VAT registration can be a complex process, and this guide provides a detailed, step-by-step explanation. It covers everything from determining who is required to register to navigating the registration process, ensuring that you gain a thorough understanding and maintain full compliance while avoiding potential issues.

Table of Contents

Introduction to VAT in UAE

The United Arab Emirates (UAE) implemented Value Added Tax (VAT) on January 1, 2018, as part of its efforts to diversify government revenue and reduce reliance on oil exports. The VAT rate in the UAE is set at 5%, which is one of the lowest in the world. This tax is applied to most goods and services, making it a key aspect of the country’s fiscal policy. However, there are exemptions and zero-rated categories, such as healthcare, education, and specific financial services, which are not subject to VAT or are taxed at 0%.

VAT is a consumption-based tax, meaning it is collected at each stage of production and distribution. Businesses registered for VAT are responsible for charging VAT on their taxable supplies, while also being able to reclaim VAT on business-related expenses. As of 2025, the VAT system continues to play an essential role in the UAE’s economy, ensuring compliance with global tax standards while supporting the government’s long-term economic goals. Businesses operating in the UAE must adhere to VAT regulations to stay compliant and avoid penalties.

Significance of VAT Registration

Legal Compliance:

VAT registration is a legal requirement for businesses with annual taxable supplies exceeding AED 375,000. If you fall below this threshold and choose not to register, you could face penalties from the Federal Tax Authority (FTA) for non-compliance. Failing to adhere to the VAT law could harm your reputation and lead to unexpected fines.

Cash Flow Benefits:

Once registered, your business can reclaim VAT on purchases related to your operations, improving cash flow and reducing your financial strain. Lacking VAT registration Dubai, you miss out on the opportunity to recover taxes paid on business-related expenses, ultimately tightening your cash flow and affecting day-to-day operations.

Tax Collection Mechanism:

VAT-registered businesses collect tax from customers and remit it to the FTA. Without VAT registration, your business would not be in line with the UAE’s tax system, which may raise red flags for clients and suppliers, especially those who expect VAT-compliant partners. This could limit your ability to do business with larger or international companies.

Improved Credibility:

VAT registration signals your commitment to compliance, bolstering your company’s professional reputation. Businesses that aren’t VAT-registered may be seen as less trustworthy or professional, which could make potential clients hesitant to engage with you or enter into partnerships.

Access to New Business Opportunities:

Many larger businesses, particularly in the UAE, require VAT registration to establish formal partnerships. Without it, your company may miss out on valuable contracts, particularly with larger organizations and government projects, ultimately limiting growth potential.

Market Competitiveness:

As the UAE’s business environment becomes increasingly competitive, staying VAT-compliant through proper VAT registration ensures you’re in line with standard practices and expectations. Non-compliance can give competitors an edge, as they will appear more transparent and trustworthy to potential clients and partners.

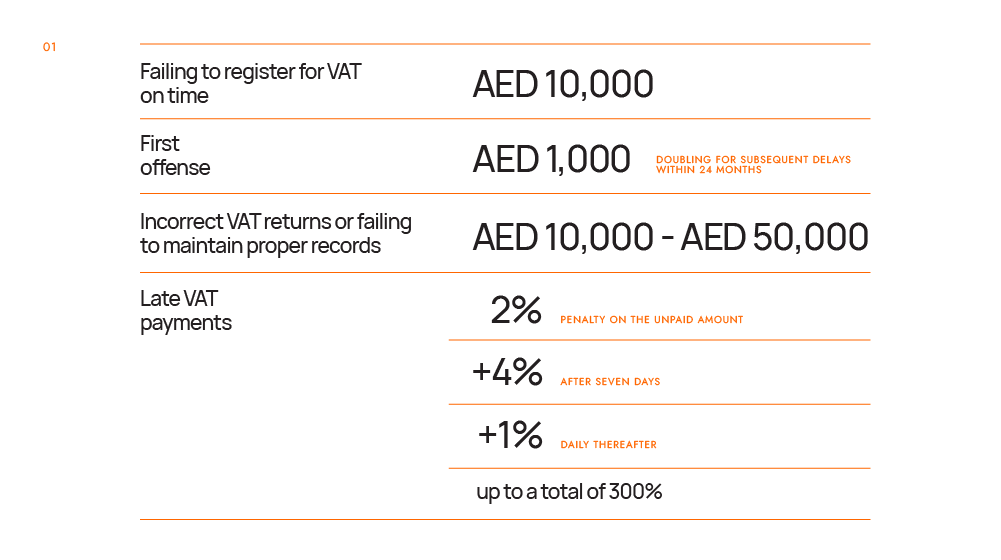

Understanding VAT Penalties in the UAE

In the UAE, VAT non-compliance comes with strict penalties. Failing to register for VAT on time results in a fine of AED 10,000. Late VAT return submissions incur a fine of AED 1,000 for the first offense, doubling for subsequent delays within 24 months. Incorrect VAT returns or failing to maintain proper records can lead to fines between AED 10,000 and AED 50,000.

Additionally, late VAT payments attract a 2% penalty on the unpaid amount, with an extra 4% after seven days and 1% daily thereafter, up to a total of 300%. These penalties can quickly accumulate, making it crucial for businesses to stay compliant with VAT regulations.

Eligibility for VAT Registration

To determine if your business is eligible for VAT registration in the UAE, here’s a breakdown of the key criteria. Below are the factors that define whether you must register, can register voluntarily, or are exempt:

1. Mandatory VAT Registration Threshold

Businesses whose annual taxable supplies and imports exceed AED 375,000 must register for VAT with the Federal Tax Authority (FTA). This threshold ensures that larger businesses contributing significantly to the economy are captured under the VAT system, making them responsible for collecting and remitting VAT on taxable goods and services.

2. Voluntary VAT Registration Threshold

Companies with annual taxable supplies and imports between AED 187,500 and AED 375,000 can opt for voluntary VAT registration. Voluntary registration allows smaller businesses to recover VAT on business-related purchases, which can benefit them in terms of cash flow and profitability, even if they’re not obligated to register.

3. Registration for New Businesses

New businesses in the UAE without any turnover can still apply for VAT registration voluntarily if their expenses exceed the voluntary registration threshold. This can be advantageous for companies planning to make large capital expenditures early on and wanting to recover VAT on those purchases.

4. Obligations Post-Registration

Once registered, businesses must file VAT returns regularly and remit payments to the FTA within specified deadlines. Failure to comply can result in fines, interest, or the suspension of the VAT registration Dubai, which can negatively affect business operations.

5. De-registration Criteria

If a business’s taxable turnover falls below AED 187,500 (the voluntary threshold) for the past 12 months, they can apply for de-registration. Businesses that initially met the VAT registration requirements but no longer qualify must complete the de-registration process within 20 days to avoid penalties, which can reach up to AED 10,000 for non-compliance.

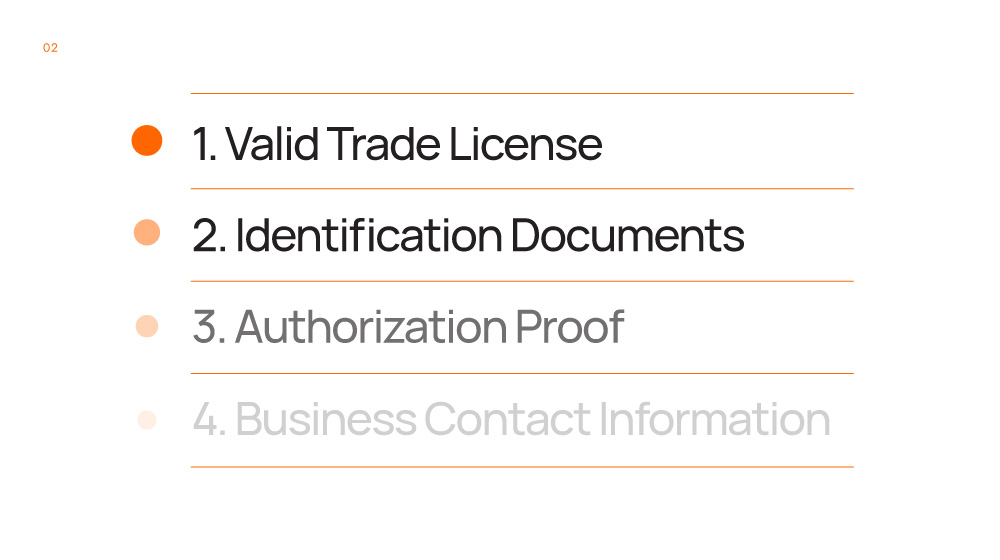

Essential Documents for VAT Registration

To successfully register for VAT in the United Arab Emirates (UAE), businesses must submit specific documents to the Federal Tax Authority (FTA).

Having these documents prepared in advance streamlines VAT registration process. Below is a list of required documents:

1. Valid Trade License

A current copy of your UAE trade license issued by the appropriate authority is required for VAT registration.

2. Identification Documents

You’ll need copies of the authorized signatory’s passport and Emirates ID to complete the VAT registration process.

3. Authorization Proof

Documents that confirm the authorization of the signatory to handle VAT registration for the business.

4. Business Contact Information

Detailed contact information including the physical address, phone number, and email address of your business.

5. Bank Account Details

A letter from your bank confirming the business’s account details, including the IBAN.

Depending on the nature of your business, you may also be required to submit additional documents for VAT registration:

For Taxable Supplies:

- Financial statements, audit reports, and revenue forecasts.

- A signed turnover declaration from the authorized signatory.

- Relevant supporting documents such as contracts, invoices, or tenancy agreements.

For Taxable Expenses:

- VAT registration may require budget reports and supporting financial statements detailing your business’s expenses.

Additional Documents:

- Articles of Association, Certificate of Incorporation, and ownership details, where applicable.

- For specific sectors (e.g., clubs, charities), power of attorney documents, custom documents, and registration papers may be necessary.

Having all the required documents prepared ensures that your VAT registration will be processed efficiently and without delays.

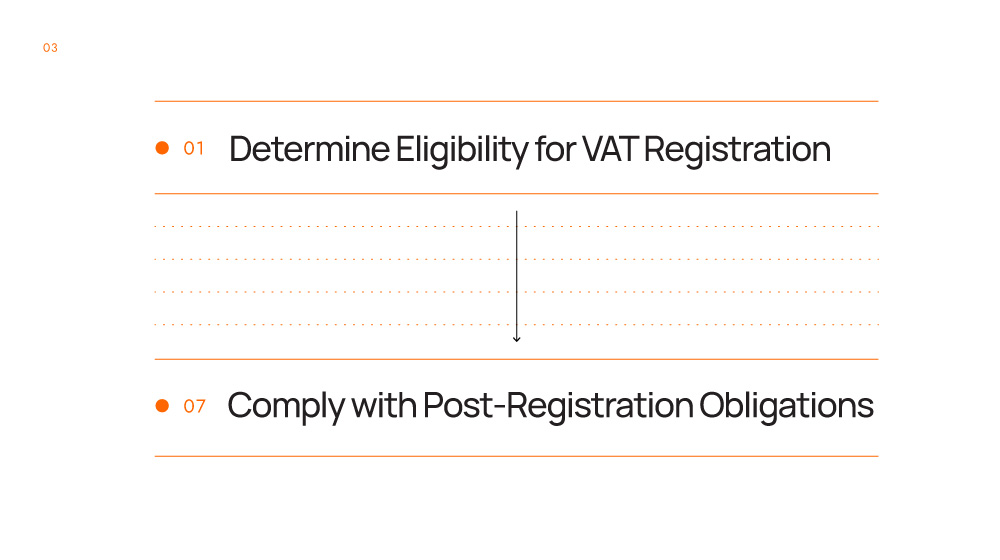

How to Register VAT For a New Company: Step-by-Step Process

Registering for Value Added Tax (VAT) is a mandatory process for businesses operating in the United Arab Emirates (UAE) that meet specific criteria. The Federal Tax Authority (FTA) oversees VAT registration and compliance. As of 2025, the VAT registration process involves the following steps:

Determine Eligibility for VAT Registration

- Assess your business’s annual taxable supplies and imports.

- VAT registration is mandatory if these exceed AED 375,000.

- Voluntary VAT registration is available for businesses with supplies and imports between AED 187,500 and AED 375,000.

Gather Required Documentation

- Prepare the necessary documents for VAT registration, such as trade licenses, identification of authorized signatories, proof of authorization, contact details, and bank account information.

- Additional documents may include financial statements, turnover declarations, and supporting financial records.

Access the FTA e-Services Portal

- Visit the FTA’s official website and register for an account on the e-Services portal to start the VAT registration process.

- Make sure you have a valid Emirates ID and other identification documents ready to proceed with your registration.

Complete the VAT Registration Application

- Log in to your e-Services account.

- Fill out the VAT registration form with accurate business details.

- Upload all required documents as specified by the FTA.

Review and Submit the Application

- Double-check all entered information for accuracy.

- Submit the VAT registration application electronically through the portal.

Receive VAT Registration Number (TRN)

- After submission, the FTA will process your application.

- Upon approval, you will receive a Tax Registration Number (TRN), which is essential for all VAT-related transactions.

Comply with Post-Registration Obligations

- Ensure timely filing of VAT returns as per the schedule provided by the FTA.

- Maintain accurate financial records to support your VAT filings.

How to Stay Compliant After VAT Registration?

Timely VAT Return Filing

- Submit VAT returns within the specified periods indicated on your VAT certificate.

- Ensure payments are made within 28 days from the end of each tax period.

- Delays or failures in filing can result in fines and penalties.

Accurate Financial Record-Keeping

- Maintain detailed and accurate financial records to support your VAT returns.

- Be prepared for potential audits, which the FTA may conduct with at least five days’ notice.

Stay Informed on VAT Updates

- Regularly review FTA communications for any changes in VAT laws or procedures.

- Attend FTA workshops or seminars to enhance your understanding of VAT obligations.

Ensure Proper Documentation

- Keep all necessary documents, such as trade licenses, financial statements, and proof of transactions, readily available for review.

Comply with VAT on Exempt and Zero-Rated Items

- Understand and apply the correct VAT treatment for exempt and zero-rated supplies.

For example, certain education and healthcare services are zero-rated, while residential properties may be exempt. See our blog on how to lower taxes in UAE for more.

GCG Structuring Simplifies VAT Registration in Dubai

Businesses must ensure their VAT registration is accurate, submitted on time, and aligned with corporate tax filings to avoid penalties, audits, or financial discrepancies. Missing deadlines or incorrect filings can lead to serious consequences, including fines and legal issues.

With over five years of experience in the UAE market, GCG Structuring simplifies the entire VAT registration process. From assessing eligibility and collecting necessary documentation to completing registration and ensuring compliance with the latest tax regulations, we handle every aspect to ensure accuracy, efficiency, and full regulatory compliance.

To stay compliant, avoid penalties, and focus on growing your business, tap the button below and book a free consultation to plan your VAT registration and ongoing compliance.

FAQ

1. 0 Who is required to complete VAT registration in the UAE?

In the UAE, businesses that meet the mandatory turnover threshold are required to complete VAT registration. This includes businesses that have taxable supplies or imports exceeding AED 375,000 annually. Companies that fall below this threshold but still have taxable supplies or imports exceeding AED 187,500 may opt for voluntary VAT registration. Completing VAT registration ensures compliance with the UAE’s tax laws and helps businesses avoid potential penalties.

2. 0 What are the consequences of failing to register for VAT when required?

Failure to register for VAT when mandated can result in fines and penalties. It’s essential to assess your business’s taxable supplies and imports to determine registration obligations.

3. 0 What is the frequency of VAT return filing?

VAT returns are typically filed quarterly. The FTA specifies the filing period on each business’s VAT certificate. It’s crucial to adhere to these schedules to avoid penalties.

4. 0 What is the process for online VAT registration UAE?

To complete the online VAT registration UAE, you must visit the Federal Tax Authority (FTA) website and create an account on their eServices portal. Once logged in, you’ll need to fill out the FTA VAT registration form, providing essential information such as your business details, financial documents, and proof of taxable turnover. The FTA will review your application, and once all requirements are met, your FTA VAT registration will be approved. It’s important to ensure all information is accurate and submitted on time to avoid delays in the online VAT registration UAE process.

5. 0 What are the penalties for late VAT return filing or payment?

Delays in filing VAT returns or making payments can lead to fines and penalties. It’s important to file returns and make payments within 28 days from the end of each tax period to remain compliant.

6. 0 How does VAT apply to social media influencers and online content creators?

As of March 2021, social media influencers and online content creators in the UAE are required to register for VAT if their annual income exceeds AED 375,000. This aligns with the UAE’s efforts to regulate digital economic activities.

7. 0 How to register VAT for new company

To register for VAT for a new company in the UAE, ensure your business meets the eligibility criteria. If your turnover exceeds AED 375,000 annually, VAT registration UAE is mandatory. For turnover between AED 187,500 and AED 375,000, voluntary registration is an option.

Prepare necessary documents such as your trade license, passport and Emirates ID copies of the authorized signatory, proof of business address, and bank account details. After gathering the documents, create an account on the Federal Tax Authority (FTA) website and complete the registration form. Once submitted, the FTA will review your application and issue the VAT registration certificate if approved.

To maintain compliance, ensure timely submission of VAT returns and proper record-keeping in accordance with UAE tax regulations.