Setting up a company in the UAE mainland is a common choice for business owners who want to operate freely within the local market and build a long term presence in the country. Among the available legal structures, the limited liability company remains the most widely used option for mainland operations.

This blog explains how LLC setup in UAE mainland works in 2026. It covers what a mainland LLC is, when it makes sense as a business structure, and how the setup process works from start to finish. You will find a step by step explanation of UAE mainland company formation, including approvals, documentation, ownership rules, visa eligibility, timelines, and cost expectations.

Table of Contents

What Is an LLC in the UAE Mainland?

A Limited Liability Company (LLC) in the UAE mainland is a legal business structure that allows local and foreign investors to operate directly in the UAE market. Unlike free zone companies, a mainland LLC can trade anywhere in the country, contract with government entities, and take on clients across all emirates without restrictions.

Key Features of a Mainland LLC

- Legal Personality: An LLC is recognized as a separate legal entity, allowing the company to enter contracts and own assets in its name.

- Liability: Shareholders’ liability is limited to the amount of their capital contribution. Personal assets are generally protected.

- Ownership Rules: Depending on the activity, foreign investors can now hold up to 100% ownership of a mainland LLC. Some sectors still require a UAE national or local service agent.

- Licensing: Every mainland LLC requires a valid LLC license UAE, issued by the Department of Economic Development (DED) in the relevant emirate.

- Visa Eligibility: A mainland LLC allows owners and employees to obtain UAE residency visas based on the company’s size and office setup.

When to Choose a Mainland LLC

- You want unrestricted access to the UAE market.

- You need to work with government entities or local clients.

- You plan to hire employees within the UAE.

You want the credibility of a mainland business, which often simplifies banking and future expansions.

A clear understanding of these basics is essential before starting an LLC setup in UAE mainland, as it determines licensing requirements, ownership rules, and overall flexibility in operations.

LLC Setup in UAE Mainland: How the Process Works in 2026 `

An LLC setup in UAE mainland follows a structured process managed by the Department of Economic Development (DED) and other government bodies. This ensures your company is fully compliant and able to operate anywhere in the UAE.

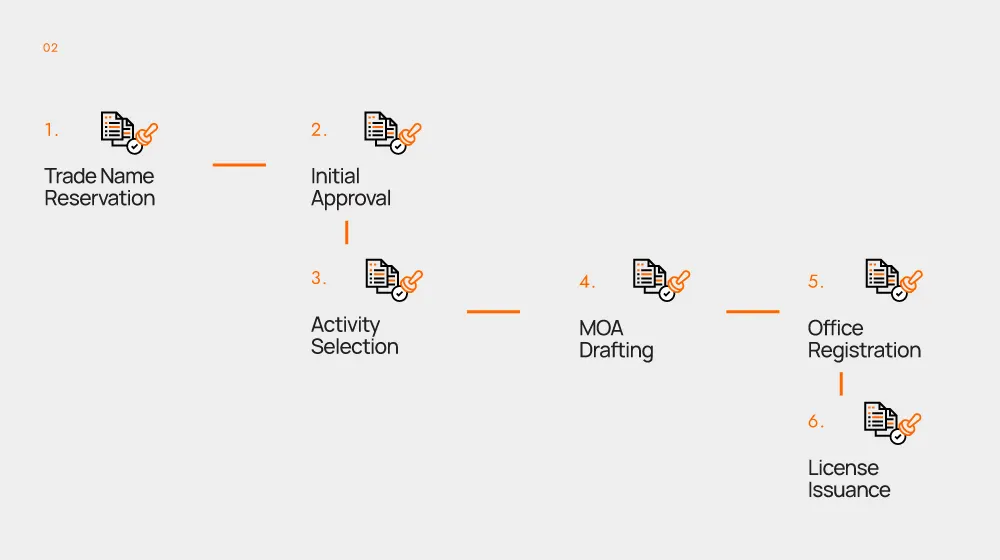

Main Steps

- Trade Name Reservation: Choose a unique name that meets DED rules.

- Initial Approval: Get approval for your business activities and ownership structure.

- Activity Selection: Certain activities may require additional government approvals.

- MOA Drafting: Prepare and notarize the Memorandum of Association detailing ownership and management.

- Office Registration: Secure a physical or flexi-desk office, which affects visa quotas.

- License Issuance: Receive your LLC license UAE, making the company legally operational.

Understanding these steps helps you plan time, costs, and documents effectively. Following the proper process reduces delays and ensures your mainland LLC UAE complies with all legal requirements.

Step-by-Step Guide to UAE Mainland LLC Formation `

Setting up an LLC in the UAE mainland requires completing several key steps. Doing each step correctly ensures your LLC setup in UAE mainland is smooth and compliant.

1. Trade Name Reservation

Reserve a unique name that matches DED rules. Avoid prohibited words and names already in use. This step usually takes 1–2 working days and is required before moving to approvals.

2. Initial Approval

Obtain approval from the DED for your business activities and ownership structure. This confirms your company is eligible for formation and is needed before drafting the MOA. Timeline is typically 2–5 working days.

3. Selecting Business Activities

Choose activities carefully. Some require extra approvals from other government authorities. Selecting the wrong activity is a common reason for delays in mainland business setup UAE.

4. Drafting and Notarizing the MOA

Prepare and notarize the Memorandum of Association, which sets out ownership percentages and management responsibilities. This step legally establishes your mainland LLC UAE structure.

5. Office Registration

Secure a physical office or flexi-desk. Your office impacts visa eligibility. Submit a tenancy contract or Ejari registration to the DED.

6. License Issuance

Submit all approved documents and receive your LLC license UAE. After this, your company can operate legally, open bank accounts, and sponsor visas.

Following these steps carefully ensures your LLC setup in UAE mainland proceeds without unexpected delays or compliance issues.

UAE LLC Ownership Rules Explained (2026 Update)

After foreign ownership reforms were introduced, around 760,000 companies have entered the UAE market, reflecting increased confidence in mainland LLC UAE structures

Understanding ownership rules is critical for an LLC setup in UAE mainland. In 2026, the UAE allows up to 100% foreign ownership for most activities, but some sectors still require a UAE national partner or local service agent.

Key Ownership Points

- Foreign Ownership: Most business activities now permit full foreign ownership. This makes mainland LLC UAE more accessible for international investors.

- Activities: Certain professional or strategic sectors still require a UAE national partner or service agent. Always confirm before starting your LLC.

- Shareholding Structure: Clearly define ownership percentages in the MOA. Disputes or unclear agreements can delay license issuance.

- Decision-Making Rights: Ensure the MOA outlines management responsibilities, voting rights, and profit distribution. This protects shareholders and aligns with UAE LLC requirements.

Proper understanding of these rules before starting an LLC setup in UAE mainland prevents legal issues and ensures your company operates smoothly.

Documents Required for LLC Setup in UAE Mainland

A successful LLC setup in UAE mainland depends on preparing the right documents in advance. Submitting incomplete or incorrect paperwork is one of the main reasons delays happen during UAE mainland company formation. Knowing exactly what is required ensures a smooth process and faster approvals.

Required Documents for Individual Shareholders

- Passport Copies: Clear copies of all shareholders’ passports are required for identity verification.

- Visa Copies: If shareholders are UAE residents, their residency visas must be included.

- No Objection Certificates (NOC): Shareholders employed in the UAE may need a NOC from their current employer.

- Proof of Address: Utility bills or tenancy contracts to confirm personal addresses.

Required Documents for Corporate Shareholders

- Certificate of Incorporation: Proves the corporate entity is legally registered in its home country.

- Board Resolution: Authorizes the company to invest in a UAE LLC.

- Corporate Memorandum of Association: Details the company’s ownership and shareholding structure.

- Power of Attorney: If someone is acting on behalf of the corporate shareholder, this must be notarized.

Office and Licensing Documents

- Tenancy Contract or Ejari Certificate: Confirms the registered office space, which is mandatory for mainland LLCs.

- Trade Name Approval and Initial Approval Documents: Submitted as part of the license application.

Ensuring all these documents comply with UAE LLC requirements not only avoids delays but also smooths the final steps of your LLC company setup Dubai. Proper preparation at this stage helps streamline the rest of the mainland business setup UAE process, including MOA notarization, visa applications, and final license issuance.

Visa Eligibility With a Mainland LLC

One of the key advantages of an LLC setup in UAE mainland is the ability to sponsor visas for owners, employees, and their families. Visa eligibility depends on the company’s structure, office size, and licensed activities.

Investor and Partner Visas

- Shareholders of a mainland LLC can obtain investor or partner visas.

- The number of visas depends on the company’s office size and approved business activities.

- Investor visas provide residency for up to three years, renewable along with the company license.

Employee Visas

- Mainland LLCs can sponsor visas for employees according to the staff quota linked to the office space.

- Each employee visa requires submission of passport copies, labor contracts, and health clearance.

Family Sponsorship

- Company owners with investor visas can sponsor family members, including spouse, children, and dependents.

- Eligibility and quota depend on the company’s size and office space.

Proper understanding of visa eligibility helps plan your mainland business setup UAE and ensures compliance with immigration rules. Preparing documents correctly in advance prevents delays in the LLC company setup Dubai process and guarantees smooth approvals for investors and employees alike.

Realistic Timelines: How Long Does UAE Mainland Company Formation Take?

As of 2025, there were over 1.4 million active companies in the UAE, reflecting a thriving market for entrepreneurs pursuing an LLC setup in UAE mainland.

Understanding timelines is crucial for planning an LLC setup in UAE mainland. While some providers advertise setups in a few days, the realistic timeline depends on approvals, documentation, and business activities.

Typical Timelines

- Trade Name Reservation: 1–2 working days.

- Initial Approval: 2–5 working days.

- MOA Drafting and Notarization: 2–3 working days once documents are complete.

- Office Registration: 2–4 working days depending on availability and Ejari registration.

- Final License Issuance: 3–7 working days after submitting all documents.

Factors That Affect Timelines

- Incomplete Documents: Missing shareholder documents or NOCs can cause delays.

- Incorrect Activity Selection: Certain business activities require additional approvals from other authorities.

- Office Setup Delays: Leasing and registering office space can add extra days.

- Government Processing Variations: Some DED branches may have longer queues depending on demand.

On average, a complete mainland LLC UAE formation takes 2–4 weeks. Planning ahead and preparing all documents according to UAE LLC requirements ensures your LLC setup in UAE mainland proceeds efficiently without unnecessary delays.

Cost Breakdown: LLC Setup in UAE Mainland (What You Should Budget)

Budgeting accurately is essential for a smooth LLC setup in UAE mainland. Costs vary depending on business activities, office space, visas, and professional fees. Understanding the breakdown helps avoid surprises.

Key Costs

- Trade Name and Initial Approval: Fees charged by the DED for reserving the trade name and obtaining preliminary approvals. Typically a few hundred to a few thousand AED depending on the emirate.

- License Fee: The LLC license UAE fee is the main cost. It varies by business activity and emirate. This is an annual fee required to legally operate.

- Office Space: Physical offices or flexi-desks are mandatory. Costs depend on location and size, and the office affects visa eligibility.

- MOA Drafting and Notarization: Professional fees for drafting and notarizing the Memorandum of Association.

- Visa Costs: Investor, partner, and employee visas include government fees, medical tests, Emirates ID issuance, and visa stamping.

- Additional Approvals: Some activities require special permits or approvals from other authorities, which may incur extra costs.

Proper planning of these expenses ensures your mainland business setup UAE is predictable. Preparing your budget according to UAE LLC requirements helps avoid unexpected delays or additional charges during the LLC company setup Dubai process.

Common Mistakes That Slow Down LLC Setup

Many delays in LLC setup in UAE mainland come from simple mistakes that can be avoided with proper planning. Recognizing these early helps your mainland LLC UAE formation proceed smoothly.

Typical Mistakes

- Incomplete or Incorrect Documents: Missing passports, NOCs, or corporate documents can halt approvals.

- Wrong Activity Selection: Choosing activities that require extra approvals without planning causes delays.

- Ignoring Office Requirements: Not securing the correct office type or size can block visa approvals and license issuance.

- Unclear MOA Details: Improperly defined ownership percentages or management responsibilities lead to resubmissions.

- Underestimating Costs: Not budgeting for all fees, visas, and approvals can stall the process.

- Skipping Professional Advice: Attempting the setup without guidance on UAE LLC requirements can result in mistakes that extend timelines.

Avoiding these mistakes ensures your LLC company setup Dubai is faster, more efficient, and fully compliant with local regulations.

Things Most People Don’t Expect Before Starting an LLC

Even experienced investors can be surprised by certain requirements during an LLC setup in UAE mainland. Understanding these factors ahead of time makes the process smoother and prevents delays in your mainland LLC UAE formation.

Key Considerations

- Bank Account Delays: Opening a corporate bank account can take longer than expected, especially for foreign shareholders.

- Activity Restrictions: Some business activities require approvals from multiple government authorities beyond the DED.

- Office Verification: Physical or flexi-desk offices must meet DED standards; inspections can add time if not prepared.

- Visa Quotas: Your office size directly affects the number of visas you can sponsor. Many underestimate this impact.

- Annual Renewals: License renewal, office lease renewal, and visa renewals are mandatory and must be budgeted for yearly.

- Compliance Obligations: Mainland companies must maintain proper accounting records and comply with UAE regulations from day one.

Being aware of these points before starting your LLC setup in UAE mainland ensures you can plan effectively, reduce surprises, and keep your mainland business setup UAE on track.

Is an LLC in the UAE Mainland the Right Choice for You?

Choosing the right business structure is crucial for success. An LLC setup in UAE mainland offers flexibility, credibility, and full access to the UAE market, but it may not suit every business.

Who Should Consider a Mainland LLC

- Market Access: If you want to operate across the UAE without restrictions, a mainland LLC is ideal.

- Government Contracts: Mainland companies can trade directly with government entities.

- Hiring Flexibility: You can sponsor employee visas according to your office size and company structure.

- Long-Term Growth: Mainland LLCs provide credibility with banks, partners, and clients, supporting expansion plans.

Who Might Reconsider

- Limited Activities: Some niche or professional activities are better suited to free zones.

- Budget Constraints: Mainland LLCs involve office requirements and higher setup costs than certain free zone options.

- Short-Term Operations: If your business is temporary or experimental, a free zone setup may be simpler.

Understanding your business goals and UAE LLC requirements helps determine if an LLC company setup Dubai is the right path. A well-informed decision at this stage prevents unnecessary costs and complications later.

LLC Setup in UAE Mainland Is Straightforward If Structured Right

An LLC setup in UAE mainland is a structured process that becomes straightforward when each step is planned carefully. From trade name approval to license issuance, understanding timelines, document requirements, and ownership rules ensures your mainland LLC UAE formation proceeds efficiently.

Proper planning helps avoid delays, ensures compliance with UAE LLC requirements, and makes it easier to manage visas, office registration, and annual renewals.

For businesses looking to simplify the process and reduce the risk of errors, GCG Structuring provides expert guidance at every stage. From initial approvals to license issuance, our team helps you navigate the LLC company setup Dubai process quickly, accurately, and in full compliance with local regulations, giving you confidence that your LLC setup in UAE mainland is done right from the start.

FAQ

1. 0 What is an LLC in the UAE mainland?

An LLC in the UAE mainland is a company structure that allows full access to the local market, trade with government entities, and sponsor visas. It requires compliance with UAE LLC requirements.

2. 0 Can foreigners fully own a mainland LLC?

Yes. Most business activities now allow 100% foreign ownership, though some regulated sectors may still need a UAE national partner.

3. 0 How long does LLC setup in UAE mainland take?

Typically 2–4 weeks, depending on approvals, documents, office registration, and business activity type.

4. 0 Is a physical office required for a mainland LLC?

Yes. A physical office or flexi-desk is mandatory and affects visa eligibility and staff quotas for mainland business setup UAE.

5. 0 Can a mainland LLC sponsor visas?

Yes. Shareholders and employees can be sponsored based on office size and approved activities. Investor visas last up to three years.