The UAE offers some of the best conditions for entrepreneurs in 2025: attractive tax rates, growing markets, and full foreign ownership in many sectors. But these benefits only work in your favour if your business is set up the right way from the start.

Most foreign entrepreneurs choose between two main structures: a Limited Liability Company (LLC) or a Freezone company. Both let you operate legally, but the difference between LLC and freezone in UAE… ownership rules, market access, taxation, costs, and visa quotas can shape your growth for years.

In this guide, we’ll break down what each structure means, how they work, and which option aligns with your goals, so you can avoid costly mistakes and start strong.

Table of Contents

Understanding the Difference Between LLC and Freezone in UAE

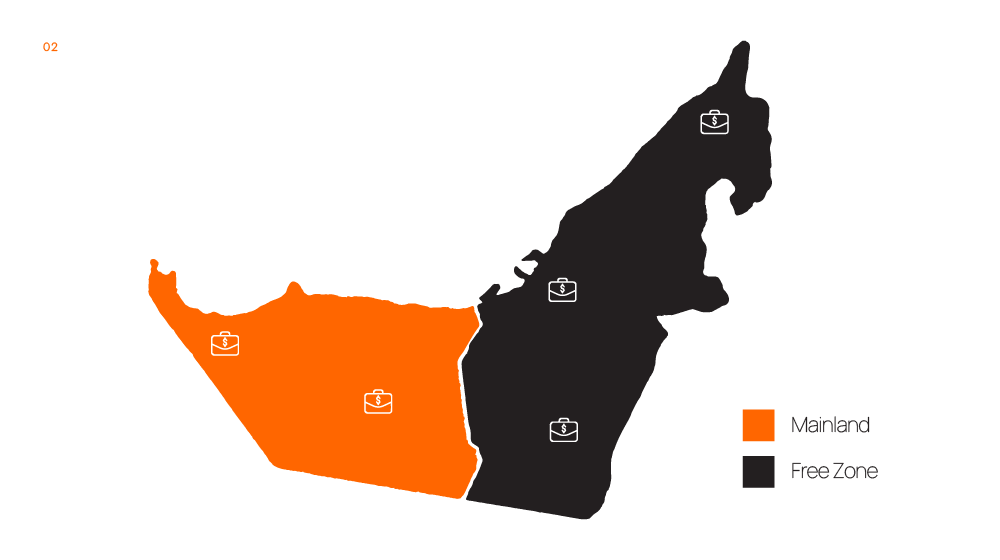

When setting up a business in the UAE, deciding between a Limited Liability Company (LLC) and a Freezone company is one of the most important steps. The difference between LLC and freezone in UAE shapes everything from who owns your business to where you can trade and how much flexibility you’ll have in the future.

LLC (Limited Liability Company)

- Licensed by the Department of Economic Development (DED) in the emirate where it’s registered, which makes it a “mainland” company.

- Can trade anywhere in the UAE and internationally without restrictions, making it suitable for businesses targeting local customers, including government entities.

- 100% foreign ownership is now possible for many activities under the approved list issued by the UAE government. If your activity is not on this list, you may still need a UAE national shareholder with at least 51% ownership.

- Direct market access means you can sell products and services on the mainland without having to use a distributor or pay extra commissions.

- Broader activity range, including some business activities that Freezones may not allow.

Freezone Company

- Licensed by one of over 40 Freezones in the UAE, each offering its own set of benefits, industries, and facilities.

- 100% foreign ownership from day one without the need for a local partner, regardless of the activity.

- Trading is limited to within the Freezone and internationally. If you want to sell to the UAE mainland directly, you’ll need to work with a licensed mainland distributor or set up a mainland branch.

- Lower setup complexity with packages that often include office space, utilities, and business services.

- Industry-focused clusters in certain Freezones (e.g., Dubai Media City for media companies, Jebel Ali Free Zone for logistics).

LLC: Better suited for companies that need full access to the UAE mainland market and want to work directly with customers and government projects.

Freezone: Ideal for businesses focusing on export, e-commerce, or specialized industries that do not require direct mainland sales.

Choosing correctly avoids future restructuring, extra licensing costs, or limitations on growth.

The rest of this guide will break down each part of the difference between LLC and freezone in UAE in more detail, covering ownership, trading rights, taxation, costs, visas, and how to align your choice with your long-term business strategy.

Also, if you’re deciding between mainland and freezone, check out this article where we break down everything so you can choose what’s best for you.

Ownership Rules: Who Really Controls Your Business

One of the most important parts of the difference between LLC and freezone in UAE is ownership. Control over your company isn’t just about the share percentage on paper, it also affects how you make decisions, manage profits, and handle compliance in the long run.

Ownership in an LLC (Mainland Company)

- 100% foreign ownership allowed for many activities under the updated UAE Commercial Companies Law. This applies to sectors on the government’s approved list, such as trading, manufacturing, and many types of services.

- UAE national shareholder still required for activities not on the approved list. In such cases, the Emirati partner must hold at least 51% ownership, with the remaining 49% belonging to the foreign investor.

- Management control can be outlined in the Memorandum of Association (MOA), even if there’s a local partner. This allows you to retain operational control while fulfilling legal requirements.

- Access to the mainland market without restrictions means you can control your supply chain, pricing, and client relationships directly.

Ownership in a Freezone Company

- 100% foreign ownership guaranteed for all activities from day one, with no need for a UAE national partner.

- Complete decision-making authority stays with the foreign owner, since there’s no mandatory local shareholder.

- Operational control is limited by market access rules, even though you fully own the company, you cannot sell directly on the UAE mainland without going through a distributor or setting up a mainland branch.

- Company regulations vary by Freezone, so the scope of ownership rights and transfer processes may differ depending on the Freezone you choose.

We get asked this question all the time: “Can a Mainland company do business in Freezone?” This is a big question and the rules are always changing. So we made an article explaining everything about it.

And if you’re new and are interested in knowing more about freezones, check out this list of freezones in the UAE.

But the difference between LLC and freezone in UAE in terms of ownership boils down to balancing who owns the shares with where you can actually operate.

Trading Rights and Market Access in the UAE

When looking at the difference between LLC and freezone in UAE, trading rights are often the deciding factor. The ability to sell goods or services in certain markets, whether locally or internationally, it will shape your customer base and revenue potential.

Trading Rights of an LLC (Mainland Company)

- Full UAE Market Access: LLCs can operate anywhere in all seven emirates without restrictions. This includes selling directly to customers, working with other mainland companies, and applying for government contracts.

- No Intermediary Required: You can manage sales, pricing, and customer relationships directly without needing a local distributor.

- Wide Industry Coverage: With the correct business license, an LLC can participate in industries such as retail, construction, manufacturing, and professional services.

- Multiple Branches Allowed: You can open branches across the UAE to expand your operations and brand reach.

Trading Rights of a Freezone Company

- Limited to Freezone and International Markets: A Freezone business can trade freely within its own Freezone and with overseas clients.

- Restricted Mainland Trading: Direct sales to mainland UAE require either a local distributor or a mainland branch office.

- Industry-Specific Clusters: Some Freezones cater to specific sectors like logistics, media, technology, or healthcare, which can give businesses targeted resources.

- Strategic Location Benefits: Many Freezones are near ports, airports, and transport hubs, making them ideal for import/export operations.

If your target customers are on the UAE mainland, an LLC’s unrestricted trading rights will be more practical. If your focus is on exports or niche services within a Freezone, the Freezone structure may work better. Understanding this part of the difference between LLC and freezone in UAE early will help you avoid restructuring later.

Tax Implications in the UAE (2025 Update)

Taxation has become an increasingly important factor for entrepreneurs in recent years, especially since the introduction of corporate tax in the UAE. Knowing how LLC and Freezone tax rules differ will help you forecast expenses and plan your finances accurately.

Corporate Tax for LLCs in 2025

- Subject to 9% Corporate Tax on taxable profits above AED 375,000, in line with the UAE’s corporate tax framework.

- No Personal Income Tax: Business owners do not pay tax on personal income or dividends from the company.

- VAT Registration Required if annual turnover exceeds AED 375,000, with the standard VAT rate set at 5%.

- Mainland Operations Taxed Equally : LLCs serving both mainland and international clients are taxed under the same corporate tax rules.

Corporate Tax for Freezone Companies in 2025

- Qualifying Freezone Income May Be Tax-Exempt : Certain income from qualifying activities and compliant transactions can remain at 0% corporate tax.

- Non-Qualifying Mainland Transactions Taxed at 9%: If a Freezone company earns income from mainland clients without meeting qualifying criteria, that portion is subject to the standard corporate tax.

- VAT Rules Still Apply: VAT registration is required when turnover meets or exceeds the threshold, even in a Freezone.

- Regulatory Compliance is Critical : To keep 0% corporate tax benefits, Freezone companies must meet substance requirements, keep proper accounts, and avoid prohibited transactions.

Many people find corporate tax registration in the UAE overwhelming. We published a blog simplifying the process of corporate tax registration in the UAE so you learn and do it right.

Cost Structures and Hidden Expenses

When comparing an LLC to a Freezone business structure in the UAE, the cost differences go beyond the headline numbers you see in advertisements. Entrepreneurs often focus on the license fee, but it’s the extra costs that determine your true long-term expenses.

Initial Setup Fees

Setting up an LLC generally requires more upfront capital compared to a Freezone company. This includes notarization of documents, local sponsor fees, and government approvals. In contrast, Freezone setups often package these costs together, making the initial payment appear lower but you still need to check for separate charges on specific services.

Annual Renewal Costs

Every year, both LLCs and Freezone companies require license renewals. For LLCs, this can involve municipal fees and sponsor renewals, while Freezone renewals are usually a flat package fee. However, Freezones can increase rates annually, so the long-term cost may be higher than expected.

Office Space Requirements

LLCs typically require a physical office lease in mainland UAE, which can be a major expense in high-demand areas. Freezones may offer flexi-desk or shared space options to reduce costs, but these can come with limitations on how many visas you can obtain.

Hidden Service Charges

It’s common for both structures to have fees for administrative services such as name changes, amendments to business activities, and extra document attestations. These add up over time, especially if you plan to scale and adapt your business model.

Visa Eligibility and Quotas

Another major difference between LLC and Freezone companies in the UAE is how many visas you can issue and who qualifies. For entrepreneurs bringing in talent from abroad, visa eligibility can make or break your expansion plans.

Visa Quotas in LLCs

Mainland LLCs usually have more flexibility in the number of visas you can issue. This is tied to the size of your physical office space, so the more square meters you lease, the more visas you can apply for. This makes LLCs a better fit for businesses planning to build large on-the-ground teams.

Visa Quotas in Freezones

Freezone visa quotas are fixed, often starting from two to six visas depending on the package you choose. While you can increase your quota, it often requires upgrading your office space, which raises costs.

Visa Eligibility for Different Roles

With an LLC, you can apply for visas across a wide range of business activities, as your operations are not restricted to one Freezone’s rules. Freezones, on the other hand, often limit visa eligibility to activities allowed within that Freezone’s license scope.

Choosing Based on Your Business Goals

When deciding on your company structure, it’s not enough to just know the difference between LLC and freezone in UAE, you need to align that difference with your actual goals. The right choice will shape your market access, tax obligations, costs, and even how easy it is to expand in the future.

Goal: Targeting the Local UAE Market

If your main focus is selling products or services within the UAE mainland, an LLC is usually the more strategic option. It allows you to trade directly in the local market without needing a distributor or a local agent. This is especially important for businesses like retail stores, service providers, and contractors who want unrestricted access to local customers.

Goal: Expanding Regionally or Globally

If your plan involves tapping into international markets, a Freezone can be more appealing. Freezones in the UAE offer full foreign ownership, simplified customs processes, and often faster setup times, which are ideal for e-commerce, export, or consulting businesses that operate primarily outside the mainland.

Goal: Balancing Costs and Control

For entrepreneurs balancing startup costs with operational control, the LLC vs Freezone in UAE decision becomes a matter of trade-off. LLCs can require more initial investment due to local licensing and office requirements, while Freezones often offer lower setup costs but limit direct access to the local market.

Goal: Attracting Investors or Partners

If securing investment is part of your roadmap, the structure can make a difference. Some investors prefer the credibility and market reach of an LLC, while others are drawn to the tax advantages and full ownership that Freezones provide. Align your choice with the type of investors or partners you want to attract when opening a business in Dubai.

Common Mistakes to Avoid When Deciding

When you’re weighing the difference between LLC and freezone in UAE, it’s easy to get caught up in the big advantages and overlook the finer details. These oversights can cost you money, time, and flexibility later on.

Some of the most common mistakes include:

- Choosing based on setup cost alone: The cheapest option now might cost more in renewals, restrictions, or lost opportunities.

- Ignoring the scope of your operations: If you misunderstand the difference between LLC and freezone in UAE, you might end up with a structure that limits your ability to sell locally or internationally.

- Not thinking long-term: Many business owners focus only on the first year without considering how their chosen structure will impact expansion, partnerships, or tax efficiency down the line.

- Skipping professional advice: Each business has unique needs, and assumptions about the difference between LLC and freezone in UAE can lead to costly restructuring later.

Avoiding these mistakes will save you from headaches and expensive corrections, as your business grows.

Final Checklist Before You Commit

Before you lock in your decision, make sure you’ve ticked off the essentials. Understanding the difference between LLC and freezone in UAE is only the first step. The real work is making sure your choice matches your operational needs, financial plan, and growth strategy.

Here’s a quick checklist to run through:

- You’ve compared the difference between LLC and freezone in UAE in terms of market access, taxes, and ownership rules.

- You know your target audience and whether you’ll be selling to the local UAE market or focusing internationally.

- You’ve calculated total costs for setup, renewals, and visas over the next 3–5 years.

- You’ve checked compliance requirements so you’re not hit with fines later.

- You’ve reviewed your five-year growth plan to ensure your business structure won’t limit expansion.

Taking the time to fully grasp the difference between LLC and freezone in UAE before committing ensures you don’t end up restructuring. Which can be costly and time-consuming.

If you’re not clear on what business documents you need to prepare before you commit, here’s a full checklist of business documents required for business setup in Dubai.

Making the Smart Move for 2025

Understanding the difference between LLC and freezone in UAE is essential for any entrepreneur planning to start or expand a business here in 2025. Your choice affects everything from ownership and market access to taxation and operational costs. Making the wrong decision can lead to restrictions, extra expenses, or the need for costly restructuring.

By carefully evaluating your business goals, budget, and target market, you can select the structure that best supports your growth and success. Whether you lean toward the flexibility and mainland access of an LLC or the full foreign ownership and export advantages of a Freezone, knowing the key differences helps you to build your business on solid ground.

At GCG Structuring, we specialize in guiding entrepreneurs through this complex decision-making process. Our experts help you navigate the legal and financial nuances, ensuring your free zone business is set up efficiently and compliantly for 2025 and beyond.

FAQ

1. 0 Can I switch from a Freezone company to an LLC later on?

Yes, but it involves legal procedures, new licensing, and potential costs. Planning your structure from the start can save time and money.

2. 0 Do Freezone companies pay VAT in the UAE?

Freezone companies must register for VAT if their taxable supplies exceed the threshold, just like LLCs. VAT applies to sales within the UAE mainland.

3. 0 Are there industry restrictions for LLC formation in the UAE?

Yes, some industries require special approvals or can only be set up in specific emirates. It’s important to check local regulations before choosing LLC formation.