally. Considering HoldCo vs OpCo together shows how this combination can facilitate scaling while protecting the company’s core assets.

Practical Example

For instance, a UAE entrepreneur might create an OpCo for a trading business and another for an e-commerce venture, while a HoldCo owns both and holds the intellectual property. This setup protects assets, simplifies financing, and prepares the business for future expansion, illustrating the practical benefits of combining HoldCo vs OpCo.

Compliance and Legal Considerations in the UAE

When structuring a business in the UAE, understanding the legal and regulatory environment is crucial. Choosing the right setup ensures your company operates smoothly while minimizing risks and maintaining flexibility for growth.

Free Zone vs Mainland Licensing

Businesses in the UAE can be established in either a free zone or on the mainland, and the choice impacts both governance and operations. HoldCos are often registered in free zones such as DIFC, ADGM, or DMCC, where regulations favor asset protection, foreign ownership, and investor-friendly policies. OpCos may operate on the mainland to access the domestic market or in free zones for specific international trade activities. Evaluating HoldCo vs OpCo helps determine which licensing option aligns with your objectives.

Corporate Tax and Financial Reporting

With the UAE’s corporate tax of 9% applied to profits above AED 375,000, businesses must plan profit flows and reporting carefully. Structuring revenues and dividends properly ensures compliance while optimizing tax obligations. You can learn how to register corporate tax in the UAE.

Legal Protections and Governance

Separating ownership from operations strengthens governance. Clear distinctions between holding and operating entities protect assets, simplify investor relations, and reduce legal exposure in case of operational disputes.

Cross-Border Considerations

For businesses with international ambitions, a HoldCo can own foreign subsidiaries, benefiting from tax treaties and supporting expansion while remaining compliant with both UAE and foreign laws.

Practical Scenarios: Which Structure Fits Your Strategy?

Choosing between HoldCo vs OpCo ultimately depends on your business goals, stage of growth, and appetite for risk. By examining practical scenarios, you can see how different setups align with specific strategies in the UAE.

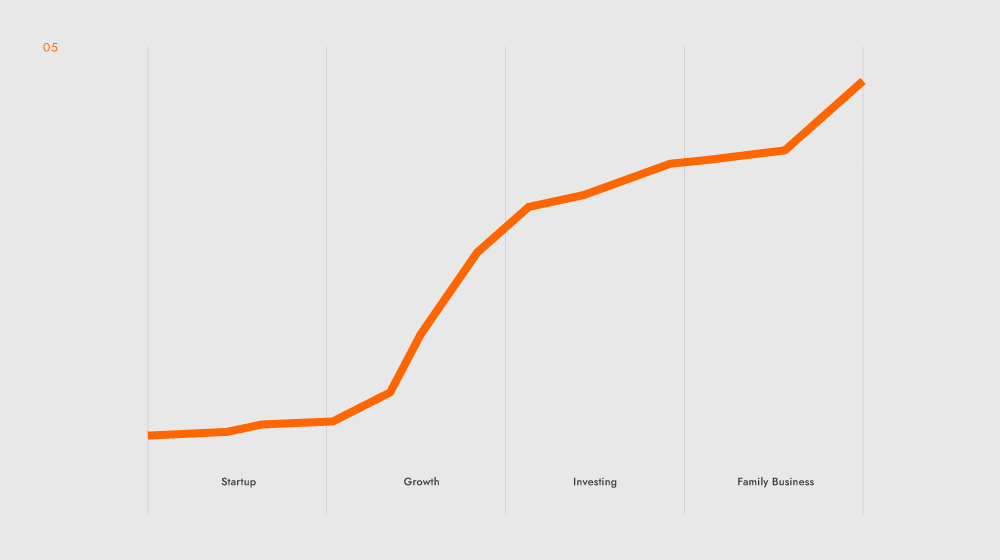

Solo Entrepreneur or Small Startup

If you are starting a single business with limited assets, an OpCo alone is often sufficient. It allows you to focus on operations, revenue generation, and establishing market presence without the added complexity of a HoldCo. In this scenario, simplicity and flexibility take priority.

Growth-Focused Business

For businesses planning expansion, creating a HoldCo to own one or more OpCos provides both protection and scalability. Revenue flows from OpCos can be channeled through the HoldCo, enabling reinvestment, acquisitions, or diversification into new markets. This setup balances operational efficiency with strategic oversight.

Investor-Driven Ventures

If attracting investors or venture capital is a key objective, a HoldCo-centric structure can be advantageous. Investors often prefer investing at the HoldCo level because it separates operational risk from core assets and offers exposure to multiple subsidiaries. In these cases, HoldCo vs OpCo thinking guides decisions around ownership, equity, and risk allocation.

Family Businesses or Multi-Venture Portfolios

For family offices or entrepreneurs managing multiple ventures, combining a HoldCo with several OpCos is common. The HoldCo safeguards assets, manages intellectual property, and oversees subsidiaries, while OpCos focus on operational execution. This approach also simplifies succession planning and provides clear governance.

Market Entry and Testing New Ventures

An OpCo alone can also serve as a test bed for new business ideas. Once operations stabilize and generate revenue, a HoldCo can be introduced to manage growth, assets, or additional OpCos. Evaluating HoldCo vs OpCo ensures that the initial structure supports long-term objectives without limiting flexibility.

Now that you know about compliance and legal considerations, and have an idea of practical scenarios, there are 8 challenges business owners face when setting up their business in the UAE. We breakdown how you can overcome those challenges easily in this blog.

Choosing the Right Model for Growth

Deciding between HoldCo vs OpCo is a critical step that shapes how your UAE business operates, grows, and protects its assets. OpCos drive revenue and market presence, while HoldCos provide control, asset protection, and scalability.

For startups or single ventures, an OpCo may be sufficient. As businesses expand, attract investors, or diversify into multiple operations, incorporating a HoldCo can centralize ownership, manage risk, and optimize profit flows. Many businesses face challenges in selecting the right structure, which can lead to higher tax liabilities, exposure to operational risks, or complications in attracting investment.

At GCG Structuring, we provide strategic guidance to align business models with growth objectives. By analyzing operational needs, assets, and long-term goals, we design a HoldCo, OpCo, or combined structure that ensures compliance, safeguards assets, and supports sustainable growth in the UAE.

FAQ

1. 0 Can a UAE company act as both HoldCo and OpCo?

Yes, but separating the two improves risk management and tax planning. Combining them can expose assets to operational liabilities.

2. 0 Does a HoldCo protect assets if an OpCo goes bankrupt?

Yes. A properly structured HoldCo shields intellectual property, reserves, and other holdings from an OpCo’s liabilities.

3. 0 Can foreign investors own a HoldCo or OpCo in the UAE?

Yes. Free zone entities allow 100% foreign ownership. Mainland companies may still require a local partner depending on the activity.

4. 0 Are there compliance requirements for a non-trading HoldCo?

Yes. Even without operations, HoldCos must follow governance rules, submit filings, and maintain audits to stay compliant.

5. 0 How do profits move from an OpCo to a HoldCo?

Profits are typically transferred as dividends. In UAE free zones, this process is usually tax-efficient if structured correctly.

6. 0 Can an OpCo later add a HoldCo?

Yes. Many businesses start with an OpCo and add a HoldCo once growth, asset protection, or multiple ventures require it.

7. 0 Is a HoldCo required for investor funding in the UAE?

Not required, but often preferred. Investors favor HoldCos as they separate risk from operations and simplify ownership structures.