In the UAE, asset protection isn’t just a smart move, it’s a necessary one. Whether you’re a business owner, investor or private wealth holder, structuring your assets correctly can mean the difference between preserving your capital and losing it to lawsuits, family disputes, or regulatory issues.

Many founders rush into launching a Free Zone Company thinking it will solve everything. Others are introduced to a DIFC foundation later, once they’ve already exposed their personal assets.

The truth is, the right structure depends on your goal. Are you trying to protect generational wealth? Or do you need a working business entity that can sign clients and issue invoices?

This guide explains the key differences between a DIFC foundation and a Free Zone Company. It walks through how each structure protects, or fails to protect your assets. It also explores when to use one over the other, or when combining both makes more sense. You’ll also see the common mistakes founders make when choosing a structure and how to make sure whatever you’ve set up is actually doing its job.

Table of Contents

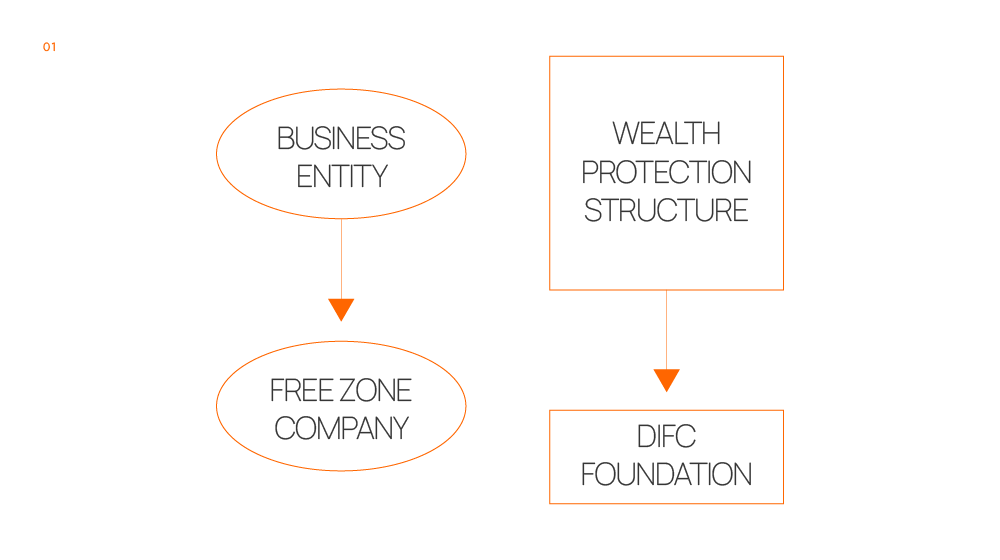

The Core Difference: Business Entity vs Wealth Structure

Before we compare asset protection features, let’s clarify what each structure is for.

A Free Zone Company is a commercial entity. You use it to run a business. It can issue invoices, hire staff and enter into contracts.

A DIFC foundation is a legal structure designed for asset holding, wealth protection and long-term planning. It isn’t meant to trade or provide services. It doesn’t have shareholders. And it doesn’t distribute profits like a company does.

Here’s the core distinction between Free Zone business vs DIFC Foundation:

- A Free Zone Company is built to generate income.

- A DIFC foundation is built to protect what you already own.

You can use both, but they solve very different problems. Let’s now look at the DIFC foundation in detail.

What Is a DIFC Foundation and Why It’s Built for Protection

The DIFC foundation is a highly structured, legally recognized vehicle established under the DIFC Foundations Law, operating within the DIFC’s common-law framework.

Unlike a company, it does not have shareholders. It has a founder (you), a council (appointed decision-makers), and optionally, a guardian (to oversee the council).

Here’s how a DIFC foundation helps you protect your assets:

1. Legal Separation of Ownership

Once you place assets inside a DIFC foundation, you no longer legally own them. This creates a firewall between you and those assets.

Creditors can no longer claim them. Courts in other jurisdictions cannot easily access them. Divorce courts often cannot touch them.

2. Ring-Fencing Family Wealth

High-net-worth individuals use DIFC foundations to hold real estate, company shares, cash holdings, intellectual property, and even digital assets.

This ring-fencing ensures that family assets are insulated from operational risks or personal liabilities.

3. Cross-Border Recognition

The DIFC foundation is based on English common law, making it easier to work across international jurisdictions. That’s critical for founders with global assets.

4. Confidentiality

The DIFC foundation provides a higher level of privacy than most structures. Details of beneficiaries and internal governance can be kept out of the public domain.

5. Custom Governance Structures

You can write a charter and by-laws to define how assets are managed, how decisions are made, and how wealth is distributed across generations.

Founders who are serious about foundation planning in Dubai almost always start with a DIFC foundation. It’s the most robust legal structure available in the UAE for asset preservation.

By 2025, DIFC foundations have become the default choice for succession planning, asset protection, and private wealth structures in the region. DIFC itself has recorded rapid structural growth, with over 1,800 active companies operating under its jurisdiction.

What a Free Zone Company Offers and What It Doesn’t

A Free Zone Company is designed for one thing: business operations.

It’s the structure you use when you want to trade, sign clients, issue invoices, and hire employees. It works well for commercial activity, but when it comes to safeguarding wealth or building a long-term asset protection plan, its limitations start to show, especially when compared to a DIFC foundation.

Here’s what a Free Zone Company offers:

1. 100% Foreign Ownership

In most UAE free zones, you can fully own the business without needing a local Emirati partner. This is one of the biggest attractions for foreign entrepreneurs and consultants who want to operate legally in the UAE without giving up equity. But unlike a DIFC foundation, this ownership also means your shares are still considered part of your personal estate—making them vulnerable in legal disputes.

When deciding between a Free Zone Company or mainland setup, it’s crucial to understand the differences in jurisdiction and benefits. Our guide on free zone vs mainland breaks this down in detail.

2. Quick Busiess Setup Process

Most Free Zone Companies can be set up in a few days, with minimal paperwork and remote registration options. Some zones even allow 100% online incorporation. But speed doesn’t equal security. A DIFC foundation takes a bit more time to structure, but that time goes into drafting protective governance rules, securing assets, and separating personal ownership—things a free zone license can’t offer.

3. Access to UAE Banking

Once registered, a Free Zone Company lets you open a business bank account, apply for tax residency, and run your business legally. This is crucial for freelancers and startups, but it’s not built for wealth holding. A DIFC foundation, on the other hand, is specifically designed to hold cash reserves, investments, and personal or family assets in a structure that can’t easily be touched by courts or creditors.

4. Business License to Operate

You’ll get a license based on your business activity—whether that’s consulting, digital marketing, e-commerce, or logistics. It’s your go-to tool for commercial transactions. But if you try to use a Free Zone Company to hold long-term wealth, you’re mixing two different objectives. That’s why founders who are serious about asset protection often use a DIFC foundation alongside their free zone entity—to separate business income from protected capital.

Choosing the right business license is a key part of setting up correctly in the UAE. Our article on different types of business licenses in Dubai breaks down what’s available and which fits your goals.

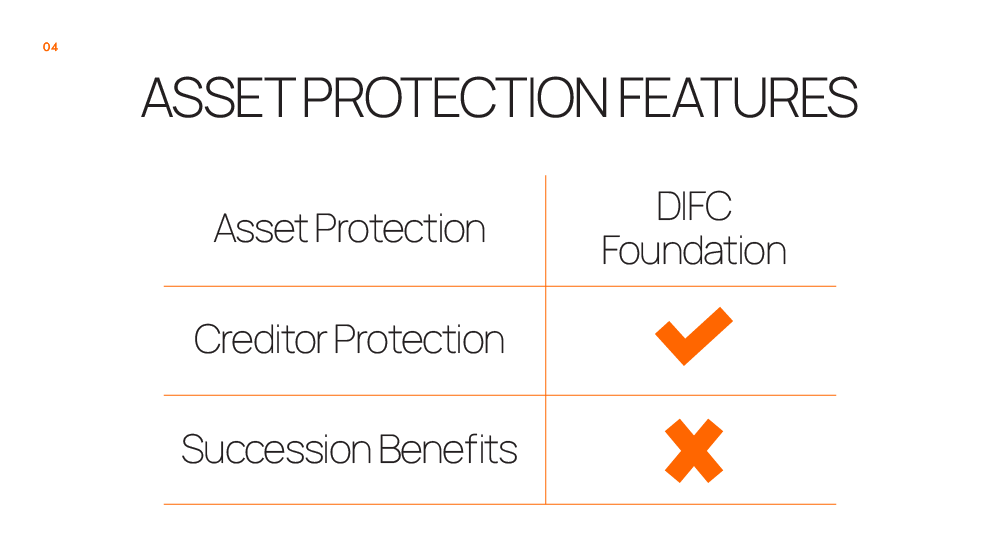

But here’s where a Free Zone Company falls short, especially when compared to a DIFC foundation:

1. It’s Not a Protection Vehicle

Yes, it offers limited liability. But that only protects you from debts inside the company. It doesn’t shield your personal estate from outside threats—lawsuits, divorce settlements, or inheritance claims. A DIFC foundation removes this risk by transferring ownership away from your name entirely. It legally separates you from the assets, which a Free Zone Company does not.

2. No Succession Mechanism

If you pass away, the shares of your Free Zone Company become part of your estate and go through the probate process. This can lead to delays, freezes, or disputes among heirs. A DIFC foundation, by contrast, comes with built-in succession planning tools. You can set custom rules for how assets are distributed across generations, avoiding the uncertainty of probate entirely.

3. Limited Legacy Structuring

There’s no way to control what happens to your Free Zone Company beyond your lifetime—unless you draft separate wills, hold shares through nominees, or build trusts (which are expensive and hard to enforce in the region). A DIFC foundation was made specifically for this purpose. It lets you define governance, control distributions, and protect assets indefinitely. That’s why it’s the go-to solution for DIFC family offices and HNW individuals in the UAE.

Many founders confuse DIFC business setup with DIFC foundation structuring. But one is for operating income, the other is for protecting wealth. If you’re using a Free Zone Company as your only vehicle, and you haven’t set up a DIFC foundation for asset protection, you’re exposed in ways you probably haven’t considered yet.

Planning for the Future: Why the DIFC Foundation Wins

Most people only think about asset protection once it’s too late—after a health scare, a lawsuit, or a family dispute. But real succession and legacy planning starts before anything goes wrong. And when it comes to forward planning, the DIFC foundation is the only structure in the UAE that was built specifically for this purpose.

Here’s how the DIFC foundation gives you an edge that a Free Zone Company simply can’t match:

1. No Need for Local Will

A DIFC foundation removes the need for a UAE will by handling inheritance directly through its charter and by-laws. It allows you to govern asset distribution across jurisdictions without triggering local probate or falling under Shariah law. That means your global estate remains under one clean structure, and your heirs avoid delays or legal uncertainty. You won’t get that kind of built-in estate control with a Free Zone Company.

2. Multi-Generational Structures

With a DIFC foundation, you can build a long-term structure that manages family wealth across multiple generations. It’s not just about passing on money—it’s about ensuring continuity of control, values, and governance. You can embed rules for succession, assign specific roles to family members, and prevent disputes before they start. A Free Zone Company, by contrast, is only built to serve one generation at a time and offers no roadmap beyond your lifetime.

3. Controlled Distributions

Unlike a Free Zone Company that simply holds shares and distributes dividends, a DIFC foundation gives you the power to define exactly how and when your assets are distributed. You can tie distributions to milestones, age, education, or performance. This level of control makes the DIFC foundation a true planning vehicle—not just for wealth transfer, but for wealth management. It ensures beneficiaries don’t just inherit—they’re protected from themselves and others.

4. Guardianship Options

In families with minor children, vulnerable dependents, or complex dynamics, guardianship is critical. A DIFC foundation lets you appoint guardians to oversee the wellbeing and financial interests of beneficiaries. It acts as a built-in layer of security, especially in situations where the next generation isn’t ready to take control. A Free Zone Company has no mechanism for this—because it was never designed for legacy planning.

Ultimately, a Free Zone Company may support your business operations, but it doesn’t help you build or protect a long-term legacy. At best, you can hold the company shares under a nominee or trust, but that requires extra paperwork and external legal tools.

If you’re serious about succession planning in the UAE—or more specifically, foundation planning in Dubai—nothing compares to the precision and protection offered by a DIFC foundation.

Compliance, Costs, and Ongoing Requirements

Setting up a DIFC foundation and a Free Zone Company involves very different levels of compliance and maintenance. One is built for stability, the other for activity—and that’s reflected in both the cost and complexity.

Here’s what to expect from each:

DIFC Foundation

Setup Cost: You’ll typically pay around AED 12,000 to AED 18,000 to establish a DIFC foundation, excluding advisory fees. This is a one-time cost to create a long-term asset protection structure that doesn’t need a trade license.

Annual Renewal: Ongoing fees are relatively low, often ranging between AED 1,000 to AED 2,000. The simplicity of this renewal is one of the reasons the DIFC foundation appeals to wealth holders who want stability with minimal admin.

No VAT: Because the DIFC foundation isn’t involved in commercial activity, it is not subject to VAT registration or filings.

No Corporate Tax: The foundation itself isn’t taxed. But if it holds shares in an operating business that is taxable, reporting obligations still apply. You’ll need to disclose if it’s linked to any taxable entities.

No Audit Requirement: Unlike most companies, a DIFC foundation does not require annual audits, keeping the structure lean and low maintenance.

Governance: t must have a registered council, and optionally, a guardian to oversee decisions. This structure aligns with how DIFC license categories define responsibilities and roles, making it a serious option for long-term legacy planning

Free Zone Company

Setup Cost: This can range widely, from AED 5,500 to AED 25,000, depending on which free zone you choose and what license you require.

Annual Renewal: In many free zones, the renewal cost is similar to the original setup—so you’re effectively re-paying the licensing fee each year to stay active.

Corporate Tax: Since June 2023, Free Zone Companies must pay 9% corporate tax if their UAE income exceeds AED 375,000. Qualifying income may be exempt, but structuring it properly is key.

Audit Requirements: Many free zones now require annual audits, especially if your revenue or transaction volume crosses certain thresholds.

Banking & Licensing: You must maintain a valid trade license, submit ESR (Economic Substance Regulations) reports, and file UBO (Ultimate Beneficial Ownership) declarations to stay compliant.

Maintaining compliance means aligning VAT filing with corporate tax rules, something that many Free Zone Companies and DIFC foundations need to get right. Our recent post on VAT Filing in UAE: aligning with corporate tax for compliance can help clarify this.

While a Free Zone Company is designed for business activity, it demands more regular filings and financial oversight. The DIFC foundation, by contrast, requires less day-to-day maintenance—but it must be used correctly. It’s not a business tool. It’s a DIFC holding company structure.

What Structure Do You Actually Need? (And When to Use Both)

Use a Free Zone Company if:

- You are actively doing business in the UAE

- You need to invoice clients and manage operations

For entrepreneurs new to Dubai, understanding the full process is essential. Check out our step-by-step guide on how to start a company in Dubai in 2025 for a clear path from idea to launch.

Use a DIFC foundation if:

- You are protecting wealth, not generating it

- You want to create succession rules

- You need to legally separate ownership from yourself

Use both if:

- Your business generates profit

- You want to move profit into a safe holding structure

- You want tax clarity and protection in one integrated plan

This hybrid approach is now common in DIFC business setup consultations. It creates a firewall between operational risk and family wealth.

Common Mistakes People Make When Choosing a Structure

Choosing the wrong structure can expose you to serious risk. Here are the top mistakes we see:

1. Using a Free Zone Company to Hold Personal Assets

This puts assets at risk in the event of a business lawsuit or debt.

2. No Succession Plan

Without a foundation or will, shares can be frozen or challenged in court.

3. Thinking a Foundation Can Operate a Business

It can’t. A DIFC foundation is not a trading entity.

4. Delaying Setup Until There’s a Problem

By then, it’s often too late to shield assets.

5. Ignoring Reporting Obligations

Whether you choose a Free Zone Company or DIFC foundation, you must stay compliant with ESR, UBO, and tax laws.

To protect your wealth efficiently, consider how your business structure affects your tax position. Our detailed blog on how to set up a tax efficient business structure for your business 2025 can guide you through the key considerations.

What You Need to Know Before Deciding

Choosing between a DIFC foundation and a Free Zone Company isn’t about picking the better structure. It’s about matching the right tool to the right job. A DIFC foundation is built for protection. A Free Zone Company is built for operations.

If you’re serious about protecting wealth, planning succession, or separating personal assets from business risks, the DIFC foundation should be at the center of your plan.

If you’re trying to run a company, serve clients, and manage revenue, you’ll need a free zone Company.

At GCG Structuring, we don’t just register entities. We help you decide whether a DIFC foundation or Free Zone Company suits your goals, structure ownership legally and securely, set up governance and tax compliance, and build long-term legacy plans that work across jurisdictions.

FAQ

1. 0 What’s the key difference between a DIFC foundation and a Free Zone Company?

A DIFC foundation protects assets and plans succession, making it a popular choice in foundation planning Dubai. A Free Zone Company runs the business and handles day-to-day operations.

2. 0 Can a DIFC foundation operate a business?

No. It holds assets but cannot trade or provide services. For business activities, a proper DIFC business setup with a Free Zone Company is required.

3. 0 How does a DIFC foundation protect assets better?

It separates ownership from you, shielding assets from creditors and inheritance disputes, which is why foundation planning Dubai often centers around DIFC foundations.

4. 0 Which costs more to set up, a DIFC foundation or Free Zone Company?

A DIFC foundation setup is generally AED 12,000–18,000; Free Zone Company costs vary from AED 5,500–25,000.

5. 0 Can I use both structures together?

Yes. Use the Free Zone Company for business and the DIFC foundation for asset protection.