Setting up a holding company in the UAE offers foreign investors a way to protect assets, manage multiple businesses, and benefit from tax efficiencies. In 2025, knowing the exact steps for UAE holding company setup 2025 is essential to ensure compliance and maximize advantages.

This blog covers what a UAE holding company is, its benefits for foreign investors, differences between free zone and mainland options, legal requirements, setup steps, costs, common mistakes, and how a holding company can support your business strategy.

Table of Contents

What Is a UAE Holding Company?

A UAE holding company is a legal entity designed primarily to own shares or assets in other companies rather than operate commercial activities directly. Its main purpose is to manage investments, control subsidiaries, and hold intellectual property, real estate, or other business assets.

Unlike regular trading companies, a holding company focuses on ownership and strategic control. This structure allows investors to consolidate multiple businesses under one parent entity, simplifying management, reporting, and financial planning.

Key Points About UAE Holding Companies:

Asset Ownership: Can hold shares in local or international companies, intellectual property, real estate, and other investments.

Control Over Subsidiaries: Provides centralized governance for multiple businesses.

Limited Business Activities: Primarily holds assets; direct trading or service provision may be restricted depending on jurisdiction.

Flexibility in Structuring: Can operate as a free zone or mainland company depending on investor needs.

Tax Planning Advantages: Often used to optimize corporate tax structures and benefit from UAE’s favorable tax environment.

A UAE holding company setup 2025 allows foreign investors to structure their investments efficiently while maintaining compliance with local regulations. Understanding the exact type of holding company that suits your business goals is crucial before proceeding.

Key Benefits of a UAE Holding Company for Foreign Investors

Setting up a UAE holding company in 2025 offers foreign investors several practical advantages. These benefits help protect assets, optimize taxes, and simplify business management.

1. Asset Protection

A holding company allows investors to separate assets from operational businesses. This structure safeguards investments from liabilities or legal issues arising in individual subsidiaries.

2. Tax Efficiency

Holding companies in the UAE benefit from favorable tax policies. Structuring your investments through a holding company can help reduce overall tax exposure and streamline profit distribution.

3. Centralized Management

Holding companies provide a central entity to manage multiple subsidiaries. This makes decision-making, reporting, and strategic planning more efficient across your business portfolio.

4. Ease of Expansion

A holding company simplifies the process of acquiring new businesses or launching new ventures. Foreign investors can expand into UAE markets quickly with a clear ownership structure.

5. Investment Flexibility

Investors can hold shares in local or international companies, real estate, or intellectual property under one entity. This flexibility makes a UAE holding company a strategic base for diversified portfolios.

6. Credibility and Professionalism

A UAE holding company enhances credibility with banks, partners, and other investors. It demonstrates a structured and professional approach to managing investments in the region.

In 2024 the United Arab Emirates issued 200,000 new economic licences across various sectors, boosting the total number of companies and economic institutions operating in the country to more than 1.1 million.

Free Zone vs Mainland Holding Company in UAE

When setting up a UAE holding company in 2025, one of the first decisions investors need to make is whether to establish it in a free zone or on the mainland. Each option has its own benefits, limitations, and suitability depending on your business goals.

1. Free Zone Holding Company

Free zone holding companies are located within designated economic zones in the UAE. They offer 100% foreign ownership and simplified company registration processes. Free zone companies are ideal for investors whose primary goal is international investment and asset management rather than direct trade within the UAE.

Key points about free zone holding companies:

- Full foreign ownership without the need for a local partner.

- Simplified administrative processes and registration.

- Access to dedicated office spaces and business services.

- Limited ability to trade directly with the UAE mainland market.

2. Mainland Holding Company

Mainland holding companies operate under UAE federal regulations and are registered with the Department of Economic Development. These companies can trade directly within the UAE and work with government entities, making them suitable for investors planning local operations alongside holding assets.

Key points about mainland holding companies:

- Can conduct business directly with the UAE market.

- May require a local sponsor or service agent depending on the business activity.

- Greater flexibility for expansion within the UAE.

- Can hold shares in other companies, similar to free zone structures.

Choosing the Right Structure

The choice between free zone vs mainland holding company UAE depends on your investment goals. If the focus is primarily on managing international assets and minimizing administrative requirements, a free zone holding company may be preferable. For investors planning local operations or looking for more interaction with the UAE market, a mainland holding company is often the better choice.

Understanding these differences is essential for a successful UAE holding company setup 2025. The right structure ensures compliance, operational flexibility, and alignment with your long-term business strategy.

Legal Requirements & Eligibility

Before starting a UAE holding company setup 2025, foreign investors must understand the legal requirements and eligibility criteria. Meeting these standards ensures your company is fully compliant and avoids delays or complications during registration.

1. Minimum Share Capital

Most holding companies in the UAE require a minimum share capital. The exact amount depends on whether you choose a free zone or mainland structure. Free zones often have lower minimum capital requirements, while mainland companies may require higher deposits depending on the business activity.

2. Shareholders and Ownership

A holding company can have one or more shareholders. Free zone holding companies allow 100% foreign ownership, while mainland companies may require a UAE national as a local service agent or sponsor, depending on the activity.

3. Directors and Management

A UAE holding company must appoint at least one director. Directors can be individuals or corporate entities, and their responsibilities include overseeing company operations, compliance, and reporting.

4. Legal Documentation

To establish a holding company, investors need to prepare and submit essential legal documents. These typically include:

- Passport copies of shareholders and directors

- Proof of address

- Memorandum and Articles of Association

- Business plan or investment strategy

5. Office Space Requirements

Free zone companies generally provide flexible office options, including virtual offices. Mainland companies usually require a physical office within the UAE, which must meet local regulatory standards.

6. Compliance with UAE Laws

Holding companies must comply with UAE commercial laws and company regulations. This includes proper accounting, annual audits where applicable, and adherence to corporate governance standards.

Step-by-Step Guide to UAE Holding Company Setup 2025

Setting up a UAE holding company in 2025 involves several key steps. Following a structured approach ensures compliance with local regulations and makes the process smoother for foreign investors.

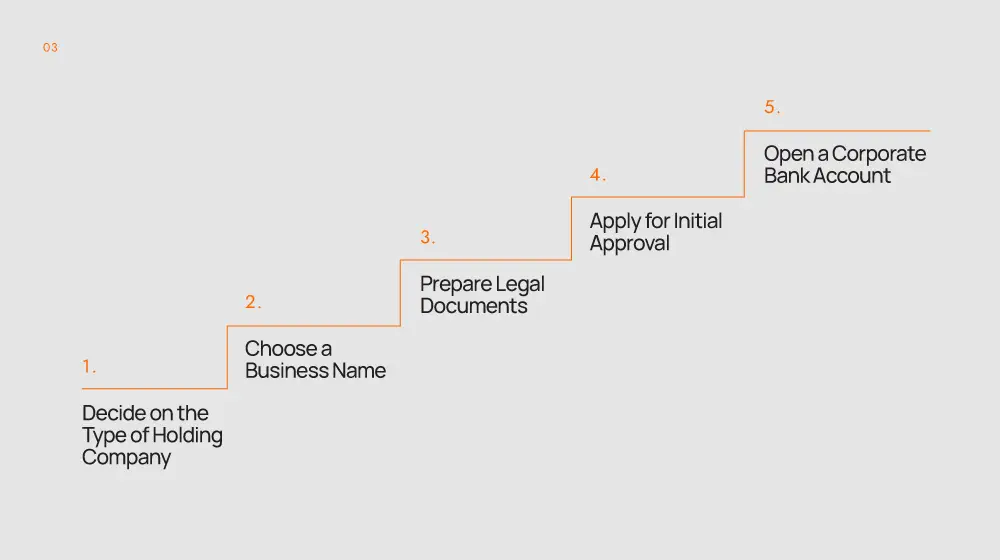

1. Decide on the Type of Holding Company

The first step is to determine whether a free zone or mainland structure best fits your investment goals. Consider factors like business scope, ownership flexibility, and local market access before making a decision.

2. Choose a Business Name

Select a unique name that complies with UAE naming regulations. Avoid prohibited terms and ensure the name reflects the nature of your holding company. Approval from the relevant authority is required before proceeding.

3. Prepare Legal Documents

Gather all necessary documentation for company registration. This typically includes:

- Passport copies of shareholders and directors

- Proof of address

- Memorandum and Articles of Association

- Board resolutions (if applicable)

- Business plan or investment strategy

4. Apply for Initial Approval

Submit your application to the relevant free zone authority or Department of Economic Development for a mainland company. This approval confirms that your proposed business activity is permitted and that your company structure meets regulatory standards.

5. Open a Corporate Bank Account

Once initial approval is received, open a UAE corporate bank account. This account is essential for depositing share capital and managing company finances. Some banks may require a detailed business plan and proof of funds.

6. Obtain License and Register Company

After approval and bank setup, complete the registration process and obtain your company license. Free zone authorities issue licenses directly, while mainland companies are licensed through the Department of Economic Development.

7. Lease Office Space

Secure the required office space. Free zones offer flexible options including virtual offices, while mainland companies must comply with local office regulations.

8. Appoint Directors and Shareholders

Officially appoint the company’s directors and shareholders. Update all legal documents accordingly and submit them to the regulatory authority.

9. Register for Taxes (if applicable)

Depending on your activities, you may need to register for VAT or other tax obligations in the UAE. A holding company that primarily manages assets may have minimal tax reporting requirements.

10. Final Compliance Checks

Conduct a final review to ensure all documentation, approvals, and registrations are complete. This includes confirming corporate governance, accounting systems, and adherence to UAE regulations.

Costs to Set Up a Holding Company in Dubai and the UAE

Understanding the cost to set up a holding company in Dubai is essential for planning your UAE holding company setup 2025. The total cost varies based on location, structure, and operational needs, but the main expenses remain consistent for most foreign investors.

1. License Fees

Holding company licenses in the UAE are generally more affordable compared to trading or service licenses. Free zones usually offer lower license fees with package options, while mainland licenses may cost slightly more depending on the issuing authority.

2. Registration and Government Fees

Both free zone and mainland setups involve government charges for registration, name reservation, initial approval, and document issuance. These fees vary across jurisdictions but form a core part of the overall setup cost.

3. Office Space or Flexi Desk

Free zones often provide flexi desk or virtual office packages that reduce upfront expenses. Mainland companies typically require a physical office, which can increase costs depending on size and location.

4. Share Capital Requirements

Some free zones have minimal or zero share capital requirements. Others may require capital to be deposited into the corporate bank account. Mainland companies sometimes require higher capital amounts, depending on the business plan.

5. Legal Documentation and Approvals

Document drafting, notarization, translation, and attestation add to the overall cost. These processes ensure compliance with UAE commercial regulations and must be completed before registration.

6. Corporate Bank Account Setup

While opening a bank account does not have a direct fee, maintaining the account requires meeting the bank’s minimum balance requirements. These vary from bank to bank and must be factored into your financial planning.

7. Ongoing Annual Costs

Renewal fees apply each year for licenses, visas, office space, and corporate services. These recurring costs are part of maintaining a compliant UAE holding company.

When calculating the cost to set up a holding company Dubai or anywhere in the UAE, it is important to consider both initial investment and recurring commitments. A clear understanding of these expenses helps foreign investors manage budgets effectively and ensures a smooth UAE holding company setup 2025.

Common Mistakes and How to Avoid Them

Even though the UAE holding company setup 2025 process is straightforward, many foreign investors still run into avoidable issues. Knowing the common mistakes helps you stay compliant and prevents unnecessary delays or extra costs.

1. Choosing the Wrong Jurisdiction

Many investors rush into a free zone or mainland structure without evaluating long-term goals. Choosing the wrong jurisdiction can limit activities, increase costs or restrict market access.

How to avoid it: Match the jurisdiction with your investment strategy, asset type and future expansion plans.

2. Incomplete Documentation

Missing or inaccurate documents can delay approvals. This is one of the most common problems during setup.

How to avoid it: Prepare all required documents early, including shareholder details, memorandums and necessary approvals.

3. Underestimating Annual Costs

Investors sometimes plan only for the initial setup costs and overlook renewal fees, office rent and compliance expenses.

How to avoid it: Account for both setup and yearly fees when planning your budget.

4. Choosing the Wrong Free Zone

Not all free zones offer the same structure, rules or benefits. Some are better suited for holding companies, while others focus on trading activities.

How to avoid it: Research free zones carefully and choose one designed for holding or investment management.

5. Not Opening the Right Bank Account

A holding company may require specific banking features like multi-currency accounts or international transfer capabilities.

How to avoid it: Choose a bank that understands holding structures and offers the services your business needs.

6. Ignoring Compliance Requirements

Some investors assume holding companies have minimal obligations, but compliance still applies. Annual audits, reporting and tax registrations must be handled properly.

How to avoid it: Establish a compliance routine early, including annual renewals, bookkeeping and audit preparation.

Avoiding these mistakes ensures your UAE holding company setup 2025 is smooth, cost-effective and aligned with your long-term objectives.

How a Holding Company Can Support Your Business Strategy

A well-planned UAE holding company setup 2025 can strengthen your overall business strategy by giving you more control, protection and flexibility across multiple ventures.

1. Centralized Ownership

A holding company lets you manage all subsidiaries and assets under one parent entity, making operations smoother and reporting clearer. This is especially useful when understanding how to set up holding company in UAE for long-term growth.

2. Strong Risk Protection

Separating your assets from operational companies limits exposure if one subsidiary faces legal or financial issues. This is one of the main UAE holding company benefits for foreign investors.

3. Flexible Investment Options

A holding company can own real estate, shares, intellectual property and international investments. This flexibility supports expansion inside and outside the UAE.

4. Better Tax Position

Choosing the right structure, whether free zone or mainland, helps support efficient tax planning while staying compliant with UAE regulations.

5. Easier Acquisitions and Exits

You can buy or sell subsidiaries without affecting the rest of the group, making market entry and exit more strategic and controlled.

6. Clear Governance

Holding companies make it easier to manage directors, shareholders and reporting across all entities. This clarity supports a stable UAE holding company setup 2025.

7. Strategic Use of Free Zone and Mainland

Some investors combine both jurisdictions under one holding company. Understanding free zone vs mainland holding company UAE helps you decide how to structure your assets for maximum efficiency.

A holding company is not just a legal requirement, it is a structure that strengthens your entire investment strategy.

Conclusion

Setting up a holding company in the UAE offers foreign investors a reliable way to protect assets, manage multiple ventures and operate with more clarity. With the right structure, your UAE holding company setup 2025 can support long-term investment plans, simplify ownership and create stronger financial stability. Whether you choose a free zone or mainland structure, understanding the requirements, costs and steps involved ensures your setup is compliant and efficient.

A well-structured holding company also helps you navigate expansion, acquisitions and market shifts without unnecessary complications. It becomes a central point for governance, planning and asset growth, especially for investors managing businesses in different sectors.

If you want a smooth process from start to finish, GCG Structuring can guide you through every part of your UAE holding company setup 2025. From choosing the right jurisdiction to preparing documents and securing approvals, our team ensures your structure is built correctly and aligned with your long-term goals.

FAQ

1. 0 What is a UAE holding company?

A UAE holding company is a parent company that owns shares in other businesses. It’s mainly used for asset protection, tax efficiency, and easier global expansion.

2. 0 How much does it cost to set up a holding company in Dubai?

The cost to set up a holding company in Dubai depends on the free zone or mainland setup you choose, but most foreign investors budget for licensing, registration, and basic approvals.

3. 0 Is a free zone or mainland better for a UAE holding company setup in 2025?

Free zones are usually better for tax savings and 100% foreign ownership. Mainland works better if you need local operations or government contracts.