Most businesses in the UAE receive and send money in more than one currency. Clients pay in USD or EUR, suppliers invoice in foreign currencies, while local costs remain in AED. Because of this, a multi currency bank account UAE is now a basic requirement for operating efficiently.

In 2025, getting approved for this type of account is not equal for every business. UAE banks assess applications based on company structure, licensed activity, ownership clarity, and compliance risk. Some structures are approved quickly, while others face delays or rejections even when the business is legitimate.

This blog explains how a multi currency bank account UAE works, which company structures receive faster approvals, which ones face challenges, and how different UAE banks approach multi-currency banking. It also covers where options like the Wio multi currency account fit and how to prepare bank-ready documentation to improve approval timelines.

Table of Contents

What a Multi Currency Bank Account UAE Actually Is (And How It Works)

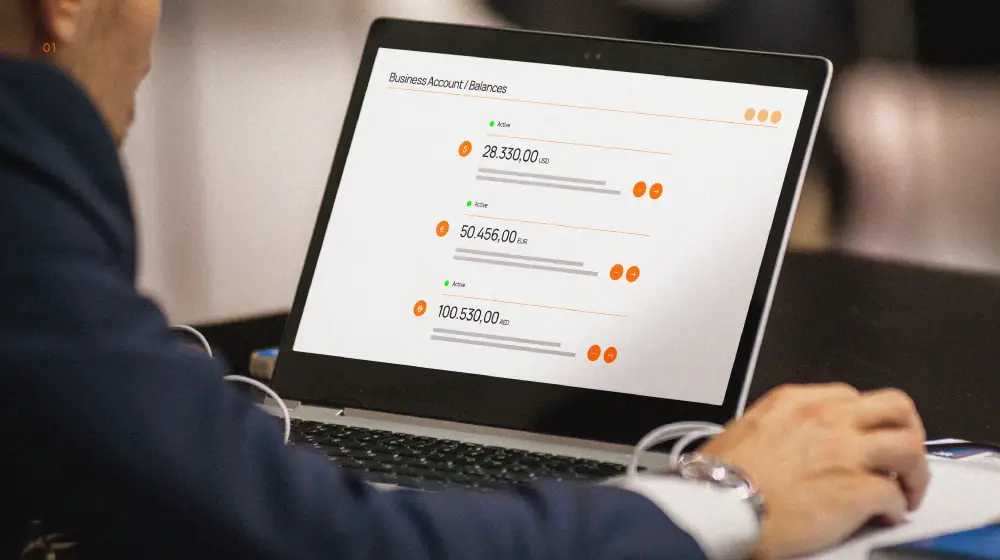

A multi currency bank account UAE allows a business to hold, receive, and send money in multiple currencies under a single account. This means you can keep balances in AED, USD, EUR, GBP, or other currencies without converting everything into one currency.

How It Works

- Each currency has its own balance within the account.

- Incoming payments can be received in the original currency.

- Outgoing payments can be made from the same currency balance.

- Banks provide online tools to manage and transfer funds across currencies.

Benefits

- Reduces unnecessary currency conversions.

- Makes international payments and collections easier.

- Helps businesses track cash flow in different currencies.

UAE banks extended AED 851.87 billion (about $232 billion) in credit facilities to business and industrial sectors, with growth from both national and foreign banks.

A multi currency bank account UAE is commonly used by companies working with foreign clients, suppliers, or subsidiaries. It simplifies international transactions while keeping all currency management in one account.

Why UAE Corporate Bank Account Approval Is Not Equal for Every Business

Approval for a UAE corporate bank account is not standard across all businesses. Banks assess each application based on risk, regulatory exposure, and how clearly the business can be understood. Two companies with similar profiles on paper can receive very different outcomes depending on structure, activity, and documentation quality.

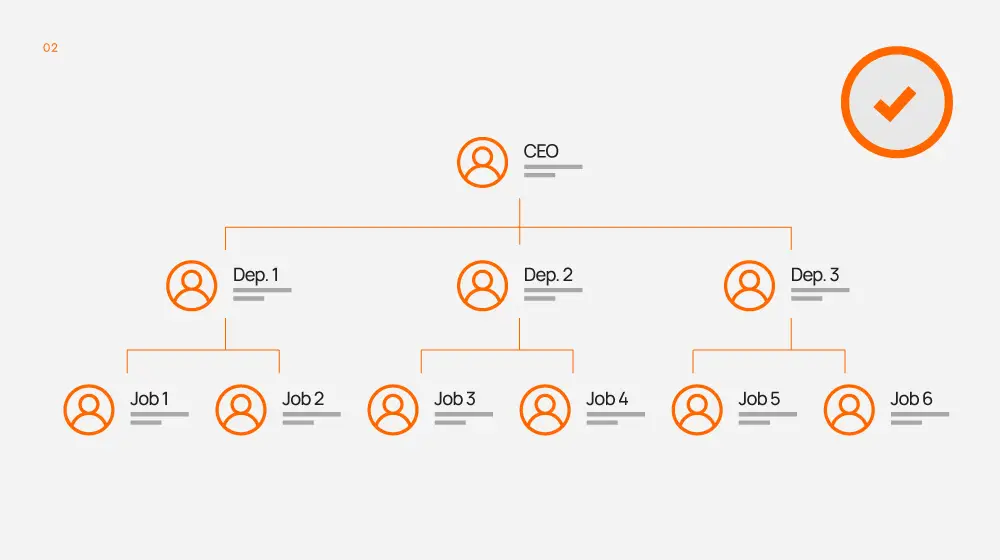

Company Structure

Banks move faster when ownership is simple and transparent. Clear shareholder and director details reduce review time and compliance follow-ups. Complex ownership chains, layered holding structures, or unclear control can slow the approval process.

Business Activity

Licensed activity plays a major role in approval speed. Service-based businesses and companies with straightforward revenue models are generally easier for banks to assess. Activities perceived as higher risk or difficult to trace require more scrutiny and additional explanations.

Compliance and Documentation

Banks expect accurate, consistent documentation that matches the company’s licensed activity and operations. Missing information, inconsistencies, or unclear source of funds commonly delay UAE corporate bank account approvals.

Industry Risk

Some industries are reviewed more cautiously regardless of company size or revenue. These businesses may face longer timelines and deeper compliance checks before approval is granted.

Company Structures That Get the Fastest UAE Bank Approval in 2025

In 2025, the fastest UAE bank approval is tied to how clearly a business can be assessed by a bank. Structures that are familiar, transparent, and aligned with their licensed activity move through onboarding more quickly, especially when applying for a multi currency bank account UAE.

Holding Companies with Clear Scope

Holding companies are approved faster when their role is limited to owning shares in operating entities. Banks are comfortable with these structures when ownership is simple and fund flows are easy to explain. When applying for a UAE corporate bank account, holding companies that do not trade or invoice third parties face fewer compliance checks.

Service-Based Companies with Simple Revenue Models

Service companies offering consulting, marketing, IT, or management services often receive the fastest UAE bank approval. Banks prefer predictable revenue, contract-based billing, and clear client relationships. These businesses are also well suited for a multi currency bank account UAE, as foreign payments can be clearly linked to services provided.

Free Zone Companies with Activity Alignment

Free zone entities are approved efficiently when the licensed activity matches actual operations. Banks closely review this alignment. When documentation, contracts, and revenue reflect the same activity, approval timelines improve, particularly within SME banking UAE.

Simple Ownership Structures

Companies with fewer shareholders and clear management roles are easier for banks to review. Simplicity reduces follow-up questions during due diligence for a multi currency bank account UAE and supports faster approval across the best banks UAE for multi currency offerings.

Why These Structures Work

Banks prioritise clarity and risk control. Structures that are easy to understand and monitor consistently move faster through approval, regardless of the bank selected.

Business Structures That Face Delays or Rejections

Some business structures consistently face slower approvals or rejection when applying for a multi currency bank account UAE. This is usually due to how difficult the business is for banks to assess from a compliance and risk standpoint.

High-Risk or Unclear Activities

Businesses in higher-risk sectors often face longer reviews. This includes crypto-related services, brokerage, payment processing, and financial intermediation. When revenue flow is not easy to trace, approval for a UAE corporate bank account becomes more challenging.

License and Business Model Mismatch

Banks closely compare licensed activities with actual operations. If the license is broad, vague, or does not reflect how the business earns revenue, compliance questions follow. This mismatch commonly delays multi currency bank account UAE approvals.

Complex Ownership Structures

Layered ownership, multiple jurisdictions, or unclear control slow down due diligence. Banks require full visibility into ownership before granting access to SME banking UAE services.

Trading Models with Limited Transparency

Trading companies without clear suppliers, buyers, or documented transactions often struggle. Banks want to understand the full trade flow before approving multi-currency access.

Weak or Incomplete Documentation

Missing contracts, unclear source of funds, or inconsistent records can lead to delays or rejection, even at the best banks UAE for multi currency accounts.

Why These Structures Face Issues

Banks prioritise clarity and regulatory comfort. Businesses that are hard to explain internally face more scrutiny, especially when applying for a multi currency bank account UAE.

Best Banks UAE for Multi Currency Accounts in 2025 (What They Typically Require)

In 2025, several banks offer multi-currency options, but approval standards differ. The best banks UAE for multi currency accounts are those whose requirements match the company’s structure and activity. Approval depends less on reputation and more on compliance fit.

Traditional UAE Banks

Local UAE banks support a full multi currency bank account UAE setup, usually covering AED, USD, EUR, and GBP. These banks expect complete corporate documentation, clear ownership, and a well-defined business model. Reviews are detailed, and approval timelines are longer, but these banks suit companies with ongoing international activity.

International Banks in the UAE

International banks operating in the UAE are typically used by companies with foreign shareholders or overseas operations. They assess both local and global structures before approving a UAE corporate bank account. Documentation requirements are strict, and approval depends heavily on transparency across jurisdictions.

Digital Banks and SME-Focused Providers

Digital banks play a growing role in SME banking UAE. They often provide faster onboarding and simpler account management but support fewer currencies. Approval for a multi currency bank account UAE is usually quicker for service-based businesses with simple ownership and predictable revenue.

Core Requirements Across Banks

Across the best banks UAE for multi currency, banks generally require incorporation documents, trade licenses, shareholder and director details, business activity explanations, and proof of revenue or source of funds. The depth of review increases with complexity and perceived risk.

Choosing the Right Bank

A service company may succeed with a digital provider, while trading or holding structures often require traditional banks. Matching the bank to the company structure improves approval outcomes for a multi currency bank account UAE.

Wio Multi Currency Account: Who It Works For And Who It Doesn’t

The Wio multi currency account is a digital solution designed for businesses that need fast access to multiple currencies without extensive paperwork. It allows companies to hold, receive, and pay in several currencies under a single account.

Who It Works For

Wio is best suited for service-based companies, small trading businesses, and startups that:

- Invoice clients internationally

- Receive regular foreign payments

- Have simple ownership and straightforward revenue

These companies can quickly open a multi currency bank account UAE through Wio and manage cross-border transactions efficiently. It’s particularly useful within SME banking UAE where speed and low overhead are priorities.

Who It Doesn’t Work For

Wio is less suitable for businesses with complex structures, multiple subsidiaries, or high-volume trading operations. Banks and digital providers like Wio may flag unclear ownership, high-risk sectors, or inconsistent revenue patterns. Companies in these categories often require a traditional UAE corporate bank account for full multi-currency support.

Key Considerations

While Wio offers convenience, it supports fewer currencies than traditional banks. Businesses planning large-scale international operations may need additional banking solutions to complement the multi currency bank account UAE.

How Bank Approval Requirements Differ Between UAE Banks

Approval requirements for a multi currency bank account UAE vary depending on the type of bank and its risk policies. Understanding these differences helps businesses choose the right bank for faster onboarding.

Traditional Banks

Traditional UAE banks require detailed corporate documentation, proof of ownership, and clear business activity. They perform thorough due diligence, which may lengthen approval times. These banks support multiple currencies and are suitable for holding companies, trading firms, and businesses with higher transaction volumes.

International Banks

International banks operating in the UAE focus on cross-border transparency. They review both local and global operations, ownership structures, and financial histories. Companies applying for a UAE corporate bank account with international operations often need additional documentation to meet compliance standards.

Digital and Challenger Banks

Digital banks streamline onboarding and approve accounts faster, especially for SMEs with straightforward structures. They prioritize simplicity, predictable revenue, and clear documentation. A multi currency bank account UAE from a digital bank may have currency limitations compared to traditional banks but is faster to open.

Approval Factors That Vary

Banks may differ in:

- Minimum deposit requirements

- Number of currencies offered

- KYC and due diligence depth

- Industry risk tolerance

Choosing a bank aligned with the company structure and activity improves the chances of fast approval, whether for SME banking UAE or larger corporate accounts.

The 2025 Bank-Ready Documentation Framework (Step-by-Step)

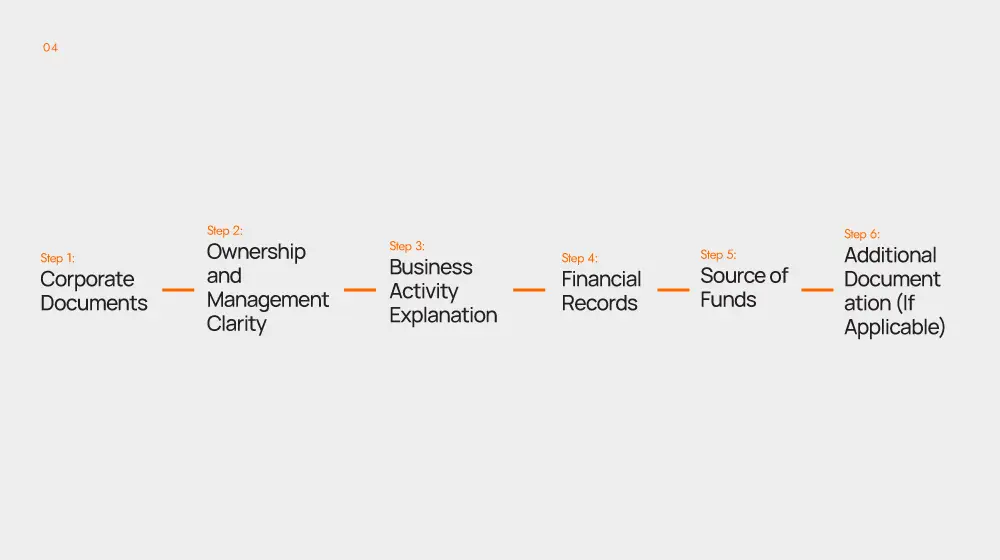

Preparing the right documentation is critical for a smooth multi currency bank account UAE application. In 2025, banks expect clarity, consistency, and alignment between company structure and operations.

Step 1: Corporate Documents

Provide incorporation certificates, trade licenses, and any relevant registration documents. Ensure shareholder and director details are current and match government records. This forms the basis of a UAE corporate bank account application.

Step 2: Ownership and Management Clarity

Submit a clear ownership chart and information about key managers. Banks review who controls the business, especially for complex or multi-layered structures. Transparent structures reduce delays.

Step 3: Business Activity Explanation

Include a detailed description of your operations, target markets, and revenue model. Align the explanation with your trade license to avoid mismatches. This helps banks assess risk when approving a multi currency bank account UAE.

Step 4: Financial Records

Provide invoices, contracts, and bank statements that show consistent revenue flows. For trading or service businesses, clear proof of income and client relationships is essential.

Step 5: Source of Funds

Explain how funds enter and leave the company. Include supporting documents such as contracts, agreements, or payment histories. Banks need this to comply with regulatory standards, especially for SME banking UAE applications.

Step 6: Additional Documentation (If Applicable)

Some banks may request:

- Ultimate Beneficial Owner (UBO) declarations

- Board resolutions authorizing account opening

- Foreign parent or subsidiary documentation

Completing these steps ensures a company is fully prepared for the approval process and improves chances of a smooth multi currency bank account UAE setup.

Choosing the Right Structure Before You Apply (Not After You Get Rejected)

The UAE banking sector hit AED 4.46 trillion in total assets, showing continued financial growth and stability.

Selecting the correct company structure before applying for a multi currency bank account UAE can save time and avoid repeated rejections. Banks assess applications based on clarity, compliance, and risk, so the structure directly impacts approval speed.

Align Your Structure with Bank Expectations

Companies with simple ownership, transparent management, and a clear licensed activity are more likely to get the fastest UAE bank approval. Holding companies, service-based firms, and aligned free zone entities often move through onboarding faster.

Avoid High-Risk or Complex Setups

Complex ownership chains, unclear operations, or high-risk sectors increase scrutiny and can slow approval. Businesses in these categories may face repeated rejections even with complete documentation.

Match the Structure to Banking Needs

The type of banking required should influence structure choice. For example, companies needing multi-currency access for international clients should ensure their structure supports a multi currency bank account UAE and aligns with bank risk policies.

Prepare Before You Apply

Planning ahead allows the business to gather documentation, clarify ownership, and choose a structure that supports compliance. This approach increases the likelihood of approval at the best banks UAE for multi currency accounts and improves access to SME banking UAE services.

Faster Bank Approval Starts with Structure, Not the Bank

Getting a multi currency bank account UAE approved quickly depends more on the company structure than on which bank you choose. Transparent ownership, clear management, aligned licensed activities, and complete documentation are the factors that determine approval speed.

Holding companies, service-based businesses, and properly aligned free zone entities consistently receive the fastest UAE bank approval, while complex or high-risk structures often face delays. Choosing the right structure before applying reduces friction and improves the likelihood of success with both traditional and digital banks.

For businesses looking to optimize their setup, at GCG Structuring, we guide companies on the best structures for faster approval, ensure documentation is bank-ready, and advise on aligning operations with bank requirements for a smooth multi currency bank account UAE application.

FAQ

1. 0 What is a multi currency bank account UAE?

It’s a corporate account that allows businesses to hold, receive, and send multiple currencies under one account, reducing conversion costs and simplifying international payments.

2. 0 Which company structures get the fastest UAE bank approval?

Holding companies, service-based firms with clear revenue, and aligned free zone entities are typically approved faster.

3. 0 Can SMEs open a multi currency account in the UAE?

Yes, many banks and digital providers offer SME banking UAE solutions suitable for small businesses with predictable international revenue.

4. 0 What documents are needed for approval?

Banks generally require trade licenses, incorporation certificates, shareholder and director details, business activity description, and proof of revenue or source of funds.

5. 0 Is the Wio multi currency account suitable for all businesses?

No, it works best for service-based SMEs with simple structures. Complex or high-volume trading companies often need a traditional UAE corporate bank account.