In the UAE, two of the most common structures are the FZE (Free Zone Establishment) and the FZCO (Free Zone Company). While both operate under the same free zone framework, the way they are owned, managed, and registered is different enough to impact your day-to-day business and long-term plans.

If you choose the wrong structure at the start, you may end up dealing with unnecessary costs, restructuring delays, and administrative headaches down the road. That’s why understanding the difference between FZE and FZCO is more than just a formality.

In this guide, we’ll break down what each structure means, where they differ, how they handle ownership, governance, licensing, costs, and compliance. We’ll also look at real-world examples of which business types fit each structure, and finish with a clear decision framework so you know which one makes the most sense for your plans.

Table of Contents

The Difference Between FZE and FZCO Explained

When you’re setting up in a UAE free zone, one of the first big decisions is whether to register your business as an FZE or an FZCO. At first glance, the only visible difference seems to be the number of owners. But in reality, the choice has a ripple effect on how your company is managed, how decisions are made, and how easy it is to change ownership later on.

What Is an FZE in the UAE?

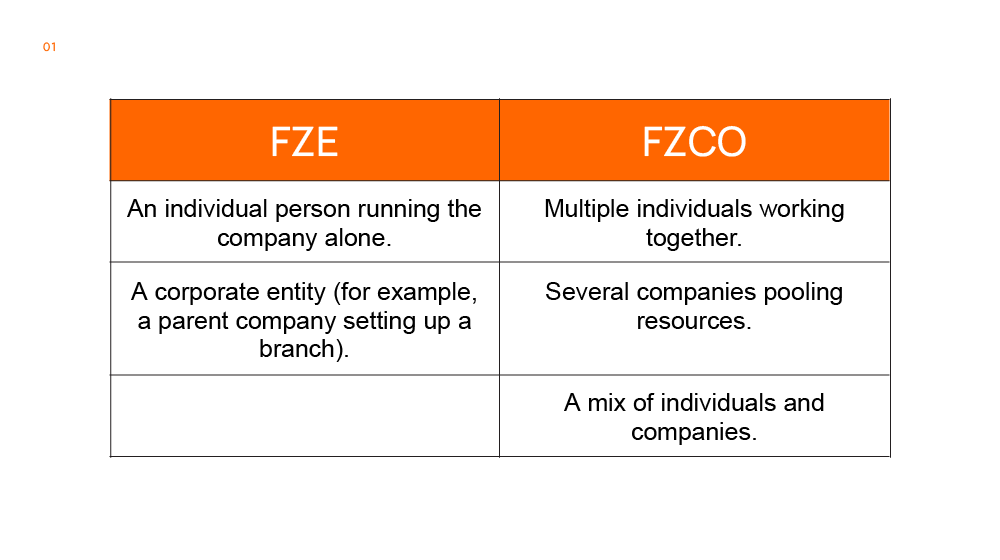

An FZE (Free Zone Establishment) is a business structure that has just one shareholder. This shareholder can be:

- An individual person running the company alone.

- A corporate entity (for example, a parent company setting up a branch).

Because there is only one shareholder, the FZE model is simple to operate. You don’t have to coordinate decisions with other owners, and you retain full control over the company’s direction. Many solo entrepreneurs and overseas companies choose an FZE because it keeps decision-making quick and straightforward.

What Is an FZCO in the UAE?

An FZCO (Free Zone Company) is formed with two to five shareholders. These can be:

- Multiple individuals working together.

- Several companies pooling resources.

- A mix of individuals and companies.

The FZCO setup is ideal if you plan to start a partnership or share investment and responsibility with others. Since there are multiple owners, the governance structure is designed for joint decision-making, which can bring more resources and skills to the business.

Key Difference Between FZE and FZCO

The difference between FZE and FZCO goes beyond the shareholder count. It influences governance, decision-making, and future flexibility in ownership changes. For example, adding partners to an FZE involves a restructuring process, whereas an FZCO is already built for multiple owners.

Both FZE and FZCO provide limited liability protection, meaning your personal assets are not at risk if the business faces debt or legal issues. They also operate under the same free zone rules, offering 100% foreign ownership, no import or export duties within the free zone, and access to modern business facilities.

Ownership Structure: Solo vs. Shared Business Control

Ownership is one of the most important factors when choosing between FZE and FZCO, because it determines how much control you have, how decisions are made, and how flexible your business is in the future.

How Ownership Works in an FZE

An FZE is built for a single owner. That owner can be either:

- An individual investor running the company alone.

- A corporate shareholder, such as a parent company registering a branch in the UAE.

With an FZE, all decision-making power sits with that one shareholder. This means you can act quickly, approve strategies without waiting for partner approval, and keep sensitive business matters entirely private. For many entrepreneurs and small business owners, this level of independence is one of the main attractions of the FZE model.

However, the simplicity of an FZE can also be a limitation. If you later decide to bring in a partner, you’ll need to restructure the company into an FZCO. This process involves legal changes, extra fees, and approvals from the free zone authority.

How Ownership Works in an FZCO

An FZCO is designed for two to five shareholders. These shareholders can be:

- Multiple individuals starting a venture together.

- Several corporate entities investing jointly.

- A combination of individual and corporate owners.

Because an FZCO has multiple owners, decisions often require majority or unanimous shareholder agreement, depending on the company’s Articles of Association. This can slow things down, but it also spreads responsibility and financial risk across more than one person or entity.

Choosing Between Solo and Shared Control

When comparing FZE vs FZCO, think about your current and future business plans:

- If you’re starting alone and want full control, an FZE offers independence with less administrative complexity.

- If you’re entering a partnership or want the flexibility to add shareholders later, an FZCO may be the better long-term choice.

It’s also worth noting that some investors choose FZCO even when starting with just two shareholders, purely to make it easier to bring in additional partners or investors in the future.

We have many people asking this question, “can a mainland company do business in a free zone?”

If you have the same question, check our article which covers exactly how that works and what you need to keep in mind.”

Share Capital & Liability Protection

Both FZE and FZCO are limited liability companies, which means the financial risk for shareholders is restricted to the amount of share capital they invest. However, the actual share capital requirements can vary depending on the free zone and business activity you choose.

Share Capital in an FZE

An FZE usually has a minimum share capital requirement set by the free zone authority. In many popular UAE free zones, this amount ranges from AED 50,000 to AED 300,000, though certain service-based activities may require no paid-up capital at all.

The key point is that as the sole shareholder, you’re entirely responsible for providing the full capital amount. While this ensures full control over funds, it also means you carry the complete investment burden.

Share Capital in an FZCO

In an FZCO, the minimum share capital is often the same as for an FZE, but it is divided equally or proportionally among shareholders. For example, if the free zone requires AED 100,000 in share capital and you have four shareholders, each might contribute AED 25,000.

This shared contribution makes FZCO a popular choice for ventures requiring larger investments, as it reduces the amount each partner needs to commit individually.

Liability Protection for Shareholders

Both FZE and FZCO provide limited liability protection. This means:

- Your personal assets are separate from your company’s debts.

- If the business fails or faces legal claims, you’re only liable up to the value of your shares.

- Creditors cannot seize personal property to cover company obligations.

This protection is one of the main reasons foreign investors choose to set up in UAE free zones, as it creates a secure framework for doing business.

Licensing & Activity Scope

One of the factors that often surprises new business owners is that the choice between FZE and FZCO can influence what activities your company can legally perform and how flexible your license is in the UAE free zone.

Business Activities Allowed for an FZE

An FZE can hold almost any license available in the free zone, including:

- Service licenses (consulting, IT services, marketing, education).

- Trading licenses (buying and selling goods within the free zone).

- Industrial or manufacturing licenses (depending on the free zone facilities).

Since there is a single shareholder, the FZE license is straightforward to manage. The company can operate under one activity category initially, but expanding into additional activities may require minor amendments to the license.

Business Activities Allowed for an FZCO

An FZCO license functions similarly to an FZE in terms of the types of activities permitted. However, because multiple shareholders are involved, adding new activities may require shareholder approval.

For example, if one shareholder wants to expand into trading while another prefers to remain in services, you’ll need to follow internal governance rules to update the license. While this doesn’t prevent growth, it does make FZCO slightly more structured in decision-making.

When choosing between FZE vs FZCO, consider:

- Flexibility: An FZE allows faster licensing amendments since there is only one decision-maker.

- Growth: An FZCO is ideal if you plan to diversify activities with the agreement of multiple partners.

- Compliance: Both structures must renew licenses annually and ensure activities comply with free zone regulations.

Certain free zones may also have specific activity restrictions. For instance, some zones prioritize technology or logistics, while others focus on trade or media. Checking activity eligibility before registration is critical to avoid delays or extra costs.

Governance & Compliance Requirements

Both FZE and FZCO must follow free zone regulations, but governance and compliance differ slightly due to the number of shareholders.

Board of Directors / Management

FZE: Managed by the single shareholder or an appointed manager.

FZCO: Requires a board or management structure agreed upon by multiple shareholders.

Decision-Making Process

FZE: Decisions are made solely by the owner, ensuring quick approvals.

FZCO: Decisions require consensus or majority approval, depending on the Articles of Association.

Annual Audits & Reports

FZE: Some free zones require audits; smaller service FZEs may have simplified reporting.

FZCO: Typically requires annual audits and submission of financial reports to the free zone authority.

Renewal & Regulatory Compliance

Both FZE and FZCO must renew licenses annually, update shareholder changes, and maintain proper accounting records.

Documentation & Formation Process

Setting up an FZE or an FZCO in a UAE free zone requires submitting specific documents and following a structured registration process. While many steps are similar, the number of shareholders can change the paperwork required.

Required Documents for an FZE

- Passport copy: Valid copy of the single shareholder’s passport.

- Proof of residence: Utility bill or tenancy contract.

- Bank reference letter: Confirms financial standing for company setup.

- Business plan: Some free zones request a brief description of activities.

- Shareholder resolution: Authorizing the FZE formation if the owner is a corporate entity.

Required Documents for an FZCO

- Passports of all shareholders: Valid copies for each individual owner.

- Shareholders’ agreement: Defines ownership percentages, responsibilities, and decision-making.

- Proof of residence for all shareholders: Utility bills or tenancy contracts.

- Bank reference letters: From all shareholders if required by the free zone.

- Business plan and approval: Outlines proposed activities and corporate structure.

Formation Process Steps

- Select free zone: Choose a free zone that supports your business activity.

- Reserve company name: Ensure the chosen name complies with regulations.

- Submit documents: Provide all shareholder information and required paperwork.

- Receive license approval: Free zone authority reviews and approves the application.

- Open corporate bank account: Proof of registration may be needed for banking.

- Receive business license and registration certificate: Start operations legally.

One of the key steps in a free zone setup is securing your visa. Here’s our quick guide on who qualifies for a Freezone visa in the UAE so you know exactly what to expect.

As you can see that the process highlights that an FZE setup is generally faster due to a single shareholder, while an FZCO may take slightly longer because of multiple owners and additional approvals.

And, there are some “must-have” business documents required for business set up in UAE. We advise you to check it out.

Cost Comparison: Setup & Annual Fees

When choosing between FZE and FZCO, cost is an important consideration. While both structures share similar base fees in UAE free zones, ownership type and company activities can influence the total setup and annual expenses.

Setup Costs for an FZE

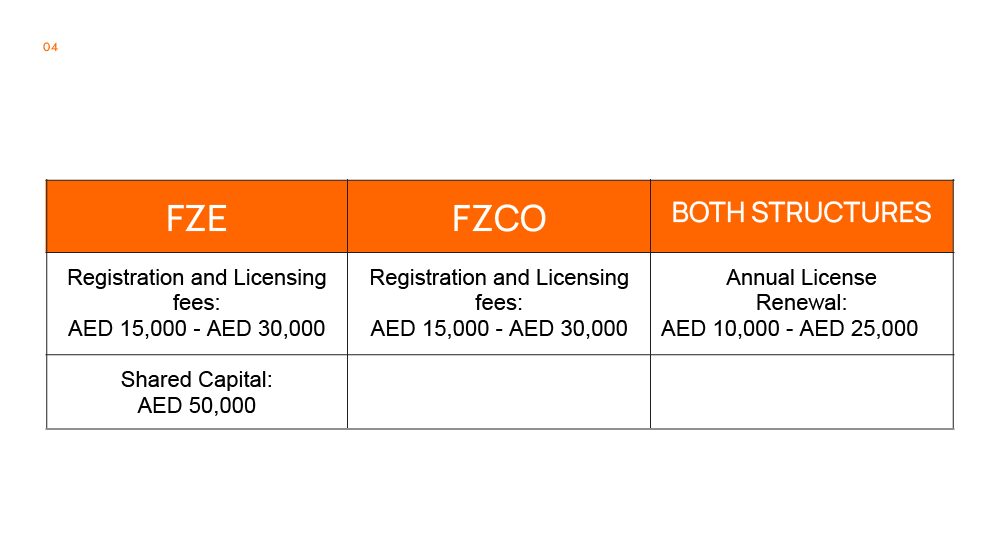

Setting up an FZE typically involves:

- Registration and licensing fees: These vary by free zone and activity type, usually ranging from AED 15,000 to AED 30,000.

- Share capital contribution: Paid entirely by the single shareholder, often starting around AED 50,000 depending on the free zone.

- Additional costs: Office rental, document processing, and bank account opening fees.

Overall, an FZE setup is often simpler and slightly more affordable than an FZCO because there’s only one shareholder to register and fewer approvals are required.

Setup Costs for an FZCO

An FZCO usually has similar base fees for registration and licensing. However, because multiple shareholders are involved:

- Shared capital contributions: Each shareholder provides a portion of the total share capital.

- Additional paperwork fees: Drafting shareholder agreements or notarized documents can increase initial costs.

- Slightly longer processing time: Coordinating signatures and approvals among all shareholders can add time and minor administrative expenses.

Annual Fees for Both Structures

Both FZE and FZCO require annual license renewal, which can range from AED 10,000 to AED 25,000 depending on the free zone and business activity. Other recurring costs include:

- Office lease or flexi-desk fees.

- Bank account maintenance.

- Annual auditing (mandatory for some free zones and corporate activities).

It’s important to note that even though an FZCO may seem more expensive initially due to multiple shareholders, spreading the share capital among partners can reduce the financial burden for each individual. Meanwhile, an FZE offers simplicity but places the full capital responsibility on a single owner.

Note: some hurdles can slow you down if you’re not prepared. Here’s a quick read on the challenges of setting up business in UAE, you’ll want to anticipate before setting up a business in Dubai.”

Ideal Use Cases: Which Structure Fits Which Type of Business

FZE

- Solo entrepreneurs or freelancers who want full control.

- Single-owner startups looking for fast setup.

- Service-based businesses with limited capital needs.

- Companies planning simple operations without multiple investors.

FZCO

- Partnerships with two to five shareholders.

- SMEs needing shared capital for trading, manufacturing, or larger projects.

- Businesses planning to add partners or investors in the future.

- Ventures requiring joint decision-making and shared responsibility.

If you’re not sure which freezone fits your industry best, we’ve put together a full list of free zones in Dubai so you can compare and choose confidently.

Pros & Cons: FZE vs FZCO at a Glance

FZE

Pros:

- Full control for a single shareholder, allowing faster decision-making.

- Simpler governance and less paperwork compared to multi-shareholder setups.

- Lower administrative effort for annual compliance, reporting, and license renewal.

- Ideal for entrepreneurs who want to keep operations private and streamlined.

Cons:

- Entire share capital responsibility rests on one owner, which may be a financial strain.

- Limited flexibility to bring in additional shareholders without restructuring.

- Growth opportunities may be slightly restricted if expansion requires partners or outside investment.

FZCO

Pros:

- Capital and responsibilities are shared among two to five shareholders, reducing individual burden.

- Access to diverse skills, experience, and perspectives from multiple owners.

- Easier to bring in additional shareholders or investors without major restructuring.

- Suitable for businesses with larger operational or investment needs.

Cons:

- Decision-making can be slower due to the need for consensus among shareholders.

- More paperwork for shareholder agreements, approvals, and compliance reporting.

- Slightly higher setup and administrative complexity compared to an FZE.

With more than 21,000 companies registered in the DMCC alone by 2022, free zones continue to attract diverse investors

Ensuring Your Business Starts Strong in the UAE

Choosing between an FZE and an FZCO is a critical step for any business in a UAE free zone. FZE is ideal for solo entrepreneurs seeking full control and a streamlined setup, while FZCO fits partnerships or SMEs that benefit from shared capital, expertise, and joint decision-making.

Understanding the difference between FZE and FZCO ensures you select the structure that aligns with your business goals, whether that’s fast independent growth or collaborative ventures.

At GCG Structuring, we guide you through every step of the process of company formation in Dubai, from choosing the right free zone and company structure to preparing all documentation and helping your secure your business license. Our team ensures full compliance with UAE free zone regulations, helps optimize governance for your chosen structure, and provides strategic advice on costs, shareholder arrangements, and licensing options.

FAQ

1. 0 Can an FZE or FZCO hire employees from outside the UAE?

Yes, both structures can sponsor foreign employees, but visa limits and costs vary depending on the free zone and company size.

2. 0 Does having multiple shareholders in an FZCO affect profit distribution flexibility?

Yes, an FZCO allows profit-sharing arrangements to be defined in the shareholder agreement, offering flexibility compared to an FZE.

3. 0 Are there restrictions on transferring ownership in FZE or FZCO?

Ownership transfer is simpler in an FZCO due to multiple shareholders, while an FZE requires formal restructuring to add or replace shareholders.