More companies are reassessing their structure in 2025, especially those that started in a free zone. As businesses grow, they often run into practical limits around hiring, banking, contract eligibility and local trading. This is why the idea of a free zone to mainland transition has become far more common for both small and mid sized companies.

A mainland setup gives a business the ability to operate across the UAE without restrictions, handle larger contracts, deal with banks with fewer questions and build a stronger presence with local clients. These are the factors driving the shift from free zone environments to mainland licensing.

In this blog, we will look at what a free zone to mainland transition actually involves, the limitations that push companies toward the mainland, the exact steps of the process, the legal and compliance requirements, cost expectations for 2025, the major risks to prepare for, the common mistakes business owners still make, and when staying in the free zone might be the smarter choice. You will also see how to evaluate the right time for the move and what support is needed to complete it correctly.

Table of Contents

What a Free Zone to Mainland Transition Actually Means in 2025

A free zone to mainland transition in 2025 is a formal shift from operating under a free zone authority to becoming a fully licensed mainland company. It is not an upgrade of your existing license, it is the creation of a new mainland structure while adjusting or closing your free zone entity.

How the Transition Changes Your Setup

Once the transition is complete, the mainland license becomes your primary legal presence. This gives your company access to the entire UAE market, eligibility for larger contracts and a clearer compliance profile when dealing with banks, government departments and local clients.

What Happens to the Free Zone Entity

You can keep it, restructure it or close it depending on your long term plans. Some businesses keep both structures for different activities, while others discontinue the free zone license once the mainland license is active.

The process gives companies more room to grow, hire, operate locally and sign contracts that free zone licenses do not always accommodate. For many businesses, this transition is the step that aligns their structure with their actual operational needs.

In this blog, we will look at what a free zone to mainland transition actually involves, the limitations that push companies toward the mainland, the exact steps of the process, the legal and compliance requirements, cost expectations for 2025, the major risks to prepare for, the common mistakes business owners still make, and when staying in the free zone might be the smarter choice. You will also see how to evaluate the right time for the move and what support is needed to complete it correctly.

Free Zone Company Limitations That Push Businesses Toward Mainland Licensing

The UAE hosts 40+ free zones, and many businesses begin in a free zone because it is simple and cost effective, but as they grow, certain limits start to interfere with day-to-day operations. These limits are the main reason companies consider a free zone to mainland transition once they reach a certain stage.

Trading and Operational Restrictions

Free zone companies cannot directly trade within the UAE mainland unless they use intermediaries or additional licensing. This becomes a problem for businesses that want to work with local clients, expand their service coverage or open physical locations. A mainland license removes this barrier and gives full access to the UAE market.

Hiring and Visa Capacity

Free zones often set visa quotas based on office size or authority rules. When a company grows, these caps slow down expansion. Mainland licenses offer more flexibility, especially for businesses that need larger teams, specialized staff or multiple roles under one structure.

Contract Eligibility

Government entities, semi-government bodies and many large private companies prefer or require suppliers to hold mainland licenses. If a business wants to compete for bigger projects, this becomes a clear limitation. This is one of the strongest reasons companies choose to convert free zone company to mainland operations when scaling.

Banking and Compliance Challenges

Some banks apply additional scrutiny to free zone companies because activity is restricted and documentation varies between authorities. Mainland structures usually provide a clearer compliance profile, which helps with account approvals, credit facilities and long term stability.

Activity and Expansion Limits

Free zones only allow activities listed under their own frameworks. If a company wants to add new services, expand its business model or restructure an existing operation, these restrictions often block progress. A mainland license supports a wider range of activities, making it easier to adjust the company’s direction over time.

Step-by-Step Process to Convert a Free Zone Company to Mainland in 2025

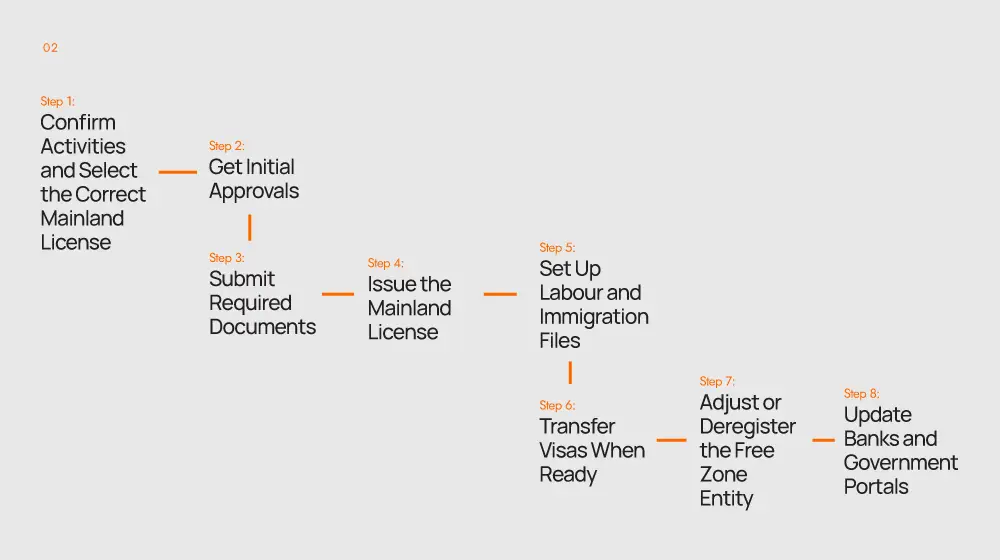

A free zone to mainland transition in 2025 follows a straightforward sequence. The goal is to activate a new mainland license while keeping your current operations stable throughout the shift.

Confirm Activities and Select the Correct Mainland License

The process starts with checking whether your current activities match mainland classifications. If adjustments are needed, they are made before applying. Once the activity is confirmed, you choose the mainland structure that fits your business model.

Get Initial Approvals

You secure name reservation and activity approval from the mainland authority. These approvals allow you to proceed with forming the new mainland entity.

Submit Required Documents

The free zone company provides its corporate documents, shareholder information and any internal resolutions needed for restructuring UAE company activities. Clean documentation helps avoid delays.

Issue the Mainland License

After approvals and document checks, the mainland license is issued. At this stage, the free zone entity remains active until you decide whether to maintain or close it.

Set Up Labour and Immigration Files

A mainland company must create new labour and immigration files so employees and owners can move their residency under the new structure.

Transfer Visas When Ready

Visas from the free zone can be transferred once the mainland files are active. This step must be timed correctly to avoid gaps in employment status.

Adjust or Deregister the Free Zone Entity

Once the mainland setup is operational, you either keep the free zone company for international work or close it. If closing, the free zone deregistration process begins.

Update Banks and Government Portals

Banks, suppliers and government systems must be updated with the new mainland details to ensure full compliance going forward.

Free Zone to Mainland Requirements: Legal, Financial & Compliance Checklist

A free zone to mainland transition in 2025 requires meeting several legal, financial and procedural standards before the mainland license can go active. These requirements ensure the new structure is compliant from day one and that the move does not disrupt existing activity.

Legal Requirements

Activity Alignment

Your current free zone activities must match the approved activity list on the mainland. Some activities require small wording changes, while others need reclassification. This alignment is essential before the mainland license application is submitted.

Shareholder and Company Documents

Authorities will request passport copies, company resolutions, incorporation documents from the free zone entity and identification details for all shareholders. These documents confirm ownership and authorize the shift toward mainland licensing.

Under new regulations: many mainland business activities now allow 100% foreign ownership (previously one of the main free‑zone advantages).

Office or Workspace Requirement

A mainland company must have an approved workspace within the relevant jurisdiction. This can be a flexi desk, serviced office or physical office depending on activity and future hiring plans.

Financial Requirements

Clearances From the Free Zone

If you plan to close or restructure the free zone entity, you must ensure there are no outstanding payments or obligations. Free zone authorities will not issue exit clearances until all dues are settled.

Mainland Government Fees

Mainland licensing, immigration setup and labour files involve government fees. These are part of the overall UAE mainland license cost 2025 and vary depending on activities and jurisdiction.

Bank Updates

Once the mainland entity is established, banks require updated corporate documents. This step prevents interruptions in payments or account access during the transition.

Compliance Requirements

New Labour and Immigration Files

A mainland company must open its own labour and immigration files before transferring staff. Without these files, no visas can be issued or moved.

Visa Status Adjustments

Existing free zone visas must be transferred, cancelled or reissued under the mainland structure. Timing matters here to avoid employment gaps or penalties.

Regulatory Portal Updates

Government systems must be updated with the company’s new mainland structure. This includes immigration platforms, invoicing portals and any industry-specific systems.

Cost Breakdown: UAE Mainland License Cost 2025 + Full Transition Budget

Understanding the full cost of a free zone to mainland transition in 2025 helps businesses plan properly and avoid surprises. Costs vary based on activity, jurisdiction and the size of the operation, but the core elements remain consistent across most cases.

Mainland Licensing Costs in 2025

The UAE mainland license cost 2025 generally includes government fees for activity approvals, trade name reservation and the issuance of the new commercial license. Prices differ between emirates, but most standard service activities fall into a predictable range. More regulated or specialized activities may require additional approvals, which increase the total cost.

Immigration and Labour Setup

A new mainland company must open immigration and labour files. These files are required before hiring staff or transferring visas. Costs depend on the number of employees you plan to move, the type of establishment card needed and the duration of the visa packages you choose.

Visa Transfers or New Visas

Transferring visas from a free zone to a mainland company carries separate government fees. Each visa transfer includes medical testing, Emirates ID processing and stamping. If the business hires new employees after the transition, those visas follow the same cost structure.

Office or Workspace Costs

A mainland company must have a workspace approved by the licensing authority. This could be a flexi desk, shared office or full office depending on the activity. Workspace pricing varies significantly across emirates, and it is one of the decisions that shapes the total transition budget.

Free Zone Closure or Continuation Costs

If you choose to close the free zone entity, you must complete its deregistration process and settle all outstanding dues. If you keep it active, you must maintain its annual renewal fees. This decision changes the long term cost structure and should be planned based on your operational goals.

Additional Administrative Costs

During a free zone to mainland transition, businesses may face additional charges such as document attestation, translation and corporate amendments. These costs are not large individually, but they add up if the company has multiple shareholders or complex activity structures.

Major Risks When Moving from Free Zone to Mainland

Shifting your business structure from a free zone to the mainland can unlock new opportunities, but it also comes with risks you need to be aware of:

1. Higher operating costs

Mainland licensing, office space, and compliance requirements are more expensive than most free zones. If your margins are thin, this jump can hurt your cash flow.

2. VAT and corporate tax exposure

You immediately fall under full UAE VAT rules and corporate tax enforcement once you enter the mainland economy. Businesses that aren’t tracking profits cleanly often run into filing and audit issues.

3. More complex compliance

Mainland companies deal with stricter reporting, ESR obligations, and more frequent updates to rules. If your current business structure is already messy, this adds pressure fast.

4. Penalties for incorrect filings

A wrong move in accounting, tax classification, or shareholder restructuring can trigger fines. Many business owners underestimate how sensitive the mainland process is.

5. Contract complications

If you aren’t migrating contracts properly… especially with suppliers, long-term clients, or payment gateways, you risk payment delays or compliance flags.

6. Operational downtime

If the migration isn’t planned correctly, you can get stuck in a transition period where you can’t invoice, renew visas, or issue new agreements.

7. Losing your free zone benefits

Once you switch, you lose perks like lower fees, simplified compliance, or sector-specific incentives. If the move doesn’t align with your long-term business structure, you end up paying more for no real gain.

Most Common Mistakes Business Owners Make During the Transition

When shifting your business structure from a free zone to the mainland, most problems don’t come from the rules, they come from avoidable mistakes. These are the ones that cause the biggest setbacks:

1. Not restructuring the company correctly before the move

Many owners switch to mainland licensing without cleaning up their current business structure first. Issues like outdated agreements, unpaid renewals, or incorrect activities often blow up later.

2. Underestimating the compliance workload

Mainland operations come with full VAT, corporate tax, and ESR requirements. Business owners often assume the free zone process will be similar, only to face penalties for late or incomplete filings.

3. Choosing the wrong licence type

A lot of transitions fail because the licence doesn’t match the actual business activities. This affects approvals, banking, invoicing, and sometimes even immigration.

4. Ignoring banking requirements

Banks treat mainland companies differently. Incomplete shareholder documents or missing proof of operations can delay or block account openings for weeks.

5. Migrating contracts the wrong way

Client and supplier contracts need to be reassigned properly. Many forget that changing jurisdictions affects tax, enforcement, and renewal terms, which can cause cash-flow interruptions.

6. Miscalculating total costs

Owners often focus on licence fees and forget the bigger picture: office rent, immigration quotas, visas, tax filings, mandatory attestations, and ongoing compliance.

7. Not planning the timing

If the transition overlaps with visa renewals, contract cycles, or audit deadlines, operations can freeze. Proper sequencing matters more than most people think.

8. Failing to assess long-term strategy

Some jump to the mainland because it “sounds bigger,” but the shift doesn’t always support their actual growth model. A mainland company only makes sense when the business structure, revenue plan, and operational needs align.

When a Company Should NOT Convert to Mainland

Not every business benefits from a mainland setup. Even though the shift offers more flexibility and credibility, some companies are better off staying in a free zone. Here are the situations where a free zone to mainland transition is not the right move:

When your business doesn’t need on-ground operations

If your company runs entirely online, has no local clients, and doesn’t require office space or field work, converting to mainland adds cost without increasing revenue.

When your current free zone structure is already optimized

Some businesses are set up in a free zone specifically for tax efficiency, simplicity, or ownership flexibility. If your company structure already fits your model, you may lose those advantages after converting.

When the cost outweighs the return

Mainland licensing requires higher annual costs, real office space, stricter compliance, and more ongoing commitments. If the expected revenue doesn’t justify these expenses, it’s better not to convert.

When your business activities don’t require mainland approvals

Certain activities… especially digital services, consulting, and global trading can operate fully within a free zone. For these, a convert free zone company to mainland process brings no meaningful benefit.

When you are not ready for full compliance

Mainland companies must follow corporate tax filings, accounting standards, ESR, UBO submissions, and immigration rules. If your operations aren’t mature enough to handle this, delaying the move is the safest option.

Final Recommendation:

A free zone to mainland transition is best when your business needs local clients, larger contracts, or more operational flexibility. Moving too early increases costs, while moving too late can limit opportunities.

Time the transition to real needs

Switch when growth or client requirements are held back by free zone limitations. If mainland licensing is necessary for contracts or operations, it’s the right moment.

Align structure with business plans

Your company structure should match your hiring, office, and compliance needs. Mainland licensing works best for expanding operations within the UAE.

Plan carefully

Understanding the free zone to mainland requirements and compliance rules upfront avoids delays, extra costs, and mistakes.

Choosing the Right Time and Structure for the Move

Choosing the right time and structure for a free zone to mainland transition can be complicated. GCG Structuring guides you through every step, from selecting the correct mainland license and securing approvals to managing visa transfers, labour files, and compliance obligations. Beyond handling the paperwork, we help you plan the transition strategically, so your company structure aligns with your growth goals and minimizes operational risk.

FAQ

1. 0 What is a free zone to mainland transition?

It’s the process of moving a company from a free zone license to a UAE mainland license, allowing full operations and local market access.

2. 0 Why convert a free zone company to mainland?

To access larger contracts, hire more staff, open offices, and meet client or government requirements.

3. 0 What are the key requirements for the transition?

Align business activities with mainland rules, submit corporate documents, secure office space, and update visas and labour files.