Setting up an online business in Dubai can feel like a maze. One consultant tells you it costs AED 25,000. Another says you can do it for AED 6,000. Then you hear about hidden visa charges, office requirements, name approvals, and bank compliance problems. It's no wonder why most first-time founders overpay or get stuck halfway through.

This blog is a practical, clear-cut guide for anyone planning to launch an online business in the UAE, especially if you’re looking to control costs without cutting corners. Whether you’re a solo entrepreneur, dropshipper, or an expat moving to Dubai to build your online brand, you’ll find the full picture here.

We’ll walk you through the legal steps, what an e-commerce license in Dubai actually is, where people usually overspend, how to compare jurisdictions like free zones vs mainland, and what fees often go unmentioned until it’s too late. We’ll also give you tips on how to negotiate better license packages and avoid the traps of flashy but restrictive setups.

By the end of this article, you’ll know how to apply for an e-commerce license in Dubai the right way without wasting money, time, or energy.

Table of Contents

Why Dubai Is the Best Place to Launch Your Online Business

Dubai is now the digital business hub of the Middle East. If you’re looking for lowering your taxes, global reach, and a legally secure setup all in English and it’s one of the best places to launch.

Here’s why more online founders are applying for an e-commerce license in Dubai:

1. The UAE’s e-commerce market is booming

The UAE has one of the fastest-growing online consumer markets in the world. According to Statista, e-commerce revenue in the UAE is projected to hit USD 17.2 billion by 2025 and grow at a compound annual growth rate (CAGR) of 8.6%.

This means more people are buying online, across all product categories from fashion and electronics to groceries and health products.

2. Full foreign ownership and zero personal tax

You can own your company fully (especially in Free Zones) and legally avoid personal income tax. That means more freedom to grow and reinvest without worrying about double taxation.

3. Top-tier logistics and digital infrastructure

Dubai’s shipping, fulfillment, and internet access are world-class. Whether you use Amazon.ae, Noon, or Shopify, operations run smoother than in most Western markets.

4. Easy setup and online-friendly policies

You can get your license fully online in many Free Zones. Shared spaces and visa-flexible packages make it cost-effective for part-time and solo founders.

5. A strategic location to sell globally

With easy access to Europe, Asia, and Africa, Dubai gives you an edge in shipping and customer acquisition. You can reach a large consumer base within hours without paying EU or U.S. tax rates.

That’s why getting an e-commerce license in Dubai has become the smart move for digital entrepreneurs, dropshippers, coaches, freelancers, and product sellers looking for both growth and security.

What Is an E-Commerce License in Dubai (And Why You Need One)

If you want to start any online business in the UAE, getting an e-commerce license in Dubai is mandatory. Whether you sell on Amazon.ae, Shopify, or Instagram, you must have a valid e-commerce license in Dubai registered with UAE authorities.

Not all e-commerce licenses in Dubai are the same. Picking the wrong one can limit your business, block payment gateways, or freeze your bank account.

Here’s why the e-commerce license in Dubai matters:

1. It’s a legal permit to operate online

The e-commerce license in Dubai is issued by the mainland Department of Economic Development (DED) or a Free Zone Authority. It lets you sell goods or services online legally in the UAE and beyond.

2. It’s required by law—even for digital products

Selling courses, ebooks, dropshipping, or freelance services? You still need the correct e-commerce license in Dubai for your activity.

3. It protects your ability to open a bank account

Banks demand a valid e-commerce license in Dubai matching your business activity. The wrong license means rejected applications. Many people skip the basics like trade name checks, but these 2025 rules can get your application delayed if ignored.

4. It comes in different types based on your setup.

You’ll get your e-commerce license in Dubai through either mainland DED or a Free Zone. Each has different rules for local sales, office requirements, and visas.

5. You’ll need this before registering a payment gateway

Payment processors like Stripe or Telr require a valid e-commerce license in Dubai, a UAE bank account, and a compliant website.

6. It helps with advertising compliance

Facebook, Google, and TikTok require license verification. The e-commerce license in Dubai is your proof.

7. It’s your gateway to UAE’s booming e-commerce sector

As mentioned earlier, the UAE’s e-commerce sector is growing fast. According to the UAE’s Telecommunications and Digital Government Regulatory Authority, over 90% of UAE residents shop online at least once a month.

That kind of consumer behavior makes Dubai one of the most promising markets for online sellers in 2025, and understanding the types of licenses in UAE including your e-commerce license is what puts you in the game legally.

Free Zone vs. Mainland: Where Most People Overpay

This is where many entrepreneurs go wrong. Not because they picked the “wrong” license, but because they didn’t fully understand what they were buying. Both mainland and free zone setups offer legal e-commerce license in Dubai options. But the cost, scope, and restrictions are very different.

If you’re trying to reduce setup costs while still staying compliant, this section is worth paying close attention to.

1. Mainland: Direct access to UAE customers, but at a premium

Getting your e-commerce license in Dubai through the Department of Economic Development (DED) means you can sell directly to UAE residents without needing a local agent or distributor. This is especially useful for product-based businesses with local fulfillment.

But here’s the catch:

- You’ll need a local office space (even if you don’t use it)

- The upfront costs are higher

- You may face longer bank account approval timelines

Average starting cost: AED 14,000 to AED 25,000

Includes name reservation, office contract, and general trading approvals

2. Free Zone: More affordable, but limited local selling

If you want to sell internationally, or operate online with minimal physical presence in the UAE, a free zone e-commerce license in Dubai is often the smarter choice. Many zones allow you to apply 100% online with no office lease, and the packages can start as low as AED 5,750.

But here’s what you need to know:

- You may not be allowed to sell directly to mainland customers without a local distributor or courier partner

- Some free zones are not recognized by all UAE banks

- The activity code on the license must match your business model exactly

Average cost: AED 5,750 to AED 12,000

Visa optional, office space not required in most cases

Where people overpay

Many founders buy a cheap license without reading the fine print. Later, they realize:

- It doesn’t allow the activity they actually need

- Their bank rejects the license

- They can’t sell in the mainland without extra permits

Knowing how much is e commerce license in Dubai isn’t enough. What matters is choosing the right license with no hidden conditions.

If you need an in-depth breakdown of Free Zone vs Mainland, this blog can help you decide based on your business type, visa needs, and long-term plans.

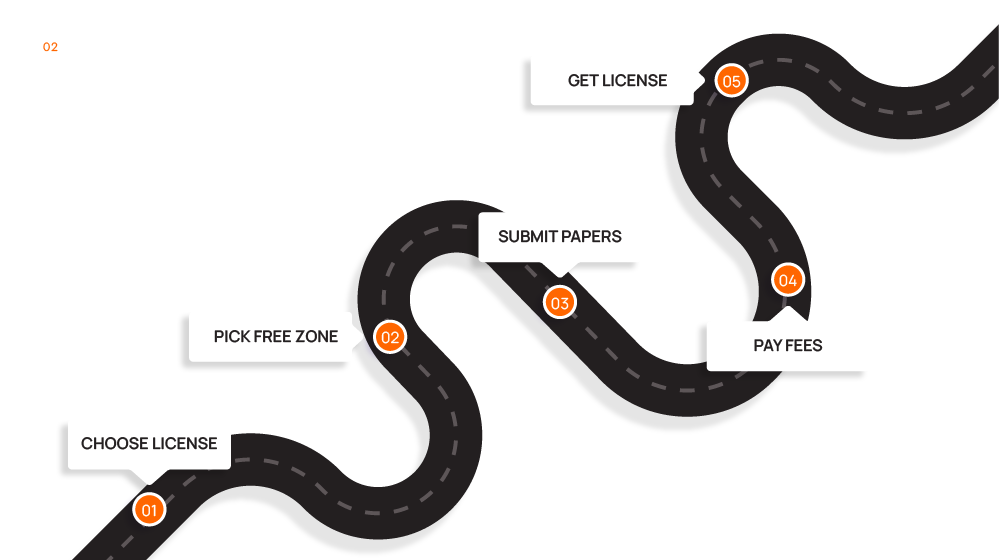

The Step-by-Step Process to Get Your E-Commerce License

Applying for an e-commerce license in Dubai doesn’t have to be complicated. But doing it right without overpaying, requires knowing what steps to follow and when to say no to extras you don’t need.

Here’s the step-by-step process explained clearly, with a focus on cost efficiency and legal accuracy.

1. Choose your jurisdiction (Free Zone or Mainland)

Start by deciding whether you’ll operate under a free zone or mainland authority. As covered earlier, free zones offer lower fees, while mainland allows full local trading. Your choice affects everything else from cost to scope of business.

This decision will define the structure of your e-commerce license in Dubai and your ability to scale or limit expenses down the line.

2. Select the right business activity

Each license must include a clearly defined business activity. For e-commerce, look for terms like:

- E-Trading

- Online Trading

- Online Marketplace

- Portal Business

- E-Commerce Through Internet

If your activity doesn’t match what you actually do, you may have issues with bank accounts or ad platforms later.

3. Reserve your trade name

Pick a business name that complies with UAE naming rules. Avoid offensive or religious terms. You’ll pay a fee for name reservation, typically between AED 600 to AED 1,000, depending on the authority.

This is required for all new applicants of an e-commerce license in Dubai and must be done before submitting your full application.

4. Submit your license application

Submit your documents to the chosen authority:

- Passport copy

- Passport-sized photo

- Proof of UAE entry or residence visa

- Trade name certificate (if applicable)

In most free zones, this can be done 100% online. This is a major advantage for expats applying for an e-commerce license UAE for expats from overseas. If you’re an expat founder doing this solo, this trade license guide for expats can save you hours of second-guessing.

5. Get initial approval and pay the license fee

Once approved, you’ll receive a payment voucher. Make the payment, and you’ll get your license issued typically within 3 to 5 working days for most free zones.

Now you’re legally allowed to operate under your e-commerce license in Dubai and proceed to open a UAE business bank account.

6. Apply for your visa (if needed)

If your license includes visa eligibility, you can begin the visa process:

- Establishment card application

- Entry permit

- Medical test and Emirates ID

- Residency stamping

If you don’t need a visa yet, you can apply later when your business grows. This is another reason why free zone packages with 0-visa options are popular for those wondering how to apply for e-commerce license in Dubai with minimal cost.

Reminder: Your business isn’t considered fully operational until you’ve opened a corporate bank account. Without a valid e-commerce license in Dubai, no UAE bank will approve your application. Here’s a detailed breakdown of how to open a business account in the UAE the right way.

Hidden Costs No One Tells You About

When looking at offers for an e-commerce license in Dubai, most focus on the headline price. What they miss are hidden fees that often push total costs 30–50% higher.

These add-ons aren’t always upfront but can make a big difference in your budget.

1. Name reservation

Every license requires you to reserve a trade name. In free zones, this usually costs AED 600–1,000. Some packages include it, others bill you separately.

2. Initial approval and registration fees

Some free zones charge a one-time approval fee just to process your documents. This ranges from AED 1,000 to AED 2,500, depending on the zone.

3. Establishment card (for visa-eligible licenses)

To apply for a UAE residency visa, you’ll need an establishment card, which costs AED 500–1,200. Many applicants aren’t told this until they reach the visa stage.

For expats applying under the e-commerce license UAE for expats, this is a mandatory step if residency is part of your plan.

4. Office or desk space (mandatory in mainland, optional in free zones)

Mainland licenses require a physical office even if unused. Free zones often offer flexi-desks from AED 2,000/year as a cheaper option, but some still bundle it in.

Knowing how much is e commerce license in Dubai only helps if you account for space costs.

5. Visa application expenses

If you’re adding a visa, budget for:

- Entry permit: AED 1,000–1,200

- Medical test: AED 350

- Emirates ID: AED 370–500

- Residency stamping: AED 500–800

Even with a “visa-included” package, you’ll likely pay these separately.

6. Mandatory insurance and approvals

Some zones require health insurance before visa issuance. Others charge for immigration file setup or local agent services especially in mainland licenses.

These extra charges rarely appear in your initial e-commerce license in Dubai quote, leading to extra expenses.

How to Choose the Right Free Zone

Not all free zones are created equal. Choosing the wrong one can lock you into limited activities, higher renewal fees, or unnecessary red tape. When applying for an e-commerce license in Dubai, the free zone you pick determines everything from cost to control.

Here’s what to look at:

1. Activities allowed

Some free zones restrict the type of e-commerce business in Dubai you can run. For example, IFZA allows consulting, trading, and digital services. DMCC caters more to commodities and tech. Always match your business model to the free zone’s approved activities list.

2. Price transparency

Look for a zone that clearly states all costs including renewal fees, visa eligibility, and hidden charges. Don’t just ask how much is e commerce license in Dubai, ask what’s included.

3. Visa eligibility

If you’re an expat, not all zones support visa applications. Some cheaper setups exclude visa quotas. If you’re planning to reside in the UAE, your e-commerce license UAE for expats needs to include a visa slot.

4. Office requirements

Zones like Meydan and SHAMS offer virtual setups with no mandatory office. Others, such as DAFZA, require physical offices. Opting for a flexi-desk or shared space can keep your e-commerce license cost in Dubai lower.

5. Renewal and flexibility

Some free zones offer 1-year, 2-year, or even 3-year license options. Check if you can pause your license without penalties, or downgrade if your business shifts.

How to Avoid Overpaying (Real Tips That Actually Work)

Overpaying for an e-commerce license in Dubai happens more often than you think. Here are practical tips to keep your license costs down without compromising compliance:

Compare packages carefully.

Don’t just look at the license fee. Check what’s included like name reservation, office space, visas, and renewal fees. A low upfront cost may hide expensive extras.

Choose the right jurisdiction.

Picking a mainland license when a free zone license covers your needs can increase your costs unnecessarily. Most small online sellers thrive on free zone licenses with lower fees.

Skip unnecessary upgrades.

Some providers push “premium” packages with add-ons you won’t use. Focus on your actual business needs, not extras.

Negotiate your package.

Many free zones and agents have flexibility on pricing or office options. Don’t accept the first offer.

Plan your visa needs wisely.

If you don’t need residency immediately, pick a package without a visa and apply later.

Using these strategies lets you secure your e-commerce license in Dubai at the best price, saving thousands.

Common Mistakes First-Time Founders Make (And How to Avoid Them)

Many new entrepreneurs rush the e-commerce license in Dubai process and run into problems. Avoid these common mistakes:

Choosing the wrong license type.

Not matching your license activity to your business causes compliance and banking issues.

Ignoring hidden fees.

Not budgeting for name reservation, office space, or visa costs leads to unexpected expenses.

Skipping professional help.

Trying to navigate licensing alone can lead to errors or delays.

Underestimating timelines.

Some free zones issue licenses quickly; others take longer. Rushing can cause mistakes.

Neglecting payment gateway requirements.

Without the right e-commerce license in Dubai, you won’t get approved for card processing.

Avoid these pitfalls by planning carefully and working with experts who understand the process. And since you’re still reading, check out essential challenges in setting up a business in Dubai to save time and money.

Launch With Confidence, Not Confusion

Getting an e-commerce license in Dubai isn’t just about filling out paperwork. It’s about making decisions that affect your business long-term where you operate, what activities you can legally do, how much control you have, and how much you’ll pay every year.

But for most first-time founders, the process is filled with guesswork. They get pulled into cheap setups that don’t support their business model. Or worse, they overpay for things they don’t need like offices they won’t use, or visa quotas they’ll never fill.

At GCG Structuring, we walk you through the full process of getting an e-commerce license in Dubai, from choosing the right free zone to opening your company in Dubai without red tape or delays. We help you look beyond just “getting the license” and focus on what your business actually needs to grow.

Whether you’re launching a new brand or relocating from abroad, you deserve a setup that works without the guesswork or the inflated costs. If you’re serious about building a real business with an e-commerce license in Dubai, we’ll help you get it right the first time.

FAQ

1. 0 Can I get an e-commerce license in Dubai without living there?

Yes, you can apply for an e-commerce license in Dubai fully online, even if you’re overseas.

2. 0 Is the e-commerce license in Dubai valid for selling on Amazon or Shopify?

Yes, the e-commerce license in Dubai works for most online platforms, including Amazon and Shopify.

3. 0 How fast can I get an e-commerce license in Dubai?

Most free zones issue the e-commerce license in Dubai within 3–5 working days.

4. 0 Do I need a physical office for an e-commerce license in Dubai?

No. Many zones let you get an e-commerce license in Dubai with a virtual office setup.

5. 0 Can I renew my e-commerce license in Dubai every year?

Yes, the e-commerce license in Dubai is renewed annually, usually with low paperwork.