International investors, entrepreneurs and business owners often face a formidable hurdle: being taxed twice on the same income, once in the home country and again where the business operates. That burden can erode profits and deter cross-border expansion. The United Arab Emirates responds to this challenge through a sophisticated network of double tax treaties UAE, offering a structured and legal pathway to reduce global tax burdens.

In this blog, we’ll explain how double tax treaties UAE work, who can benefit from them, and how investors can use these agreements to avoid paying tax twice on the same income. We’ll break down what these treaties mean, how they operate, which countries the UAE has agreements with, and what advantages they bring to investors. You’ll also learn who qualifies for treaty benefits, how to claim them, and what common myths to avoid.

Table of Contents

What Is Double Tax Treaty in the UAE?

A common question investors ask is what is double tax treaty in the UAE, and how it actually works in practice. In simple terms, a double tax treaty is an agreement between the UAE and another country that prevents the same income from being taxed twice. Once where it’s earned and again where the investor resides.

What Are Double Tax Treaties?

A double tax treaty is a formal agreement between two countries that defines how income earned across borders will be taxed. It decides which country has the right to tax certain types of income, such as business profits, dividends, royalties, or interest.

For example, if a UAE company earns profits from another country, the treaty ensures that income isn’t taxed again when it’s brought back to the UAE. This prevents overlapping tax liabilities and gives investors clarity on what they owe and where.

How the UAE Applies These Treaties

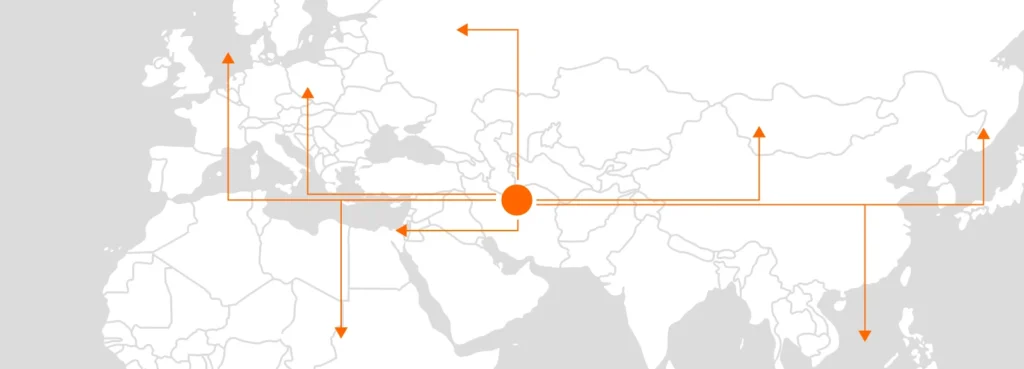

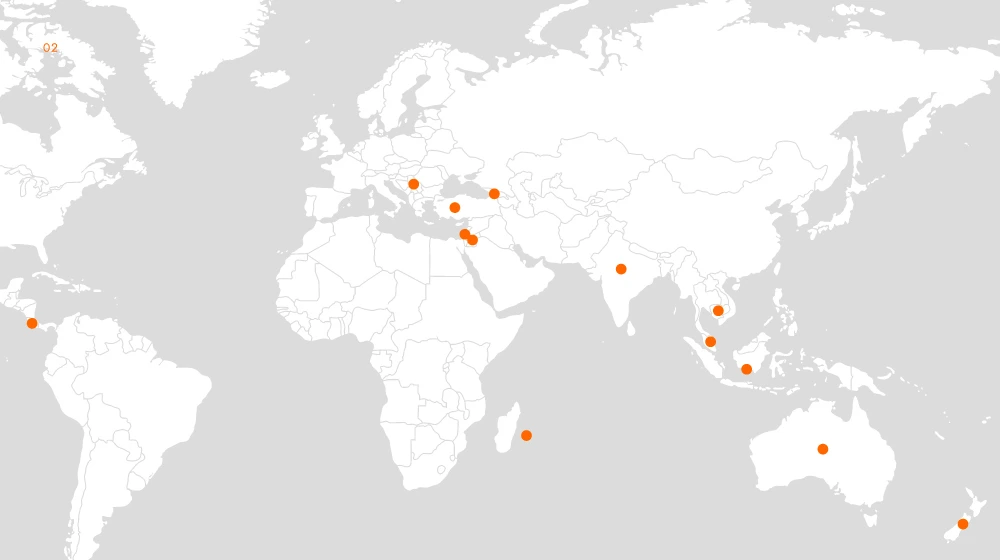

The UAE’s Ministry of Finance negotiates and manages these agreements to make global business simpler and more predictable. As of 2025, the UAE has signed over 140 double taxation agreements covering most major economies in Asia, Europe, Africa, and the Americas.

These treaties often reduce or eliminate withholding taxes on cross-border payments and clarify the rules for residency, permanent establishment, and profit allocation. That makes them especially valuable for holding companies, multinationals, and investors using the UAE as a base for global operations.

Why Double Tax Treaties UAE Matter

Double tax treaties UAE help investors protect their global income from unnecessary taxation. They also promote international trade, attract foreign direct investment, and make the UAE a trusted center for international business.

In recent years, the UAE has also updated many of its treaties to align with international tax standards set by the OECD, improving transparency and credibility. For investors, this means they can enjoy UAE investment tax benefits while staying fully compliant with global tax laws.

What Is Double Tax Treaty in the UAE Exactly?

When people ask what is double tax treaty in the UAE, they’re really asking how these agreements apply to real situations and how they work for individuals and companies doing business across borders.

A double tax treaty in the UAE isn’t just a symbolic agreement. It’s a legal framework that decides which country gets to tax which income. It prevents situations where a company or investor pays full tax abroad and then faces another tax bill in the UAE on the same profits.

Here’s how it works in practice:

1. Clarifying Taxing Rights

Each treaty defines “tax residency” and assigns taxing rights. For example, if a UAE company operates in another treaty country, that income is usually taxed there, not again in the UAE.

2. Reducing Withholding Taxes

Many UAE international tax agreements lower or remove withholding taxes on dividends, royalties, and interest. This lets investors repatriate profits efficiently without losing a large portion to foreign tax authorities.

3. Preventing Double Taxation

If taxes are still paid in another country, the treaty allows the investor to claim a credit or exemption in the UAE. This ensures that the total tax burden is fair and not duplicated.

4. Aligning with UAE’s Tax Policy

The UAE has built these treaties to work alongside its own tax regime. Zero personal income tax and a modest 9% corporate tax rate. This combination makes the country one of the most favorable jurisdictions for UAE investment tax benefits.

5. Ensuring Legal Transparency

All UAE treaties follow international standards under the OECD Model Convention. This makes them globally recognized and gives investors confidence that their tax positions are legitimate and defensible.

How Double Tax Treaties Work: Key Principles and Mechanisms

To understand the real impact of UAE international tax agreements, it helps to see how they actually function. Each treaty sets out clear mechanisms to determine tax rights, reduce double taxation, and encourage cross-border trade and investment.

Here are the key principles that drive these treaties:

1. Tax Residency

The starting point is determining where an individual or company is considered a “resident.” Residency usually decides which country has the first right to tax income. In most cases, UAE residents are taxed only in the UAE, while foreign residents are taxed in their home country avoiding overlap.

2. Source of Income

Each treaty outlines where income is “sourced.” For example, income earned from a business operation in another treaty country is generally taxed there. This prevents the UAE from taxing income that’s already subject to tax elsewhere.

3. Allocation of Taxing Rights

The treaties assign taxing rights between the UAE and the partner country depending on income type, such as business profits, employment income, real estate income, or dividends. This creates certainty for taxpayers about who gets to tax what.

4. Elimination of Double Taxation

When both countries have taxing rights, the treaty ensures that double taxation is eliminated through either:

- Tax exemption, where one country gives up its right to tax; or

- Tax credit, where taxes paid abroad are credited against domestic tax obligations.

5. Withholding Tax Relief

Without a treaty, foreign investors might face withholding taxes of up to 30% in some countries. The UAE’s treaties significantly reduce these rates, often to 0–10%. This allows businesses to repatriate income more efficiently.

6. Non-Discrimination Clause

All UAE tax treaties include a non-discrimination clause, meaning foreign investors are treated the same as domestic ones under similar conditions. This builds investor confidence and helps attract foreign capital.

7. Exchange of Information

Modern UAE treaties include provisions for information exchange between tax authorities. This promotes transparency, prevents tax evasion, and ensures compliance with international standards like those set by the OECD.

Countries That Have Double Tax Treaties with the UAE

The UAE has built an extensive network of double tax treaties UAE, covering over 140 countries as of 2025. These treaties make it easier for investors to move money across borders without facing double taxation, giving the UAE a strong position as an international investment hub.

Key Regions and Examples

1. Europe:

The UAE has treaties with most major European economies, including the UK, Germany, France, Italy, and Switzerland. These agreements often reduce withholding tax rates on dividends, interest, and royalties, helping European investors benefit from UAE investment tax benefits.

2. Asia:

Treaties with countries like India, China, Japan, and Singapore allow businesses to operate across Asia while avoiding duplicate taxation. India, for instance, is one of the UAE’s largest treaty partners, making it easier for UAE-based companies to invest in the Indian market.

3. Africa:

Agreements with Egypt, South Africa, Morocco, and Mauritius provide a framework for investors in African markets to minimize their tax burdens. These treaties help promote trade and cross-border investment between the UAE and the continent.

4. Americas:

The UAE has treaties with Canada, Brazil, Argentina, and others. While the UAE does not currently have a treaty with the United States, ongoing negotiations indicate that more partnerships may develop in the near future.

5. Middle East & GCC:

The UAE has treaties with Bahrain, Kuwait, Oman, and Qatar, supporting regional business operations and cross-border trade within the Gulf.

Having a large treaty network ensures that investors from almost every major economy can access global tax reduction UAE strategies legally. It simplifies cross-border operations, reduces withholding taxes, and strengthens investor confidence in UAE-based structures.

Benefits of Double Tax Treaties for Investors

Investors operating internationally gain several clear advantages from double tax treaties UAE. These treaties not only reduce tax burdens but also make cross-border business more predictable and secure.

1. Avoiding Double Taxation

The main benefit is obvious: investors don’t pay tax twice on the same income. If income is taxed in another country, the treaty allows UAE residents to claim a tax credit or exemption, ensuring their total tax liability is fair and manageable.

2. Reduced Withholding Taxes

Dividends, interest, and royalties sent across borders often face withholding taxes. UAE treaties lower these rates, sometimes to 0%, allowing companies and individuals to repatriate funds efficiently. This is a major reason why UAE investment tax benefits are attractive to global businesses.

3. Legal Certainty and Transparency

Treaties clarify which country has the right to tax different income types. This reduces disputes with foreign tax authorities and provides investors with certainty about their obligations, making it easier to plan long-term strategies.

4. Encouraging Cross-Border Investment

With lower taxes and clear rules, treaties make it easier for UAE-based businesses to invest abroad and for foreign investors to invest in the UAE. This increases capital flow, facilitates expansion, and promotes economic growth.

5. Compliance With Global Standards

Modern UAE international tax agreements follow OECD guidelines and international best practices. Investors can enjoy tax benefits while staying fully compliant with global tax regulations, protecting themselves from penalties or audits.

6. Protection Against Discrimination

Double tax treaties include non-discrimination clauses, ensuring foreign investors are treated the same as domestic investors. This strengthens investor confidence and fosters a fair business environment.

7. Supporting Global Tax Planning

Overall, double tax treaties UAE provide investors with tools for legal tax planning, helping them structure international holdings, repatriate profits efficiently, and optimize returns without breaching local or international law.

Eligibility: Who Can Benefit from Double Tax Treaties in the UAE

Not everyone can automatically claim benefits under double tax treaties UAE. Eligibility depends on residency, documentation, and the type of income.

1. Individuals

UAE residents who earn income from countries with which the UAE has a treaty can benefit if they hold a valid UAE Tax Residency Certificate (TRC). This confirms to foreign tax authorities that the individual qualifies for treaty benefits, reducing or eliminating double taxation.

2. Companies

Companies incorporated or effectively managed in the UAE can also benefit from treaties. The business must meet UAE residency requirements and, in some cases, show sufficient substance, such as office presence, employees, or active management to access treaty provisions.

3. Types of Income Covered

Eligibility typically applies to:

- Dividends and interest

- Royalties

- Business profits

- Employment income

- Capital gains

4. Documentation Required

To claim treaty benefits, investors generally need:

- A UAE Tax Residency Certificate

- Proof of income origin

- Relevant treaty forms or applications to foreign tax authorities

5. Common Mistakes

Some investors assume that simply being in the UAE is enough. In reality, claiming UAE investment tax benefits requires proper documentation and adherence to treaty conditions. Incorrect claims can lead to denied benefits or penalties.

By meeting eligibility criteria and maintaining proper records, individuals and companies can fully leverage double tax treaties UAE to reduce their global tax exposure legally.

How to Claim Tax Benefits Under a Double Tax Treaty

Claiming benefits under double tax treaties UAE is straightforward if the correct steps are followed.

1. Obtain a Tax Residency Certificate (TRC)

The UAE Tax Residency Certificate is essential. It proves to foreign tax authorities that you qualify for treaty benefits.

2. Submit Required Documents Abroad

Provide the TRC along with any forms or applications required by the foreign tax authority where the income is sourced. This may include proof of income type, treaty claim forms, or company registration documents.

3. Apply for Withholding Tax Relief

Many treaties reduce withholding taxes on dividends, interest, and royalties. Submit the TRC and claim forms to ensure reduced rates are applied at source.

4. Claim Tax Credits if Needed

If foreign taxes are already paid, you may be able to claim a credit against UAE taxes where applicable, preventing double taxation.

5. Maintain Records

Keep all documents, TRCs, and correspondence in case of audits. Proper record-keeping ensures compliance and smooth processing of treaty benefits.

Common Misconceptions About Double Tax Treaties UAE

Despite their benefits, several misconceptions can mislead investors about double tax treaties UAE.

1. “UAE Treaties Eliminate All Taxes”

Some believe that treaties remove all tax obligations. In reality, they prevent double taxation but don’t necessarily exempt all income from tax in either country.

2. “Anyone Can Claim Benefits”

Only UAE residents or companies meeting residency and substance requirements can claim treaty benefits. Proper documentation, like a Tax Residency Certificate, is mandatory.

3. “All Income Types Are Covered”

Not all income qualifies. Certain passive income or special business activities may fall outside the treaty’s scope. Always check the treaty text for covered income types.

4. “No Need for Documentation”

A common mistake is assuming benefits apply automatically. Authorities require TRCs, forms, and proof of income. Missing paperwork can result in denied claims.

5. “Treaties Apply Even If the Other Country Has No Tax”

If the other country doesn’t tax certain income, the treaty may have little effect. Benefits are most useful when both countries impose taxes that could otherwise overlap.

Use UAE’s Double Tax Treaties to Build a Tax-Efficient Global Strategy

Double tax treaties UAE are essential for investors aiming to reduce global tax burdens legally. By clarifying which country can tax specific income, lowering withholding taxes, and providing mechanisms to avoid double taxation, these treaties make cross-border business more predictable and profitable.

Investors and companies that understand how to use these treaties can structure international operations efficiently, repatriate profits, and optimize returns while staying fully compliant with both UAE and international tax regulations.

With treaties covering over 140 countries, the UAE provides a unique environment for global investment. Leveraging UAE investment tax benefits allows businesses to grow internationally without unnecessary tax exposure.

At GCG Structuring, we help investors set up their UAE companies or holding structures correctly to fully benefit from these treaties. From obtaining Tax Residency Certificates to ensuring compliance with treaty rules and structuring global operations, our team guides investors step by step, making it easy to maximize the advantages of double tax treaties UAE.

FAQ

1. 0 Which countries have double tax treaties with the UAE?

The UAE has treaties with over 140 countries, including the UK, India, China, France, Singapore, and many others.

2. 0 How long does it take to get a Tax Residency Certificate?

Typically, it takes a few weeks if all documents and residency requirements are in order.

3. 0 Can a foreign company benefit from UAE treaties without a UAE presence?

No. Companies must be incorporated or effectively managed in the UAE and meet residency requirements.

4. 0 Do UAE treaties apply to personal income like salaries or dividends?

Yes, many treaties cover personal income, dividends, interest, royalties, and capital gains but specifics depend on the treaty.

5. 0 Are there penalties for incorrectly claiming treaty benefits?

Yes. Submitting incomplete or false documents can lead to denied benefits or fines from foreign tax authorities.