In recent years, the UAE has taken major steps toward liberalizing its business ownership laws especially in Dubai. The highly anticipated shift to allow 100% foreign ownership in mainland companies has opened new doors for international investors. Yet, despite these changes, several industries still require a local partner in Dubai.

This has caused confusion among entrepreneurs, many of whom mistakenly believe that full foreign ownership is now possible across all sectors. The reality is more nuanced.

In this blog, we will break down everything you need to know about industries that still require a local partner in Dubai. We’ll clarify the difference between a local sponsor in Dubai and a local service agent (LSA). You’ll also learn what has changed since the 2021 reform, and most importantly, which industries in 2025 still need a local partner in Dubai to operate legally.

Table of Contents

Understanding the Role of a Local Partner in Dubai

To make informed decisions about your company setup, it’s important to first understand what is local partner in Dubai.

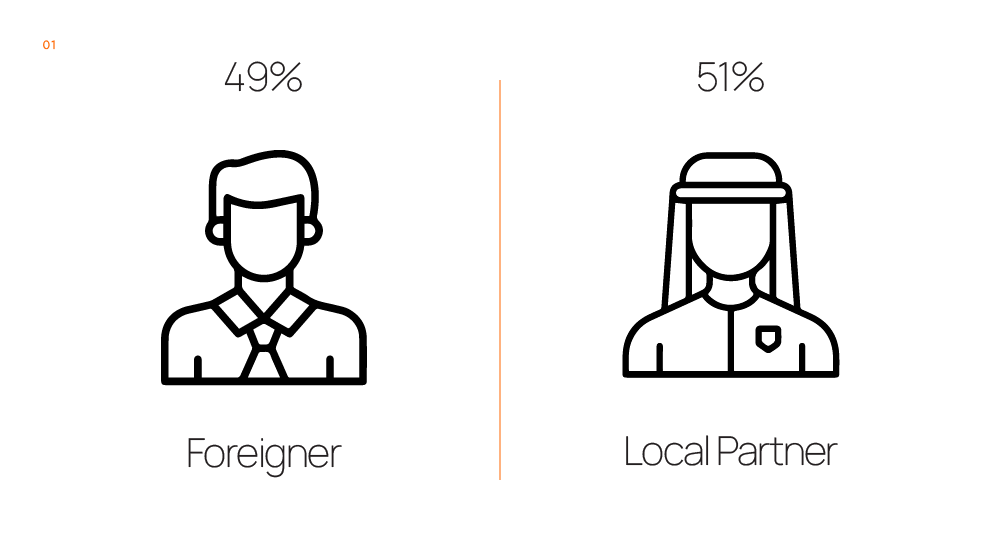

A local partner in Dubai is a UAE national (either an individual or a corporate entity) who holds a legal stake, typically 51% in a mainland business. This model is mandated for certain activities under UAE Commercial Companies Law (CCL).

There are two types of arrangements:

- Equity Partnership: The local partner in Dubai holds 51% ownership.

- Local Service Agent (LSA): The local partner does not own shares but helps with licensing and government processes (more on this later).

Using a local partner in Dubai is a legal requirement for businesses operating in sectors deemed strategically important or sensitive.

Now, with the introduction of full foreign ownership for many sectors, the confusion lies in knowing where a local partner in Dubai is still mandatory.

This section alone should make it clear that the role of a local partner in Dubai is more than just a figurehead. The partner has legal responsibilities and, depending on your license, might be a key stakeholder in your operations.

It’s also worth noting that this requirement doesn’t apply in UAE free zones, which allow 100% foreign ownership by design. But if you’re going mainland, it’s a different story.

If you’re still torn between free zone and mainland setups, check out our guide on free zone vs mainland in Dubai.

Which Industries Still Require a Local Partner in Dubai?

Despite reforms, several key industries still require a local partner in Dubai due to national security, regulatory sensitivity, or public interest. Here are the main ones to know in 2025:

1. Oil & Gas

This is a state-controlled sector. Any business involved in exploration, drilling, refining, or distribution of oil and gas must have a local partner in Dubai. This also applies to energy-related logistics and equipment supply.

2. Telecommunications

Telecom is one of the most regulated industries. Operating in this space… whether infrastructure, services, or digital telecom, requires a local sponsor in Dubai.

3. Defense & Military Equipment

Businesses in defense, security systems, surveillance, or military-grade technology fall under high regulatory scrutiny. They must appoint a local partner in Dubai to be eligible for licensing.

4. Transportation (Air, Sea, Land)

Whether you’re offering commercial trucking, maritime shipping, or aviation-related services, a local partner in Dubai is needed. This includes logistics companies involved in import/export.

5. Financial Services (Banking, Insurance, Investment)

Due to its sensitive nature, the finance industry, including banking, investment firms, and insurance providers requires a local partner in Dubai.

According to UAE Central Bank regulations, all banking institutions must have local majority ownership.

6. Media & Publishing

If you’re entering publishing, broadcasting, or media production, especially with political or public content, you will need a local partner in Dubai.

7. Utilities and Infrastructure

Power generation, water supply, and waste management firms need a local partner in Dubai. These are considered public-interest sectors.

8. Medical & Pharmaceutical Retail

Running a pharmacy, distributing medical devices, or importing pharmaceutical products? You’ll need a local partner in Dubai.

9. Recruitment & Labor Supply

Employment agencies and labor outsourcing companies require a local sponsor in Dubai, due to the sector’s impact on the local workforce.

10. Fishing & Marine Activities

Commercial fishing and vessel operations are regulated and require a local partner in Dubai.

11. Commercial Agencies

If you act as an exclusive distributor or commercial agent for foreign products, a local partner in Dubai is mandatory.

These are just the most common examples. Dubai’s Department of Economic Development (DED) maintains an updated list of all activities that still require local ownership. And if you’re dealing with import/export or labor supply, don’t forget that there are business documents required for business setup in Dubai: full checklist that must be submitted.

What Changed After the 2021 UAE Ownership Reform?

Before 2021, virtually all foreign investors looking to establish a mainland company were required to appoint a local partner in Dubai who held 51% of the company’s shares. This ownership structure was mandatory, regardless of the type of business, making foreign entrepreneurs dependent on local equity partners even when they were the sole financiers and operators of the business.

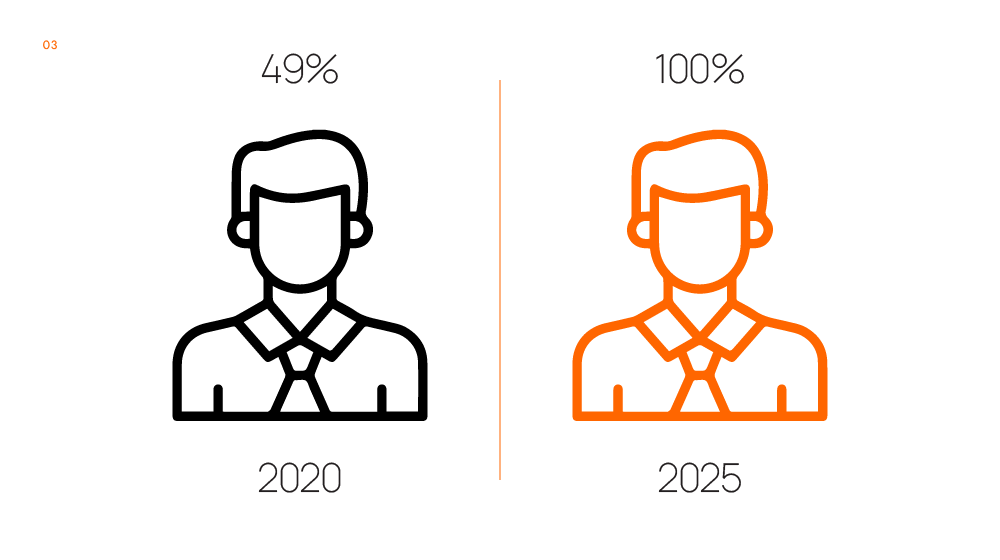

That changed with the introduction of Federal Decree Law No. 26 of 2020, which amended the UAE Commercial Companies Law and came into effect on June 1, 2021. This reform significantly modernized how foreign ownership is handled in Dubai and across the UAE.

1. Full Foreign Ownership in Over 1,000 Mainland Activities

The reform permits foreign nationals to own 100% of companies in more than 1,000 commercial and industrial business activities within the mainland. For these activities, a local partner in Dubai is no longer required. This is especially relevant for sectors like e-commerce, IT, advertising, consulting, and various trading categories.

2. Authority Delegated to Each Emirate’s DED

Each emirate’s Department of Economic Development (DED) including Dubai’s now has the power to decide which specific business activities are open for full foreign ownership. This means rules may vary slightly between emirates, and whether or not you need a local partner in Dubai could depend on where you’re setting up.

3. The DED Published a “Positive List”

To clarify which business activities are eligible for 100% ownership, the Dubai DED introduced a “Positive List.” This list outlines all the business types that do not require a local partner in Dubai. It’s updated periodically and should be the first place investors look before proceeding with any mainland setup.

4. Strategic Sectors Still Require a Local Sponsor in Dubai

Despite the reform, certain industries remain off-limits to full foreign ownership. These include oil and gas, telecom, defense, financial services, utilities, and other public-interest sectors. For these, a local sponsor in Dubai holding 51% equity is still mandatory. This distinction is crucial for investors operating in regulated fields.

If you’re looking to stay compliant while optimizing for tax, we’ve covered the basics in corporate tax registration in UAE made easy: what you need to know.

Local Service Agent (LSA) Model for Professional Licenses

1. Who Needs an LSA in Dubai?

If you’re planning to offer professional services like consulting, marketing, legal advice, accounting, or design work, you’ll likely need a Local Service Agent. These types of businesses are issued a professional license, which means you can own 100% of your company without needing a local partner in Dubai.

However, that doesn’t mean you’re completely independent of local involvement. While you’re not required to give up equity, UAE law still mandates an LSA to legally operate a professional firm in the mainland.

2. What Does an LSA Do?

An LSA is a UAE national (either an individual or a company) who acts as your official liaison with the government. They don’t touch your profits, your management decisions, or your equity, but they help you get through the legal side of setting up and running your business.

Here’s what they typically handle:

- Submitting license applications and renewals

- Coordinating with immigration and labor departments

- Managing approvals with local authorities

- Helping you stay compliant with UAE regulations

So even if you don’t need a local partner in Dubai, you can’t skip the LSA if your license type requires one.

3. LSA vs. Local Partner in Dubai

This is where a lot of people get confused.

A local partner in Dubai holds 51% ownership of your company. They are a shareholder and a legal stakeholder in your business, typically required for commercial or industrial activities.

An LSA, on the other hand, holds zero ownership. They’re not involved in business decisions, operations, or profit sharing. Their role is purely administrative and regulatory.

In short:

If your business trades goods or operates in a restricted sector, you’ll likely need a local partner in Dubai.

If your business offers personal or professional services, you’ll need an LSA instead.

4. Is It Still Required in 2025?

Yes. Even after the UAE’s 2021 ownership reforms, the LSA model is still required in 2025 for professional licenses issued in the mainland. The reform removed the local partner in Dubai requirement for many commercial sectors but it didn’t eliminate the LSA model for professionals.

So if you’re a solo consultant, freelancer, or service provider, don’t assume you’re exempt. You may not need a local partner in Dubai, but the LSA requirement still applies.

5. Can You Choose Your LSA?

Absolutely. You’re free to appoint an LSA of your choice, there’s no assignment by the government. Most LSAs work on a fixed annual fee, which you can negotiate. There are no revenue splits, and they don’t interfere with how you run your business.

Just make sure the LSA you choose is responsive and experienced in dealing with the specific licensing authorities related to your business.

Choosing the right LSA ensures you get all the benefits of 100% ownership, without the risks or confusion that can come from misunderstanding the difference between an LSA and a local partner in Dubai. And if you’re planning to open a consulting, marketing, or legal firm, this post walks you through how to get a professional license in Dubai in 10 Easy Steps.

What If You Choose the Wrong Business Setup? Legal & Practical Risks

Setting up your business in the UAE requires more than just selecting a trade name and submitting documents. One of the most common and costly mistakes investors make is choosing the wrong business structure either by misjudging whether they need a local partner in Dubai or by incorrectly classifying their business activity.

While the UAE has introduced greater flexibility since 2021, certain sectors still require a local partner in Dubai by law. Failing to comply can expose you to serious legal, financial, and operational risks.

Here’s exactly what can go wrong:

1. License Denial or Cancellation

If your business activity legally requires a local partner in Dubai and you attempt to register without one, your trade license application may be rejected outright. Even if your license is approved initially, regulatory audits could flag the error, resulting in suspension or cancellation of your license later. This is why understanding the types of business licenses is critical from the start.

Result: Your business could be shut down or made inoperable, regardless of your investment or business setup costs.

2. Heavy Fines and Government Penalties

Running a company that bypasses the requirement for a local partner in Dubai is a violation of the Commercial Companies Law. The authorities can impose fines, enforce compliance corrections, or even blacklist your trade name.

These penalties can range from tens of thousands of dirhams to full business closure in more serious cases.

3. Forced Restructuring and Loss of Control

If authorities find that your company was structured incorrectly, meaning you didn’t appoint a local partner in Dubai when it was required then you’ll be forced to restructure. This might involve:

- Adding a local shareholder retroactively

- Paying legal fees to amend contracts

- In some cases, selling a portion of your business to remain compliant

And if you’ve already onboarded clients or opened a bank account, this restructuring process becomes even more complicated and expensive.

4. Problems with UAE Banks

Banks in the UAE are increasingly strict about compliance. If your company lacks the correct licensing structure or skips the need for a local partner in Dubai, your bank account application could be delayed or denied.

In many cases, even existing bank accounts are closed after internal reviews reveal inconsistencies in ownership or licensing structure.

Many entrepreneurs don’t realize that banks can refuse your application if your structure isn’t set up correctly. Here’s how to avoid that: how to open business bank account in UAE the right way.

5. Visa Restrictions and Delays

Your visa quota and immigration approvals are directly tied to your license type. If your business isn’t set up correctly, especially if it bypasses the required local partner in Dubai, your visa applications for employees or dependents may be put on hold or rejected altogether.

That can delay staffing, stall operations, and complicate personal residency for business owners that are also applying for an entrepreneur visa in Dubai.

6. Risk of Losing Credibility and Contracts

Companies that ignore the legal need for a local partner in Dubai may be viewed as non-compliant by suppliers, partners, and clients. If you bid for government contracts or work with regulated institutions, improper structuring could disqualify you instantly.

Also, legal disputes over ownership and representation become more likely when setup isn’t done properly from the start—a common challenge in setting up business in Dubai.

Conclusion

Despite the 2021 reform, several high-impact industries still require a local partner in Dubai and that’s not changing in 2025.

Understanding where you fall on that list is critical. You must check your business activity code and determine whether it falls under those requiring a local sponsor in Dubai or an LSA. Making the right decision early can save time, money, and legal hassle.

If you’re unsure, GCG Structuring specializes in helping businesses and investors navigate these complexities with confidence. Whether you’re setting up in a free zone, mainland, or exploring dual structures, our team provides precise, compliant solutions to fit your goals.

FAQ

1. 0 What is local partner in Dubai and why is it still required in some sectors?

A local partner in Dubai is a UAE national or company that holds 51% ownership in certain types of mainland businesses. While the UAE now allows 100% foreign ownership in many activities, strategic and regulated industries still require a local partner due to national policy, legal compliance, and regulatory control. These include sectors like oil & gas, finance, telecom, and defense.

2. 0 How do I know if my business needs a local partner in Dubai or not?

The Department of Economic Development (DED) in Dubai maintains a regularly updated list of business activities. If your activity appears on the list of restricted sectors, you’ll need a local partner in Dubai. If it’s on the “Positive List,” you can likely own 100%. It’s essential to review the classification carefully before applying.

3. 0 What happens if I try to bypass the local partner requirement?

If your business activity requires a local partner in Dubai and you attempt to register without one, your license application could be denied, your business could face fines, or worse, your license could be revoked later. Banks may also refuse to work with non-compliant businesses, and restructuring costs can be high.

4. 0 Is a local sponsor in Dubai the same as a local service agent (LSA)?

Not exactly. A local sponsor in Dubai typically refers to a partner with equity ownership (51%) in your business. A Local Service Agent (LSA), by contrast, doesn’t hold shares or interfere in operations. LSAs are only required for professional licenses, while a local partner in Dubai is required for certain commercial and industrial activities.

5. 0 Can I switch from a local partner model to 100% ownership later?

Yes, but only if your business activity becomes eligible for full foreign ownership. In such cases, you can apply for a license amendment, remove the local partner in Dubai, and restructure your company. However, the process involves approvals and legal steps, so expert guidance is recommended.