Corporate tax is no longer a distant concept for businesses in the UAE. Since the introduction of the corporate tax regime, every company has been forced to look closely at how its income is classified and reported. The difference between qualifying and non-qualifying income can decide whether you benefit from a 0% tax rate or pay the standard 9%. That is why understanding qualifying income for corporate tax has become a non-negotiable part of running a compliant business in 2025.

Many Free Zone companies in the UAE are particularly focused on this point. Their ability to maintain the 0% corporate tax benefit depends on correctly identifying what qualifies and what does not. At the same time, businesses must also meet new requirements such as audited financial statements, economic substance compliance, and stricter reporting obligations. Filing incorrectly or failing to classify income properly can easily result in unnecessary tax exposure or, worse, disqualification from the Free Zone regime.

In this blog, we are going to break everything down in a clear and practical way. We will start by answering the most direct question, what is qualifying income in UAE corporate tax. From there, we will explain the role of Free Zones, outline the categories of qualifying income for corporate tax, and show what types of income do not qualify and are taxed at 9%. We will also cover the compliance requirements that apply in 2025, the reporting process, and how to prepare before you file.

Table of Contents

Here’s What Is Qualifying Income in UAE Corporate Tax

The concept of qualifying income for corporate tax is central to the UAE’s new tax framework. In plain terms, it refers to the types of income that allow a Free Zone company, known as a qualifying free zone person, to continue enjoying the 0% corporate tax rate rather than paying the standard 9% that applies to most mainland companies.

So, what is qualifying income in UAE corporate tax? The law defines it as income earned by a qualifying free zone person that meets certain conditions set by the Ministry of Finance. (Click here to see if you meet the 2025 criteria.)

These conditions are designed to make sure Free Zones remain attractive for international businesses while still maintaining compliance with global tax standards like the OECD’s Base Erosion and Profit Shifting (BEPS) requirements.

Qualifying income for corporate tax generally includes:

1. Revenue from business activities conducted within the Free Zone

Transactions between two Free Zone entities usually fall under qualifying activities UAE corporate tax rules, provided the activities are on the approved list.

2. Income from exports and cross-border transactions

If a Free Zone company sells goods or services outside the UAE, that income is typically treated as qualifying income for corporate tax, reinforcing the country’s role as a global trade hub.

3. Passive income such as dividends, capital gains, and royalties

These forms of income are usually considered qualifying, provided they come from eligible sources and are properly reported.

4. Certain transactions with mainland UAE companies

This is where many businesses get confused. Not all mainland income qualifies, but some activities are structured in a way that they still count toward qualifying income for corporate tax.

Understanding the boundaries of qualifying income is critical because any misclassification can lead to higher tax bills or the loss of Free Zone benefits. For example, if a Free Zone company earns significant revenue from mainland activities without meeting the exemptions, that portion will likely be taxed at 9%.

The Federal Tax Authority (FTA) has increased its scrutiny on filings. Companies are now expected to maintain clear records that separate qualifying income from non-qualifying income, backed by audited financial statements. Failure to do so can easily lead to penalties.

The Role of Free Zones in Defining Qualifying Income for Corporate Tax

Free Zones play a critical role in shaping how businesses calculate and report qualifying income for corporate tax. The UAE designed these zones to attract international investment, offering benefits such as simplified regulations, full foreign ownership, and the possibility of a 0% tax rate. However, under the corporate tax regime, simply being based in a Free Zone is not enough. To secure the tax advantage, a company must meet the conditions of a qualifying free zone person and prove that its earnings are recognized as qualifying income for corporate tax.

The classification of income is what makes the difference. The Federal Tax Authority has made it clear that Free Zone incentives are only meant for businesses that actively contribute to economic activity within the UAE, not for those looking to exploit a legal gap. That is why the distinction between qualifying and non-qualifying income for corporate tax has become one of the most important compliance points for Free Zone entities in 2025.

Let’s look at the ways Free Zones define qualifying income for corporate tax:

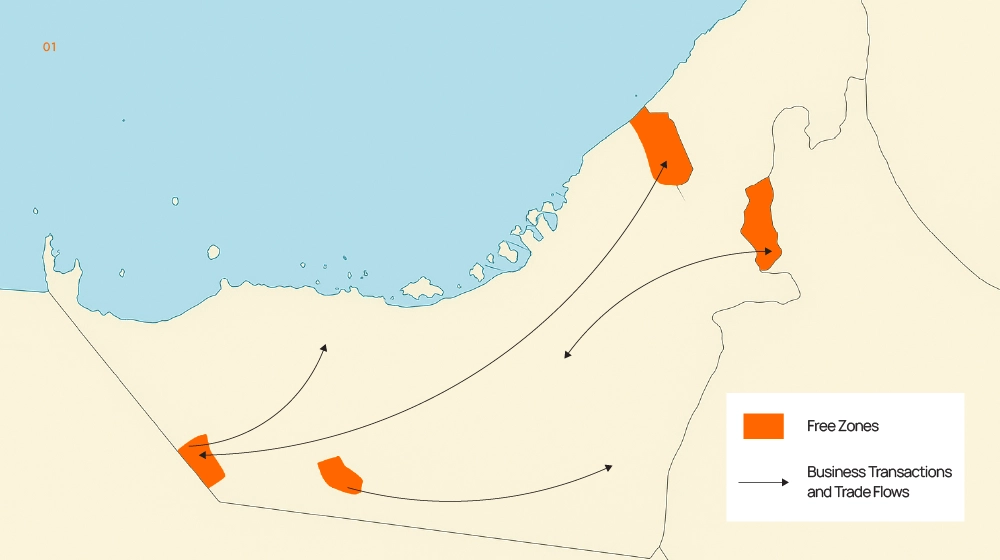

Transactions between Free Zone entities

If a business in one Free Zone provides goods or services to another Free Zone company, this is usually treated as qualifying income for corporate tax. The purpose is to encourage trade and cooperation between Free Zones while reinforcing their role in the UAE economy.

Income from exports and international operations

Revenue generated from customers outside the UAE is often recognized as qualifying income for corporate tax. Free Zones were originally created to connect the UAE to global markets, so exports and international dealings remain one of the strongest categories of qualifying income.

Dealings with mainland UAE businesses

Not every transaction with the mainland is treated the same way. In some cases, services to mainland clients are excluded from qualifying income for corporate tax and taxed at 9%. In other cases, if the activity falls under qualifying activities UAE corporate tax rules, it may still qualify.

Maintaining the status of a qualifying free zone person

Earning qualifying income for corporate tax is not only about revenue sources but also about compliance. A company must maintain audited financial records, meet economic substance requirements, and align its business license with the approved activities. If it fails to meet these conditions, all of its income could lose qualifying status and face the standard 9% tax.

Free Zones remain one of the UAE’s strongest competitive advantages, but the government has tightened its rules to prevent misuse. For 2025, the message is clear: only companies that can demonstrate qualifying income for corporate tax will retain the 0% rate, while others will default into the standard regime.

Understanding qualifying income for corporate tax often goes hand-in-hand with knowing the differences between FZE and FZC, since your company type can affect how income is classified.

Categories of Qualifying Income for Corporate Tax in the UAE

Understanding the specific categories of qualifying income for corporate tax is essential for any business operating in the UAE. By knowing which types of income qualify, companies—especially qualifying free zone persons—can structure their operations to retain the 0% tax benefit. In this section, we break down the key categories of qualifying income for corporate tax, explain what qualifies, and highlight common areas where businesses make mistakes.

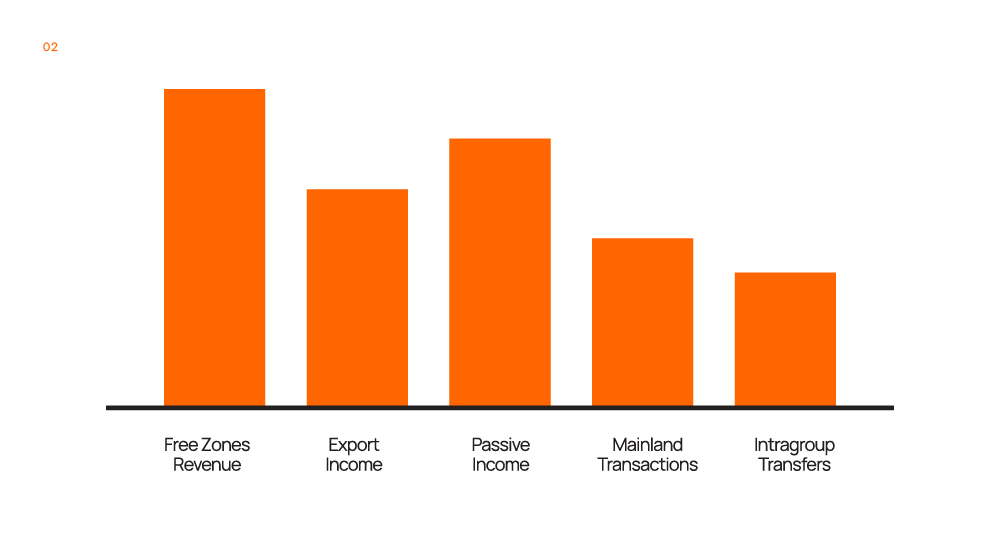

1. Revenue from Free Zone Business Activities

Income generated from activities carried out entirely within a Free Zone generally counts as qualifying income for corporate tax. This includes trading, service provision, and manufacturing activities conducted in accordance with the Free Zone license. These activities are often the backbone of a Free Zone company, making this category one of the most critical for maintaining tax advantages.

Maintaining accurate records of these transactions is essential. Only revenue earned from activities aligned with qualifying activities UAE corporate tax rules qualifies, so companies must ensure their operational activities match their approved license.

2. Export Income and Cross-Border Sales

Revenue from sales of goods or services to clients outside the UAE is almost always considered qualifying income for corporate tax. Exports support the UAE’s international trade strategy, and the government treats this income favorably for Free Zone businesses.

This includes digital services provided to international clients, physical goods exported from Free Zone warehouses, and cross-border consultancy services. Companies should carefully track export invoices and contracts to substantiate the qualifying nature of this income during filing.

3. Passive Income Streams

Certain forms of passive income also qualify as qualifying income for corporate tax. This includes:

- Dividends from eligible UAE or international subsidiaries

- Capital gains from the sale of assets within approved categories

- Royalties for intellectual property used in qualifying activities

While passive income is generally easier to manage, it still requires proper documentation and alignment with qualifying activities UAE corporate tax regulations. Misclassifying passive income can result in it being taxed at the standard 9%.

4. Transactions with Mainland UAE Entities

This is a nuanced area. Some Free Zone companies provide services to mainland UAE clients, and certain transactions can still be recognized as qualifying income for corporate tax if they meet specific criteria. These criteria often relate to the nature of the activity and its alignment with approved qualifying activities UAE corporate tax.

Companies must carefully structure these dealings and maintain clear records, as any misclassification may lead to those revenues being taxed at the standard corporate tax rate.

5. Intragroup Transactions

Intragroup transactions between qualifying free zone persons or between a Free Zone entity and its parent/subsidiary abroad can count as qualifying income for corporate tax. These transactions must be priced at arm’s length and documented appropriately to avoid scrutiny from the Federal Tax Authority.

This category often includes management fees, intercompany service charges, and transfers of intellectual property. Proper planning ensures that these transactions maintain their qualifying status and do not inadvertently increase taxable income.

6. Other Special Cases

Some activities may qualify under unique circumstances. For example, income from licensing intellectual property developed within the Free Zone can be recognized as qualifying income for corporate tax if the IP is actively used in approved business activities.

Businesses should review the official lists of qualifying activities UAE corporate tax and confirm that their income aligns with these categories. In 2025, the Federal Tax Authority has emphasized that demonstrating alignment is as important as the income source itself.

Non-Qualifying Income: What Gets Taxed at 9%

Not every revenue stream qualifies for the 0% rate. If income does not meet the definition of qualifying income for corporate tax, it is taxed at the standard 9%. Knowing what falls outside the rules is just as important as knowing what qualifies.

1. Direct Mainland Business

Income from goods or services provided directly to mainland UAE clients usually does not count as qualifying income for corporate tax unless the activity is specifically listed under qualifying activities UAE corporate tax rules.

We have an article on doing business in a freezone if you have a mainland company, which will also help you understand how qualifying income for corporate tax may be affected by mainland operations.

2. Activities Outside the Approved List

If a Free Zone company generates revenue from services or trades not included in qualifying activities, that income is considered non-qualifying and taxed at 9%.

3. Compliance Failures

Even if income would normally qualify, a company can lose the benefit if it fails to meet requirements like audited accounts or Economic Substance rules. A qualifying free zone person must remain compliant to preserve tax-free status.

4. Misclassified Passive Income

Dividends, royalties, and capital gains can be treated as qualifying income for corporate tax, but if they don’t align with the approved framework, they become taxable.

5. Poorly Documented Related-Party Transactions

Intragroup transactions can qualify, but without proper documentation or transfer pricing compliance, the FTA may reclassify them as taxable.

Compliance Requirements in 2025 for Maintaining Qualifying Income Status

Qualifying income for corporate tax is not automatic — companies must continuously meet strict compliance standards to retain the 0% rate. In 2025, the Federal Tax Authority (FTA) has placed greater emphasis on monitoring and documentation, meaning Free Zone businesses must stay diligent.

1. Maintain Audited Financial Statements

A qualifying free zone person must prepare and submit audited financial statements annually. Failure to provide proper financials can strip away 0% eligibility, even if the income itself is qualifying.

2. Adhere to Economic Substance Regulations (ESR)

To enjoy qualifying income corporate tax benefits, businesses engaged in relevant activities must demonstrate substantial activities in the UAE. This includes having adequate staff, premises, and expenditure aligned with operations.

3. Meet Transfer Pricing Obligations

Transactions between related parties must follow the arm’s length principle and be backed by transfer pricing documentation. Without it, the FTA may reclassify income and impose penalties.

4. Correct Classification of Income

Businesses need to clearly separate qualifying and non-qualifying income. Poor classification or weak recordkeeping may lead to the entire income being taxed at 9%.

5. Timely Filing and Reporting

All qualifying free zone persons must file corporate tax returns on time. Missing deadlines can disqualify companies from benefiting from the 0% rate.

Staying compliant with qualifying income for corporate tax also means keeping up with visa and operational requirements, which we covered in this blog.

How to Calculate and Report Qualifying Income for Corporate Tax

Getting qualifying income for corporate tax right isn’t just about knowing what counts—it’s about how you calculate and report it. The UAE Ministry of Finance and the Federal Tax Authority (FTA) have issued clear frameworks to make sure businesses remain compliant while maximizing the 0% free zone incentive.

Steps to calculate qualifying income for corporate tax:

- Identify eligible revenue streams: Start by separating transactions that fall under qualifying income for corporate tax, such as exports of goods/services or dealings with other free zone entities.

- Exclude non-qualifying income: Mainland UAE transactions that don’t meet conditions, passive income outside the scope, or restricted activities should be removed from your qualifying income calculation.

- Apply the correct percentage: Qualifying income for corporate tax is generally taxed at 0%, while non-qualifying income falls under the standard 9% rate. Businesses need to apportion carefully if they have mixed revenue streams.

- Prepare supporting documentation: Financial statements, contracts, and transfer pricing documentation should clearly demonstrate how qualifying income for corporate tax was derived.

Reporting qualifying income for corporate tax:

- Companies must declare qualifying income for corporate tax in their annual corporate tax return filed with the FTA.

- Audited financial statements are mandatory for most free zone entities. These records help validate that the claimed qualifying income for corporate tax aligns with actual business activities.

- Transparency is critical. Misreporting qualifying income for corporate tax can lead to disqualification from the 0% rate and penalties.

In short, calculating and reporting qualifying income for corporate tax is about precision and documentation. The clearer your separation of qualifying and non-qualifying revenue, the stronger your position when filing with the FTA.

Preparing for Filing: Step-by-Step Checklist

For many business owners, the first step is understanding what is qualifying income in UAE corporate tax and how it applies to their Free Zone activities. Once that’s clear, you can move into preparation. Here’s a practical checklist:

Identify Qualifying Income

Review your revenue sources and categorize them correctly (e.g., exports, services to foreign markets, or inter–Free Zone transactions).

Check Free Zone Compliance

Confirm that your company meets substance requirements such as maintaining a physical office, employing staff, and conducting core income-generating activities. And if you’re new, check this list of Free Zones in Dubai to plan your operations and optimize qualifying income for corporate tax.

Maintain Documentation

Keep invoices, contracts, and accounting records that prove why a revenue stream is treated as qualifying income.

Apply the Right Tax Treatment

Ensure that only qualifying income benefits from the 0% corporate tax rate, while non-qualifying income is taxed at 9%.

Cross-Check with FTA Guidance

Regularly review Federal Tax Authority (FTA) updates and clarifications to align your reporting with the latest rules.

File Accurately and On Time

Submit your corporate tax return within the FTA deadline to avoid fines and demonstrate compliance.

Secure Your 0% Tax Advantage in 2025

Understanding what is qualifying income in UAE corporate tax is about protecting your profits. Free Zone businesses that get this right enjoy the 0% corporate tax rate, while those who misclassify income risk penalties and unnecessary tax burdens.

The key here in the UAE is simple: document clearly, stay aligned with FTA guidance, and structure your business correctly from the start.

At GCG Structuring, we specialize in helping businesses set up tax-efficient structures, interpret the rules around qualifying income, and file with confidence. With the right structuring, you don’t just stay compliant, you secure your 0% tax advantage in 2025 and beyond.

FAQ

1. 0 What is qualifying income in UAE corporate tax?

It’s the portion of a Free Zone company’s revenue that can still enjoy the 0% tax rate. Only specific types of income qualify, while the rest may be taxed at 9%.

2. 0 How do I know if my business income qualifies?

Generally, revenue from doing business outside the UAE, approved Free Zone-to-Free Zone activities, and certain ancillary services fall under qualifying income. Anything outside this scope may not.

3. 0 Does every Free Zone activity count as qualifying income?

Not always. Income from dealing with mainland UAE (unless exempted), restricted activities, or certain non-qualifying services won’t be considered qualifying.

4. 0 Why is structuring important for qualifying income in UAE corporate tax?

Proper structuring helps maximize how much of your revenue counts as qualifying. The way contracts, transactions, and entities are set up can directly affect whether your income keeps its 0% tax status.