If you're setting up a financial firm in the Dubai International Financial Centre (DIFC), one of the most important early decisions you'll face is selecting the right license category. This isn’t just a formality. The license you choose defines your permissions, responsibilities, capital requirements and ultimately your ability to grow compliantly within the DIFC regulatory environment.

The Dubai Financial Services Authority (DFSA) regulates financial service providers within the DIFC. Two of the most sought-after license categories under this framework are the DIFC category 3C license and the DIFC category 4 license. Each license serves a very specific purpose.

This blog is designed to help financial advisors, fintech founders, fund managers and investment firms understand how these two license categories differ, what services each covers and how to align your license with your actual service model. We’ll also cover the application process, capital expectations and crypto endorsements.

Table of Contents

What Is a DIFC Category 3C License?

The DIFC category 3C license is one of the most powerful licenses within the DIFC framework. It’s designed specifically for firms that want to manage client assets, operate investment funds, or run discretionary portfolio strategies. If your business model includes actively managing money or launching investment vehicles, this is likely the license you’ll need to operate legally and compliantly in the DIFC.

Who Typically Applies for It?

You’ll see this license used by:

- Private equity and venture capital firms

- Hedge funds and wealth managers

- Fintech platforms offering digital investment products

- Discretionary portfolio management firms

- Tokenized asset managers or multi-strategy fund operators

These firms often require broader regulatory permissions, including the ability to:

- Make investment decisions on behalf of clients

- Create and manage investment funds

- Offer cross-border asset management services

- Operate platform-based or tokenized fund ecosystems

The DIFC category 3C license makes all of that possible while ensuring that your business aligns with DFSA regulations and international compliance standards.

Core Activities Permitted Under the DIFC Category 3C License

The DFSA classifies this license under “Operating a Collective Investment Fund”, which is a broader regulatory category that covers multiple financial services. Here’s what you can legally do under this license:

Manage Collective Investment Funds

You can launch and manage public funds, Exempt Funds, and Qualified Investor Funds (QIFs). These can be structured for institutional or high-net-worth clients.

Discretionary Portfolio Management

Unlike the DIFC category 4 license, this license allows you to buy and sell investments without pre-approval from clients. This is ideal for active managers and quant-based strategies.

Operate Investment Platforms

You can run digital investment platforms including tokenized portfolios, REITs, or thematic funds so long as you have the right controls and compliance systems in place.

Cross-Jurisdiction Asset Management

With proper structuring, you can manage both DIFC-registered funds and foreign funds domiciled outside the UAE.

The DIFC category 3C license is a foundational asset for serious investment firms looking to scale across borders.

Without it, your business:

- Cannot manage funds

- Cannot execute trades on behalf of clients

- Cannot operate as a full-fledged asset management firm

That’s why this license is often seen as the benchmark for serious asset managers and fintechs launching funds in the UAE.

With the UAE receiving over $22 billion in foreign direct investment in recent years, having a compliant DIFC company formation backed by the correct license is a smart business move.

What Is a DIFC Category 4 License?

The DIFC category 4 license is a regulatory license issued by the Dubai Financial Services Authority (DFSA) that allows firms to offer non-discretionary investment services without directly managing assets or holding client funds. This is one of the most popular DIFC license categories for startups, fintech platforms, and advisory firms looking to enter the DIFC ecosystem with a leaner, low-risk model.

While it doesn’t offer the same breadth of permissions as a DIFC category 3C license, it serves a distinct need: regulated investment support without full-scale asset management.

Who Should Consider a DIFC Category 4 License?

Firms that do any of the following should consider this license:

- Offer investment advice to individuals or institutions

- Provide investment research or market analysis

- Act as intermediaries or deal arrangers between investors and product issuers

- Operate fintech platforms that enable deal facilitation without custody

- Launch MVPs (Minimum Viable Products) for early-stage investment apps

The DIFC category 4 license is a great entry point for companies that eventually plan to grow into full asset management but are not quite there yet. Many businesses use it as a stepping stone before upgrading to a DIFC category 3C license as they expand their service offering.

For UHNW clients planning long-term wealth structuring through asset management, our breakdown of the DIFC Family Office trend shows why so many are setting up in 2025.

What You Can Do with a DIFC Category 4 License

Under this license, your firm can legally offer:

Advising on Financial Products

You can offer personalized or general investment recommendations to clients. However, you cannot manage portfolios or execute trades on a client’s behalf unless you have additional permissions.

Arranging Deals in Investments

This allows you to introduce clients to investment opportunities, negotiate terms, and facilitate transactions. You’re essentially acting as a middleman, not the decision-maker.

Marketing Investment Funds (Under Certain Conditions)

You can promote regulated investment funds to clients within the scope of your license provided the funds themselves are appropriately registered and you do not hold custody or discretion.

Providing Research and Investment Reports

You may publish or distribute research that helps clients make investment decisions.

Operating Comparison or Marketplace Platforms

Think of robo-advisors, financial aggregators, or investment marketplaces that don’t hold client funds or assets. This is a sweet spot for DIFC category 4 firms especially in the fintech space.

Dubai has seen a surge in fintech licenses, especially in lightweight categories such as advisory and arrangement. Over 700+ fintech and innovation startups are now part of the DIFC Innovation Hub, many of which began with a DIFC category 4 license before expanding their regulatory footprint.

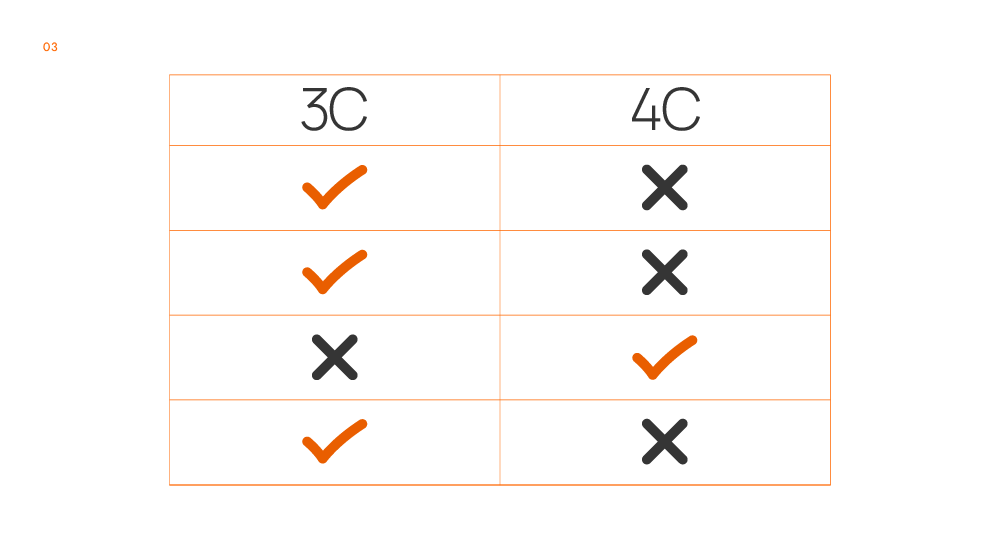

Key Differences Between Category 3C and Category 4

Understanding the functional and regulatory differences between the DIFC category 3C license and the DIFC category 4 license is essential for financial firms, especially when structuring services inside the DIFC. Both license types serve specific business models, and the Dubai Financial Services Authority (DFSA) classifies them based on risk, activity, and responsibility.

Let’s break down how they compare without a table, so you can clearly see where your business fits.

Main Activity

The DIFC category 3C license is for firms that manage investment portfolios, operate funds, or run digital investment platforms. If you’re making investment decisions or managing pooled investor capital, this license applies.

The category 4 license, in contrast, is for firms that advise clients, arrange investment deals, or act as intermediaries. You cannot manage funds or hold assets under this license.

Asset and Fund Management

Holding a category 3C license DIFC allows you to launch, manage, and operate collective investment funds including Public, Exempt, and Qualified Investor Funds. This includes the ability to structure private equity, hedge, or real estate investment vehicles.

A DIFC category 4 license does not permit any fund management. You’re only allowed to provide recommendations or connect parties to investment opportunities.

Discretionary Authority

With a DIFC category 3C license, you can offer discretionary portfolio management, meaning you execute investment decisions on behalf of clients without their pre-approval.

With a category 4 license, all client instructions must be non-discretionary, you cannot act on their behalf without explicit consent on every transaction.

Capital Requirements

Capital requirements are a major differentiator between the two.

- The DIFC category 3C license requires a minimum base capital of USD 70,000, with higher thresholds depending on projected expenses and business model. Expense-based capital (13/52 of annual operating costs) often applies here.

- The DIFC category 4 license starts with a base capital of USD 10,000, making it more accessible for startups and early-stage fintechs.

If you’re aiming for full asset management rights, your capital base must align with category 3C license DIFC expectations.

Risk Profile

By nature, a firm with a DIFC category 3C license carries a higher regulatory and operational risk due to the activities it performs. Managing client capital, operating funds, and making discretionary trades.

The category 4 license is considered lower risk, as it doesn’t involve custody or control of funds, and primarily involves advisory and facilitation roles.

DFSA Fast-Track Options

Both licenses may qualify for the DFSA’s fast-track process, but in different contexts.

- A DIFC category 3C license can be fast-tracked when managing Exempt Funds or Qualified Investor Funds.

- A category 4 license application may also qualify if the firm limits itself to advisory-only services and does not plan to hold client funds or securities.

Common Use Cases

You’ll typically see the DIFC category 3C license used by:

- Fund managers

- Private equity platforms

- Tokenized investment startups

- Firms offering discretionary wealth management

The category 3C license DIFC gives these firms the freedom to operate with full financial authority and build scalable asset management models.

On the other hand, the category 4 license is common among:

- Independent financial advisors

- Robo-advisory platforms

- Investment consultants

- Early-stage fintech apps or MVPs

These firms start light but may later evolve toward applying for a DIFC category 3C license as they scale and gain investor traction.

Staffing and Governance Requirements

To get approved for a DIFC category 3C license, the DFSA expects you to hire or appoint:

- A full-time Senior Executive Officer (SEO)

- A Compliance Officer (CO) and Money Laundering Reporting Officer (MLRO)

- A Finance Officer (FO)

- Recognized internal and external auditors

The category 4 license requires fewer mandatory roles, making it faster to launch and easier to manage, especially for small teams or startups.

Some firms don’t require a full DFSA license at all. If you’re unsure, see our guide on which DIFC license category to choose. It explains the difference between regulated and non-regulated activities clearly.

How to Choose the Right License for Your Business Model

Choosing between a DIFC category 3C license and a DIFC category 4 license starts with one critical question: Do you manage investor money, or do you simply advise on investments?

Let’s walk through common business scenarios to help you evaluate your model:

1. Are you setting up a fund?

If you’re establishing a collective investment scheme, hedge fund, venture capital fund, or any structure that pools investor capital, you’ll need a DIFC category 3C license. This license gives you the legal authority to manage funds under the DFSA framework, something you can’t do with a category 4 license.

2. Will you make investment decisions on behalf of clients?

This is the hallmark of discretionary portfolio management. If your business model involves actively trading or investing client funds without their prior approval on each transaction, a DIFC category 3C license is mandatory. It’s the only license that allows such discretionary authority within the DIFC.

3. Are you only providing financial advice or investment research?

If your role is limited to recommending products, publishing research reports, or advising on financial instruments but not holding or managing capital, then a DIFC category 4 license will suffice. You’re not engaging in regulated asset management, so you don’t need the broader scope of a DIFC category 3C license just yet. For businesses looking at long-term structuring and capital ownership, exploring a DIFC holding company can also be a strategic option.

4. Do you want to offer robo-advisory or build an investment app without custody?

Many early-stage fintechs begin with a category 4 license to launch MVPs or lightweight advisory services. If you’re offering algorithm-based recommendations without directly managing funds, a DIFC category 3C license isn’t required at this stage, but may become relevant as you grow.

5. Are you launching a platform to tokenize real-world assets or manage digital portfolios?

In most cases, tokenization or digital asset management, especially when paired with discretionary trading—falls under asset management activities. This means you’ll likely need a DIFC category 3C license, possibly with endorsements under the Digital Assets Regime. If your platform touches custody or investment decisions, play it safe with a DIFC category 3C license from day one.

6. Are you planning to grow into a fund manager role over time?

If your current operations are advisory-based but your long-term strategy includes managing investor capital or launching your own fund, it’s wise to start with a category 4 license and upgrade later. Many firms take this phased approach. They start lean, then transition into a full DIFC category 3C license as their infrastructure and compliance maturity grow.

If you’re still at the planning stage, don’t miss our step-by-step guide to starting a business in Dubai. It lays the foundation before you even talk to DFSA.

DFSA Licensing Requirements: Appointments, Capital, Office Space

Once you’ve selected the right license, you need to meet DFSA’s operational readiness standards. These include key appointments, physical presence and financial strength.

For a DIFC category 3C license:

- Senior Executive Officer (SEO): Must be a UAE resident with senior financial experience

- Finance Officer (FO): Can be outsourced; must be qualified

- Compliance Officer (CO): Must be full-time, UAE-based; can combine with MLRO

- Money Laundering Reporting Officer (MLRO): Required, often dual-role with CO

- Internal/External Auditors: Appointed from DFSA-recognized firms

Capital Requirements:

- Base Capital: USD 70,000

- Expense-Based Capital: 13/52 of projected annual expenses

- Risk-Based Capital: Calculated on specific exposures

- Highest of the three becomes the final requirement

Office Space:

- Firms must lease an office within DIFC boundaries

- Office size affects visa quota (approx. 80 sq ft per visa)

If you’re comparing a DIFC foundation with a more flexible free zone company, our asset protection structure guide can help you decide which route aligns better with your fund’s regulatory goals.

What If You’re Dealing with Crypto or Digital Assets?

The DIFC has moved steadily toward a regulated framework for digital assets. Whether you want to advise on crypto products or operate a tokenized investment platform, the DFSA now permits such activities but only under specific conditions.

For most businesses looking to offer crypto-related services, a DIFC category 3C license is the logical foundation. This license can be endorsed with additional digital asset permissions, allowing firms to legally engage in:

- Advising on crypto assets

- Arranging deals in digital assets

- Managing portfolios of tokenized securities or crypto

Firms applying for endorsements must meet additional compliance requirements, including enhanced AML procedures, wallet custody standards, and updated disclosures in their business plans.

If your activity is advisory only (no custody or trading), and limited to crypto education or referrals, a DIFC category 4 license with crypto endorsements may be sufficient.

The Application Process and Timeline: What to Expect

Applying for a DIFC category 3C license or category 4 license involves a clear process with defined steps.

1. Introductory Call

Meet with DIFC and DFSA to determine if the DIFC category 3C license fits your model.

2. Submit RBP

Send a short Regulatory Business Plan for initial feedback (7–10 business days).

3. Full Application

Submit complete documentation—policies, structure, financials, and KYC.

4. DFSA Interviews

Your SEO, CO, and MLRO will be interviewed for role readiness.

5. In-Principle Approval

Once approved, proceed with DIFC setup—capital deposit, office lease, auditors.

6. Final Licensing

You receive your Financial Services Permission and can operate legally.

Timelines:

Category 4: 10–12 weeks.

DIFC category 3C license: 14–16 weeks.

Getting your DIFC license is only part of it. You’ll also need to open a business bank account the right way in the UAE or risk early compliance setbacks.

Get Your License Right

Whether you’re building a fintech product, launching a fund, or offering investment advice, aligning your DFSA license with your actual services is critical.

Choosing between a DIFC category 3C license and a DIFC category 4 license can define your entire market scope. Each license has implications for capital, staffing, permissions and future growth. The decision should not be rushed or treated as a checkbox.

At GCG Structuring, we help firms align their license with their actual services. From selecting the right option to securing the DIFC category 3C license, we handle the entire process of DIFC business setup, including documentation, appointments, legal setup, and digital asset endorsements.

FAQ

1. 0 Can I manage both local and foreign funds with a DIFC category 3C license?

Yes, the DIFC category 3C license allows you to manage both DIFC-registered funds and foreign funds, provided you meet the DFSA’s criteria.

2. 0 Is a DIFC category 3C license required if I want to launch a tokenized investment platform?

If you’re managing assets or making discretionary decisions, you’ll need a DIFC category 3C license, even if the assets are digital or tokenized.

3. 0 What’s the minimum capital needed for a DIFC category 3C license?

The base requirement starts at USD 70,000, but actual capital depends on your financial model. A DIFC category 3C license often involves higher expense-based capital too.

4. 0 Can I upgrade from a DIFC category 4 to a DIFC category 3C license later?

Absolutely. Many firms start with a category 4 and transition to a DIFC category 3C license as they grow into full asset management.

5. 0 Why is the DIFC category 3C license preferred by fund managers?

Because the DIFC category 3C license allows discretionary portfolio management, fund setup, and cross-border asset services, making it the gold standard for serious investment firms operating in the DIFC.