In recent years, the UAE has transformed from a tax-free destination into a jurisdiction with one of the most competitive corporate tax systems in the world. The introduction of the 9% corporate tax on profits above AED 375,000, effective from June 2023, has created a new reality for business owners. While the rate is relatively low compared to other countries, the change has made tax optimization an essential consideration for every entrepreneur and investor operating in the country.

The truth is, building a successful business in the UAE is no longer just about generating revenue, it is also about how much of that revenue you can retain and reinvest. With rising global tax transparency requirements, investors and partners are also looking for businesses that are not only profitable but also compliant and efficient in how they handle their financial obligations. This is where tax optimization comes into play.

In this blog, we will look at how UAE business owners can use tax optimization strategies to protect profits, improve cash flow, and strengthen long-term stability. We will start by answering a common question: what is tax optimization? Then, we will cover the new corporate tax rules, explain the difference between tax optimization vs tax evasion, and outline practical strategies such as using free zones and double taxation treaties.

Table of Contents

What Is Tax Optimization?

Tax optimization is the practice of organizing a company’s financial and operational structure in a way that ensures the lowest possible tax liability within the boundaries of the law. It is not about avoiding taxes, but about applying legal methods and frameworks to pay only what is necessary.

How Tax Optimization Works

At a practical level, tax optimization involves choosing the right company setup, structuring cross-border transactions correctly, and applying treaties or exemptions that reduce exposure to unnecessary taxation. For example, using a UAE free zone company for qualifying income or applying a double taxation treaty on overseas payments are both legitimate approaches.

The Key Elements Of Tax Optimization

Several factors play a role in proper tax optimization:

- Business structure: whether a company is registered as a mainland entity, free zone company, or holding company.

- Applicable tax rules: such as the 9% UAE corporate tax on profits above AED 375,000.

- International considerations: including how treaties reduce withholding taxes on cross-border trade.

- Profit distribution: structuring dividends or reinvestment in a way that minimizes additional liabilities.

The goal of tax optimization is to keep more profit available for reinvestment, protect cash flow, and ensure compliance with the law. For business owners in the UAE, it offers a balance between cost efficiency and credibility with regulators and investors.

Understanding UAE Corporate Tax Rules

Understanding the UAE’s current corporate tax system is essential before exploring how tax optimization works in practice. Since the corporate tax framework only came into effect in 2023, many business owners are still adapting to the rules. While the rates are considered low compared to most countries, the way a company is structured determines how much it pays and whether it qualifies for exemptions.

Corporate Tax Rate

The UAE applies a 9%corporate tax on taxable profits above AED 375,000. Profits up to AED 375,000 remain untaxed, which is designed to support small and medium-sized businesses. This threshold makes it one of the most competitive systems globally.

Free Zones

Free zones continue to play a central role in the UAE’s economy. Companies established in these zones may benefit from a 0% corporate tax on qualifying income, provided they meet specific conditions set by the Federal Tax Authority. However, non-qualifying income or mainland-sourced revenue may be subject to the standard 9% tax rate.

Exemptions

Not all entities fall under the corporate tax regime. Businesses involved in natural resource extraction, certain government-owned entities, and selected non-profit organizations are exempt. These carve-outs ensure that strategic sectors continue to operate without additional tax burdens.

International Alignment

The corporate tax system was introduced in line with global transparency standards, particularly the OECD’s Base Erosion and Profit Shifting (BEPS) framework. This alignment enhances the UAE’s credibility in international markets and reassures investors that the jurisdiction is committed to compliance and transparency.

Many business owners find corporate tax registration complicated. We have an article that explains everything you need to know about corporate tax registration in the UAE.

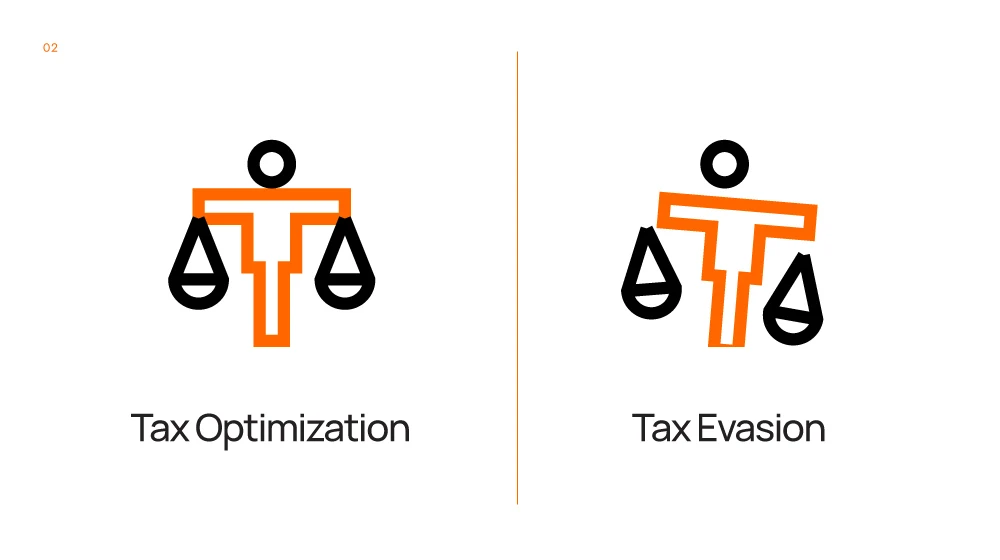

Tax Optimization vs Tax Evasion

Reducing taxes can mean two very different things, depending on how it is done. For business owners in the UAE, understanding the difference between tax optimization vs tax evasion is critical. One strengthens a company’s reputation and efficiency, while the other creates unnecessary legal and financial risks.

Tax Optimization as a Legal Strategy

Tax optimization means using legal frameworks to minimize what a business pays. It is about structuring operations in a way that follows the law while keeping costs low. Common examples in the UAE include:

- Setting up in a free zone and benefiting from 0% tax on qualifying income.

- Applying double taxation treaties to reduce withholding tax on cross-border payments.

- Planning how dividends or profits are distributed to avoid unnecessary liabilities.

These actions are legal, strategic, and part of responsible business management.

Tax Evasion as an Illegal Practice

Tax evasion is the opposite approach. It involves concealing the true financial position of a company to avoid obligations. This can include:

- Hiding income or fabricating expenses.

- Using offshore accounts to obscure profits.

- Ignoring reporting rules or withholding information from the authorities.

Unlike tax optimization, these practices are illegal. In the UAE, tax evasion can lead to fines, reputational damage, and in severe cases, criminal charges.

The Key Difference Business Owners Should Recognize

The difference between tax optimization vs tax evasion comes down to intent and legality:

- Tax optimization = legal, strategic, compliance-focused.

- Tax evasion = illegal, deceptive, high risk.

One important note if you’re new in the UAE. VAT in the UAE is a 5% tax imposed on goods and services, which businesses are required to file with the Federal Tax Authority (FTA) on either a monthly or quarterly basis. Failure to submit VAT returns on time can result in penalties, starting at AED 1,000 for a first offense, with increasing fines for subsequent violations.

In this guide, we explain how you can stay compliant and avoid fines by filing VAT properly.

Key Strategies for Tax Optimization in the UAE

Now that the difference between legal and illegal practices is clear, what you need to know next is how to apply tax optimization in practice. The UAE offers several tools that help businesses legally reduce their liabilities while staying fully compliant with the rules. These strategies vary depending on company size, activity, and where the business is registered.

Choosing the Right Business Structure

The foundation of effective tax optimization is selecting the right entity type. A mainland company may provide access to the local market but is subject to corporate tax on most income. A free zone company, on the other hand, can qualify for a 0% rate on eligible income if it meets the conditions set by the Federal Tax Authority. Holding companies are also used to organize group structures and control tax exposure across subsidiaries.

If you want to learn how to set up a tax efficient business structure in the UAE, we recommend reading this article.

Making Use of Double Taxation Treaties

The UAE has signed more than 140 double taxation treaties with countries worldwide. These agreements help reduce withholding taxes on cross-border dividends, royalties, and interest payments. For businesses with international dealings, applying the correct treaty terms can significantly lower overall costs.

Structuring Profit Repatriation and Dividends

Another part of tax optimization is planning how profits are moved or reinvested. Companies may choose to reinvest earnings in the business to delay tax obligations or distribute dividends in a way that benefits from exemptions. A poorly structured profit distribution plan can increase liabilities unnecessarily. to learn more how to legally lower taxes in the UAE, please read this article.

Managing Intra-Group Transactions Properly

Many UAE businesses operate within a group structure. Transactions such as loans, service agreements, or intellectual property use between related companies must follow transfer pricing rules. Proper documentation and fair pricing not only avoid compliance risks but also support tax optimization by ensuring costs and income are recorded where they are most efficient.

Using Free Zone Incentives Correctly

Free zones are attractive for tax reasons, but benefits only apply when conditions are met. Qualifying income may remain at 0%, but non-qualifying income can be taxed at 9%. Businesses must carefully structure their operations to enjoy free zone incentives without triggering higher liabilities.

The Role of Free Zones in Tax Optimization

Free zones have been a defining feature of the UAE’s business environment for decades. They offer regulatory and tax advantages that make them particularly valuable for companies seeking tax optimization. Understanding how free zones work and which rules apply is critical for any business owner who wants to minimize tax liability legally.

Benefits of Free Zones for Reducing Tax Liability

Free zones can provide significant tax incentives, including:

- 0% corporate tax on qualifying income.

- Exemption from import/export duties for certain goods.

- Flexible ownership rules, often allowing 100% foreign ownership.

These benefits make free zones an effective tool for legal tax optimization, as they reduce both direct and indirect costs.

Choosing the Right Free Zone for Your Business

Not all free zones offer the same incentives, and not all income qualifies for the tax benefits. Some free zones are specialized for industries like media, technology, or finance. When selecting a free zone, companies must consider:

- Whether the zone aligns with the business activity.

- The type of income that qualifies for exemptions.

- Any requirements for physical presence or local operations.

Structuring Operations Within Free Zones

Proper structuring within a free zone is key to maintaining tax benefits. Businesses should ensure that:

- Revenue qualifying for the 0% corporate tax is correctly allocated.

- Non-qualifying income, such as mainland-sourced income, is tracked separately.

- Compliance with reporting and substance requirements is maintained.

There are more than 30 free zones in the UAE. If you’re interested in checking out the pros and cons of each, here’s a list of active free zones in the UAE.

Benefits of Strategic Tax Optimization for UAE Business Owners

zImplementing effective tax optimization strategies goes beyond simply paying less tax. For UAE business owners, the benefits extend into operational efficiency, financial stability, and long-term growth. By planning carefully, companies can unlock advantages that strengthen both the bottom line and their market position.

Preserving More Profits for the Business

One of the most direct benefits of tax optimization is retaining a larger share of profits. By arranging finances and operations legally, businesses pay only what is required, leaving more capital available for reinvestment, expansion, or other strategic initiatives.

Improving Cash Flow and Liquidity

Reduced tax obligations also improve cash flow. More liquidity means businesses can handle operational costs, invest in technology or talent, and respond to market opportunities faster. Well-planned tax optimization ensures that cash is available where it is most needed.

Attracting Investors and Strategic Partners

Investors favor businesses that demonstrate financial discipline and transparency. Companies that practice legitimate tax optimization signal to investors that they are compliant, well-managed, and positioned for sustainable growth. This can make it easier to secure funding or form strategic partnerships.

Enhancing Global Competitiveness

For businesses operating internationally, strategic tax planning can reduce costs associated with cross-border transactions. Using double taxation treaties and correctly structuring overseas operations allows UAE companies to compete on a more level playing field with global competitors.

Supporting Long-Term Stability

Tax optimization is not just about immediate savings. By aligning with legal requirements and structuring operations efficiently, businesses create a foundation for long-term stability. This approach reduces the risk of future penalties, ensures compliance with evolving regulations, and builds a strong reputation in the market.

Compliance and Risk Management in Tax Optimization

While reducing tax liabilities is important, maintaining compliance is equally critical. Effective tax optimization in the UAE requires aligning financial planning with legal obligations and regulatory expectations. This ensures that businesses minimize risk while benefiting from available incentives.

Keeping Accurate Records and Documentation

Accurate record-keeping is essential for tax optimization. Companies must maintain clear documentation of:

- Income and expenses.

- Intra-group transactions.

- Profit distributions and reinvestments.

Proper records make it easier to demonstrate compliance during audits and prevent disputes with the Federal Tax Authority.

Following Reporting Requirements

UAE businesses must adhere to specific reporting rules, including corporate tax filings and notifications regarding free zone benefits. Staying up-to-date with these requirements ensures that any tax optimization strategy is fully legal and recognized by authorities.

Avoiding Penalties and Legal Risks

Non-compliance can lead to fines, interest charges, or reputational damage. Effective tax optimization strategies are designed with these risks in mind, ensuring that all arrangements are lawful and defensible.

Maintaining Transparency for Investors

Transparent financial practices support investor confidence. When tax optimization strategies are clearly documented and compliant, potential partners and investors can trust the business structure, making it easier to attract funding or strategic collaborations.

If you’re setting up in the UAE, there are 8 must-know challenges most businesses face and here’s how to avoid them to stay compliant and save on taxes.

Why Smart Owners Prioritize Tax Optimization

Strategic tax optimization allows UAE business owners to retain more profits, improve cash flow, and operate efficiently while staying fully compliant.

Many businesses, however, fail to plan properly. Without a structured approach, they pay more taxes than necessary, risk penalties, and miss opportunities to reinvest capital or attract investors. Inefficient tax handling can limit growth and create unnecessary financial pressure.

At GCG Structuring, we help businesses implement legal, efficient tax strategies tailored to their operations. By optimizing company structure, income allocation, and international transactions, we ensure that companies reduce liabilities legally, protect cash flow, and position themselves for sustainable long-term success.

FAQ

1. 0 Can a UAE business combine multiple tax optimization strategies?

Yes. Combining free zone registration, treaty benefits, and structured profit distribution reduces liabilities legally.

2. 0 Does it affect eligibility for government incentives?

No. Proper tax planning often improves eligibility by demonstrating compliance.

3. 0 How often should a business review its tax strategy?

At least once a year or when there are significant changes in tax laws, structure, or international operations.

4. 0 Can startups benefit from tax optimization with low profits?

Yes. Early planning sets a strong foundation even below the AED 375,000 taxable threshold.

5. 0 Is tax optimization only for large companies?

No. Businesses of any size can legally reduce costs and improve cash flow with proper planning.

6. 0 Does tax optimization conflict with international reporting standards?

No. Legal tax optimization aligns with OECD and other global transparency requirements.

7. 0 Can tax strategies change as a business grows?

Yes. Regular review ensures strategies remain efficient and aligned with growth.

8. 0 Are there risks if planning is done incorrectly?

Yes. Mistakes can trigger fines or audits, so it’s important to follow legal frameworks.

9. 0 Does planning affect future expansion?

Proper strategies can make growth smoother by reducing financial strain and keeping operations compliant from the start.